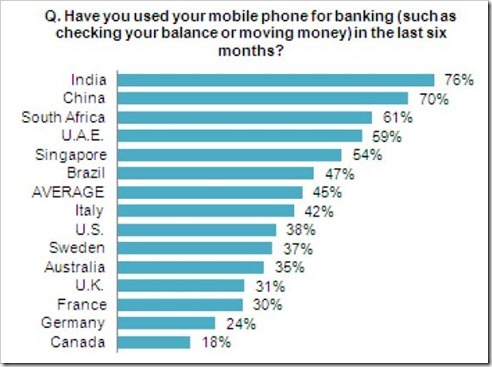

Mobile Banking has really caught up in India – according to recently conducted survey by ACI Worldwide, 76% of Indian mobile respondents used their mobiles for banking in last 6 months. This percentage is highest across the world.

Comparatively, only 38% respondents from US, and 31% from UK used mobile banking in last 6 months. China, came in after India with 70% users using mobile banking followed by South Africa (61%). The global average for Mobile Banking adoption rate stands at 35%.

Source: Aite Group; ACI Worldwide study of 4,200 consumers in 14 countries, Q1 2012

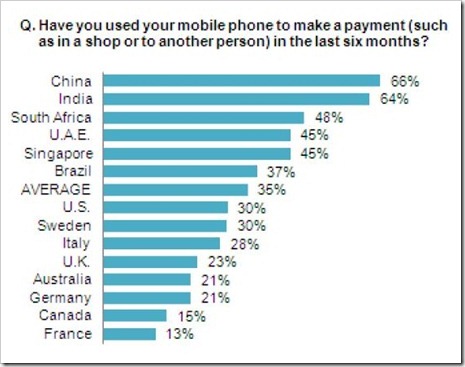

Source: Aite Group; ACI Worldwide study of 4,200 consumers in 14 countries, Q1 2012

Mobile Payment Usage

India comes in 2nd in terms of making payments on mobile. 64% of the survey respondents from India used their mobile phones to make payment atleast once in last 6 months, while Chinese led the pack with 66%. Surprisingly, only 30% of US respondents & 23% of UK respondents have made payments on mobile in last 6 months.

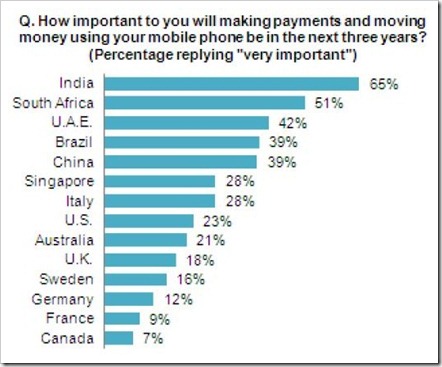

Importance of Mobile Payments & Money Movement

According to the survey, the countries with highest levels of mobile payment adoption also display highest importance on mobile payments and money movement. Roughly two-thirds of Indian consumers consider making payments and moving money using their mobile phone in the next three years to be “very important” to them —in contrast only one in 10 French and Canadian consumers think mobile payment is “Very Important”.

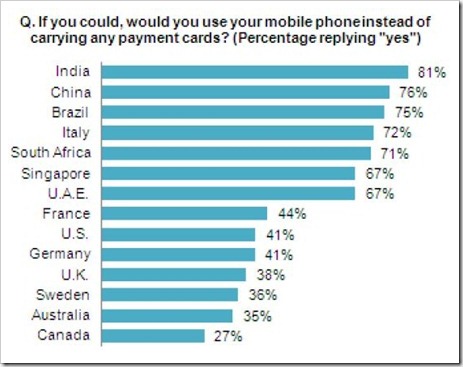

Replacing Traditional Payment Cards with Mobile Payments

Over 8 out of 10 Indians responded that they would prefer using a mobile phone to make a payments instead of traditional payment cards.

The lack of importance of mobile payments and money movement in a number of countries belies the interest that many consumers across the globe have in using their mobile phone to replace carrying payment cards. In Brazil, for example, although 39% of consumers consider mobile payment and money movement to be “very important,” 75% would use their mobile phone to replace cards.

Even in France, where just 9% of French consumers place a high importance on mobile payments and money movement, 44% express interest in replacing their payment cards.

One surprising fact in all the above findings is that western countries like US, UK, France, Germany etc. are low on mobile banking and payments. One of the reason I see is that they transact more from Desktop PC’s. Whereas in countries like India & China, majority of consumers only have mobiles on which they can carry out mobile banking / payments ( as they don’t own personal computers).

[…] Not surprisingly, way back in 2012, we had already stated that India’s mobile banking adoption is highest in the world. […]

In terms of technology, India is becoming very sophisticated. I have also used mobile devices for banking purpose. It is fast, accessible and reliable for me. I am a facility management service provider and I advice other people to rely on technology for their business needs.