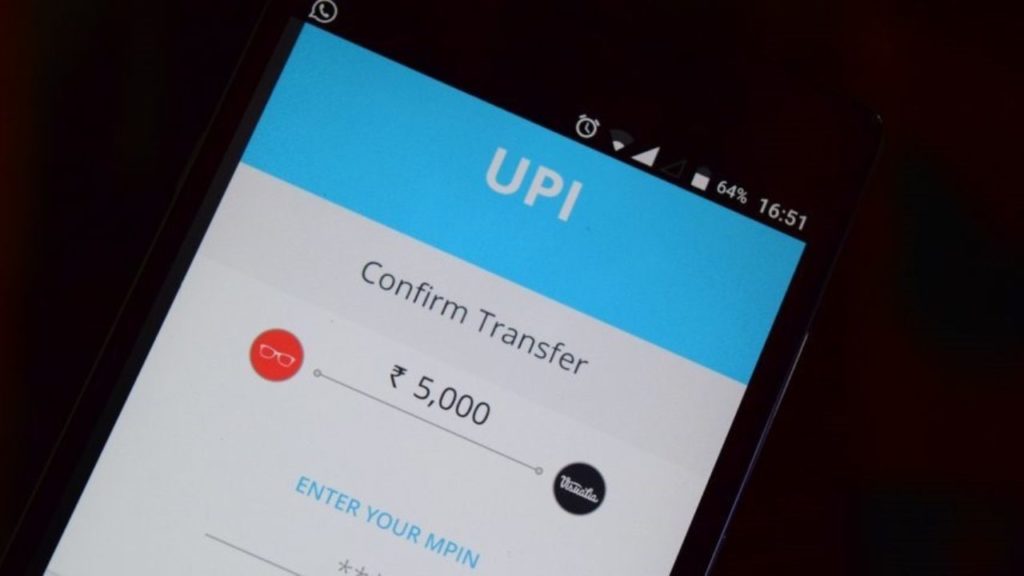

Relief For Google Pay, Paytm, PhonePe: NPCI May Roll Back 33% Marketshare Rule!

According to sources, the National Payments Corporation of India (NPCI) is looking to roll back its plan to put a cap of 33% on the market share of third-party Unified Payment Interface (UPI) apps.

Why Would This Happen?

On the condition of anonymity, sources said “The decision to roll back the proposal was taken for some unknown reasons. It may be a result of lobbying by TPAPs (third-party app providers) opposing the proposal,”.

So far, the NPCI has been mulling capping UPI market share to 33% for all third-party apps.

It was expected to come out with detailed guidelines and notification on the capping volume of TPAPs from April this year, according to a meeting held in August last year.

So far, there has been no notification released by the umbrella organization.

All third parties and bank apps have to put a limit on the volume and value of transactions which starts at 50% in the first year of operations, 40% in the second year and 30% in third years of incorporation, according to the guidelines formulated by the steering committee almost eight months ago.

Mainly, the proposal was aimed at curbing the concentration of volume of transactions from a few limited firms such as Google Pay, PhonePe and Amazon Pay.

How Would This Affect?

If such regulations came into effect, it would have impacted the volume and value processed by Google Pay and PhonePe, which have been clocking over 33% of total transactions via UPI.

As, collectively, Google Pay, PhonePe, Amazon Pay and Paytm have a market share of 90%.

On the other hand, Paytm had dropped out of the race of commanding more market share in the UPI ecosystem last year.

While Google Pay and PhonePe have been battling hard for supremacy.

“The delay by NPCI in releasing the proposed notification is quite surprising and certainly hints at a strong criticism from the TPAPs. We all know how foreign firms use trade and diplomatic channels to convince the regulator and political class for a favorable ecosystem. It might be a result of the same,” said the sources.

Further, they emphasized that limiting transaction volume can cause significant inconvenience to users who transact frequently via a preferred app.

Although, it could be one of the reasons that guided NPCI not to release the notification.

What Does NCPI Say?

While NPCI didn’t immediately respond to the request for comment so far.

Applying a cap on UPI market share was among few rules which could not get a go-ahead from NPCI while other rules such as doubling UPI transactions to Rs 2 lakh and cash withdrawal from merchants using UPI apps were allowed by the organization.

These two proposals were also part of the same meeting where the steering committee had agreed to cap an app’s market share.

Moreover, the rollback decision will encourage the UPI payments ecosystem as there is a fall in online payments due to the coronavirus outbreak.

UPI had recorded a slight reduction in monthly transaction volume in March as compared to the previous month, as per the latest data.

Comments are closed, but trackbacks and pingbacks are open.