HDFC Bank Offers Instant Multi-Bank Money Transfer Through Chillr App

HDFC Bank has officially launched a mobile based money transfer platform enabled by a third party app: Chillr, using which their customers can send money to any of their phonebook contacts instantly.

The best part about using this money transfer mechanism is that, there is no need to add beneficiary details such as bank account number, IFSC codes etc. HDFC customers can simply select their phonebook contact to whom they want to send money, enter the amount and done. The money would be transferred instantly, 24 hours a day.

The app also offers an option wherein users can send money without sharing their mobile numbers. Using GPS positioning, the app will discover near-by users, and instantly facilitate money transfer without the need of even adding them in their phonebook.

Nitin Chugh, head -digital banking, HDFC Bank shared, “Chillr is a third-party app, which will be available exclusively for our customers. It will allow them to transfer money using a contact’s mobile number alone. It will increase convenience, as the sender will not have to face the hassle of adding beneficiaries before sending money”, adding, “We expect adoption to be very quick. We will be promoting this at worksites where we have salary accounts through microsites online and through videos,”

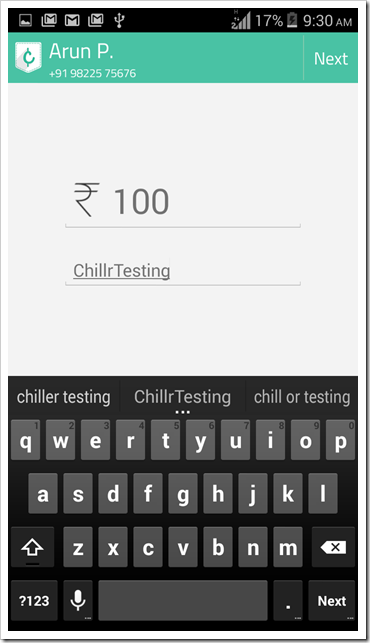

As of now, only Rs 1000 can be transferred at a time, daily limit has been set at Rs 25,000.

Here is the introductory video:

How to Make Mobile Money Transfers Using Chillr

If you are an HDFC Bank customer, then here are the steps to start using this new money transfer mechanism:

Step 1: Generate MMID or Mobile Money Identifier (MMID) for your HDFC Bank account, using this path in your Internet banking or Mobile banking account: Click ‘Third Party Funds Transfer’ > Click ‘Generate MMID’ > Select Bank A/c No. > Confirm350

Step 2: Call 1800 2666 262 (Toll free) to generate your M-PIN (which is required to transfer money)

Step 3: Install Chillr from Google Playstore. It will be soon available on Apple Store & other platforms as well.

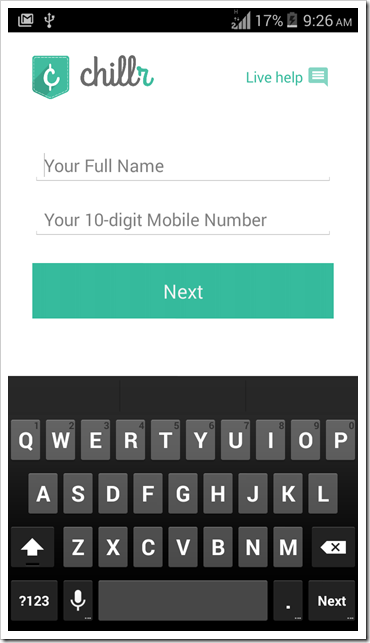

Once installed, it will ask you name and mobile number:

And once entered, it will send an OTP for verification.

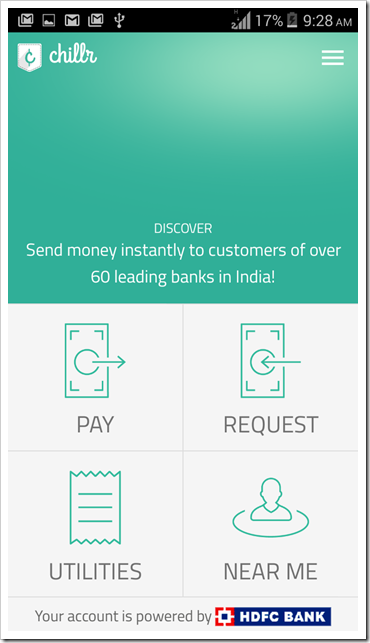

This is how the home screen appears, after the verification is done:

To send money, you will need to tap on “Pay” and then select the phonebook contact to whom you want to transfer money.

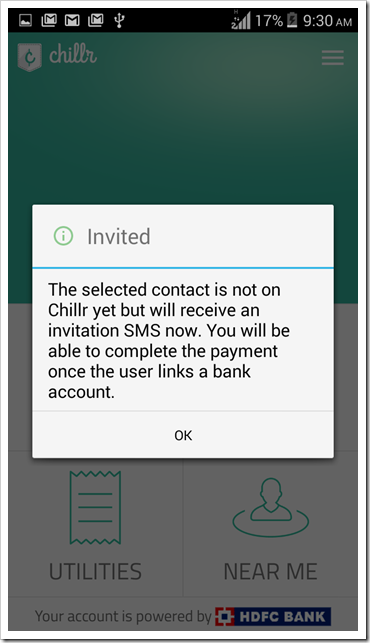

In case the recipient doesn’t have Chillr app installed, then they will notified:

The recipient will instantly receive an SMS, prompting to download the app, and receive money:

Once the recipient downloads the app, then you will again receive a notification regarding the money transfer, and then in the final step, you will be asked to enter the M-Pin to authorize the transaction:

In case you enter incorrect MPin, the transaction would be cancelled, and you will need to again initiate the transaction with the new MPin.

Other services such as prepaid recharge, bill payments etc would also be launched on this platform.

About Chillr

Chillr is a mobile app startup based in Cochin, founded by Sony Joy. HDFC Bank is their first partner in soliciting mobile based money transfer service, and it seems that its an exclusive partnership as Chillr is not yet available for any other bank user.

Here are few videos which describe the functionality and features of Chillr; and explains why it has the potential to become one of the favorite apps for money transfer. You can also find answers to most commonly asked question related with mobile app payment service here.

In our initial test, the app functioned flawlessly, and the interface seems smooth, and laser targeted. If we observe the functionality and user-friendliness, then it can be a good competitor to Kotak Mahindra’s KayPay and ICICI Bank’s Twitter and Facebook based payment platform. Additionally, it can always complement HDFC’s own digital wallet, which they recently launched.

In case you are using Chillr, then do share your experience by commenting right here!