Banks Will Clear Cheques Faster With This New Tech; Non-CTS Cheques Will Not Work After Sep, 2020

Banks Will Clear Cheques Faster With This New Tech; Non-CTS Cheques Will Not Work After Sep, 2020

The Reserve Bank of India (RBI) in its Statement on Developmental and Regulatory Policies issued on February 6, 2020 has announced that the Cheque Truncation System (CTS), which is currently functional at the major clearing houses of the country will be made operational pan India by September 2020.

Those users holding non-CTS cheque books won’t get their cheques cleared starting September 2020!

What is the Cheque Truncation System (CTS) ?

Cheque Truncation System or Image-based Clearing System, in India, is a project of the Reserve Bank of India, for faster clearing of cheques.

The Reserve Bank of India first implemented CTS in New Delhi from 1 February 2008 with ten pilot banks.

The time taken in clearance is less and the process is even cost-effective. The time and cost taken to physically move the cheques around reduces. Also the cheque collection time is saved.

How Does CTS Work?

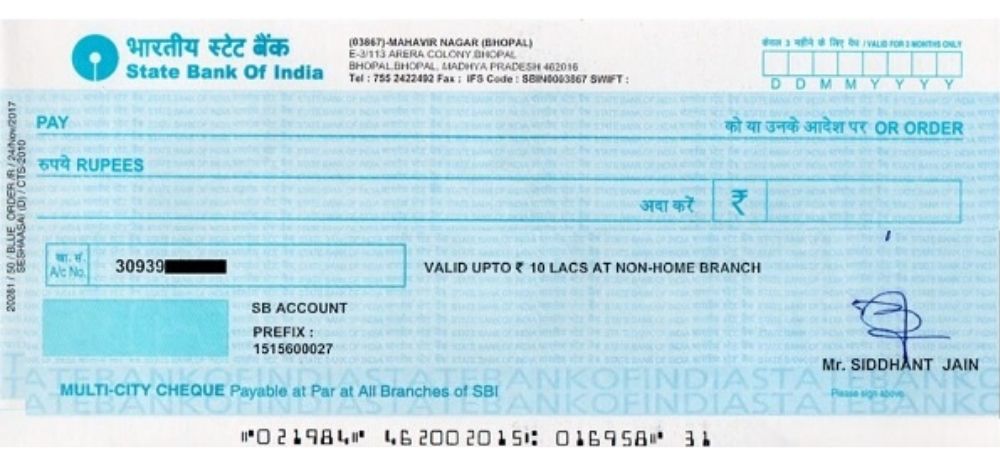

In cheque truncation, the movement of the physical instrument is ceased and replaced by electronic images.

The electronic image of the cheque is transmitted to the paying branch through the clearing bank, along with relevant information like data on the Magnetic Ink Character Recognition (MICR) band, date of presentation, presenting bank, etc.

In CTS, the clearing bank captures the data (on the MICR band) and the images of a cheque using their Capture System (comprising of a scanner, core banking or other application).

CTS-2010 cheques have certain common security features and standardised field placements for enabling image based processing of cheques through optical / image character recognition technology, which are absent in non-CTS cheques, according to banking experts.

The CTS system has increased the customer satisfaction as well! The process takes less time and reduces the risk of fraud.

Banning the Non-CTS Cheque Books: A Smart Move!

Many banks have already stopped accepting non-CTS cheques since January, 2019.

The users should first check if their cheque books are CTS. The CTS cheque books will have a CTS-2010 cheque leafs. If you still have a non-CTS cheque book, you need to get it replaced by your banker.

RBI said, “The Cheque Truncation System (CTS) has stabilized well and it has made large efficiency gains. In view of this, a pan India CTS will be made operational by September 2020.”

This move by The Reserve Bank of India ensures faster and smoother clearance of cheques, as cheques playing an important role in the financial transaction process.

Comments are closed, but trackbacks and pingbacks are open.