[This is 2nd post of 3 part series post written by Ashwini Anand, CFA who is the CEO of Investopresto. The 3 part series will help small investors make smart investment decisions. ]

Contents [hide]

A recap

In my previous article in this series, I lamented that inflation has averaged ~9.8% p.a. over the last 5 years and that it has essentially obliterated the purchasing power of money by 37.5% during this period. I also talked about how the after tax return of fixed deposits was too meager to make up for inflation this high and bemoaned the fact that stock markets have not performed too well over the last 5 years.

I also mentioned that an investment of Rs. 100 made in the Sensex on 1st January 2008, would have returned ~ -1.8% p.a. To make up for all the negativity, I also promised to show you a solution to these problems.

In this article, I will talk about another asset class – Gold and how it is part of the solution.

Gold to the rescue

To cheer you up, let me point out that gold has returned ~17.64% p.a from January 2000 till today, ~ 23.08% since January 2005 and ~24.64% since January 2010. Yes, shocking but true.

Gold has outperformed stocks, fixed deposits, bonds and every other major asset class in the recent past. To drive home the point, here is a table that shows how much you would have today had you invested Rs 100 in gold at different points of time.

Present value and returns on investments of Rs 100 in gold on different dates

| Date | Present value (Rs) | Return (%p.a) |

| 1st January, 2000 | 814.71 | 17.64% |

| 1st January, 2005 | 516.39 | 23.08% |

| 1st January, 2010 | 189.60 | 24.64% |

You will notice that gold has returned more than enough to comfortably beat inflation. So, is gold the solution we have been looking for? Conventional wisdom tells us that gold is a fantastic hedge against inflation. The reasoning is that when prices go up across the board, the prices of gold go up too.

But in reality, gold prices are not heavily driven by Indian factors.

What drives gold prices?

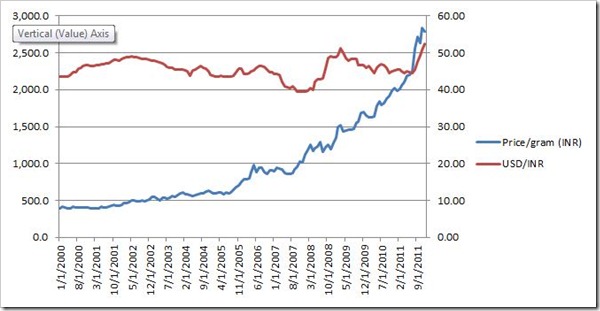

Gold prices are quoted in US dollars. Global political and economic events are essentially what drive gold prices (in USD). As I had pointed out in an article on Investopresto’s investment education section – when you invest in gold in rupees, you are essentially investing in gold as well as in the US dollar. Therefore, gold prices in India are heavily influenced by the USD/INR exchange rate.

Gold prices and USD:INR exchange rates.

What drove the phenomenally high gold returns in the last few years?

What typically happens during periods of global economic uncertainty is that the price of gold in USD goes up. This happens because gold is considered a safe haven. What also happens during such times is that global investors lose their risk appetite.

When this happens, Foreign Institutional Investors (FIIs) start selling Indian stocks/bonds and start moving their money away from India. This results in a sharp depreciation of the rupee and appreciation of the US dollar. This double whammy results in a steep rise in gold prices in rupees. Remember, Gold price in rupees = Gold price in USD X Exchange rate between USD and INR.

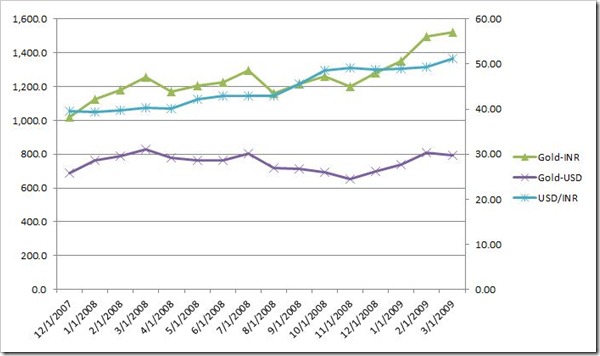

To illustrate, here is what happened during the last major recession – At the end of December 2007, the Sensex traded at about 20,200 and gold in INR quoted at about Rs 1,000 per gram. In the beginning of April 2009, the Sensex was roughly at 9,700 and gold was at Rs 1,430 per gram. The Sensex fell by about 52% and gold in rupees rose by about 43%. The corresponding change in gold quoted in USD was only about 11%.

Chart 2: Gold prices and exchange rates during the last recession

Gold prices and inflation

What happens when inflation is high? Gold prices rise. Why? Remember what I told you about gold being a hedge against inflation? Also, all things being equal, the rupee depreciates sharply against the dollar when there is unexpected inflation. This is great for gold in rupees since gold prices in rupees rise when the USD: INR exchange rate rises (if gold prices in USD don’t fall too much).

Do you remember how inflation in 2008 shot up like a rocket? Well, gold shot up like a rocket on steroids- rising by about 25% in 2008.

I got it. Chuck stocks! I will invest in gold.

Wrong! While gold performed extremely well in the last decade or so, there is no guarantee that it will continue to perform this well. Though your wife/mother will love you for buying gold, especially if you gift it to her, you can lose a lot of money even on gold.

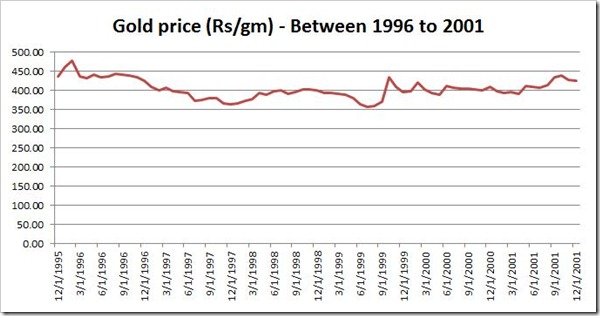

For example, gold lost 2.4% between January 1996 and December 2001. Let me rub it in- minus 2.4% over 5 years. Isn’t that abysmal? Stocks did poorly during this period too, returning a meager 4.7% during this period. But nonetheless, they vastly outperformed gold during this period.

Stocks performed just as well as gold between 2000 and 2005, returning roughly 13% p.a. Stocks have vastly outperformed gold in several periods of time in the last 10 years; e.g. 2005-2007. So, don’t write off stocks so easily.

Chart 3: Gold prices between 1996 and 2001

So, what is the solution?

Investing in gold is part of the solution, but as I pointed out, it is no panacea. I will conclude this 3 part series next week and present a solution that will help you beat inflation and create wealth.

Till then, happy investing!

[For any queries, author can be contacted at ash@investopresto.com]

Gold has been a great investment overall and may remain so till world do not find some new formula to resolve their economic woes. But investing in gold is bad for the economy as your money lies in a piece of metal sitting in lockers instead of being lent to needy entrepreneurs whose business do economic wonders. Gold plays a role in slowing down Indian growth and increase the need for foreign investments.

Not sure. The price is way to high for any middle class family to be able to afford I feel.

I do accede with you on price of gold being high but what i know is middle class Indians do save money which they can invest in gold rather keeping it with banks only.