A combination of factors such as macroeconomic problems in euro zone, high trade deficit, slowing FII and FDI inflows, and renewed RBI policy of not interfering in the forex market, saw Rupee tumbling down to 2-year lows of Rs.48 per US dollar-mark in early trade today.

You heard it right – RBI has not intervened in the foreign exchange market for a long streak of eight successive months; and has reaffirmed its view that unless the situation is grave and adverse enough for the country’s apex financial institution to check volatility in the currency market, it would continue with its hands-off approach.

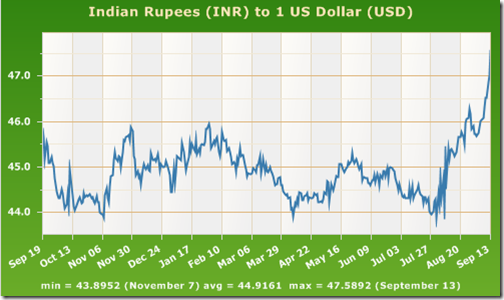

One Year Rupee Vs Dollar Exchange Rate Graph

While weakening rupee is beneficial for exporters; it renders imports across import-intensive industries, including petroleum products, costlier for the payments made in US dollars. India is the world’s largest importer of pulses, cooking oil and fertilizers. A sharp depreciation in the value of rupee negates the impact of fiscal measures, such as imposition of export duties to fulfill domestic demand, undertaken by the government to cool down inflation.

Coming back to impact on petroleum products, a dramatic dip in rupee’s value has a negative impact on the economy, not only in terms of expensive imports, but also costlier crude oil prices for a net fuel-importing country like India. With the depreciating rupee, imports of crude oil, edible oil and capital goods become expensive. Higher oil prices puts pressure on inflation.

While weakening rupee benefits exporters in meeting their cost and wage bills better; it negatively impacts the outbound tourist traffic clouded by fluctuating ATF prices pushed higher by the strengthening dollar, which adversely impacts operating costs of airline companies.

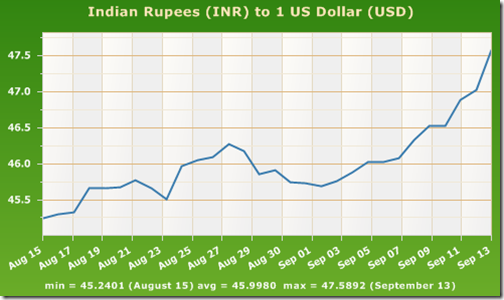

30 Day Rupee Vs Dollar Exchange Rate Graph

The purchasing power of rupee vis-à-vis dollar is determined by the demand for and supply of rupee in the international market. Forex dealers have attributed the recent sharp drop in rupee value to concerns related to Europe’s debt problems snowballing into a banking crisis, pushing investors to seek shelter under dollar’s perceived safety.

Today, the Indian rupee opened at 47.78 per dollar, as against yesterday’s close of 47.60, and went past 48 levels for a few early morning trades. Technical forex analysts have maintained that if rupee remains weak below the crucial 48-mark for few more days, the currency is likely to go down all the way to 50 per dollar.

Trade analysts are of the view that India’s high current account deficit and low interest from exporters to sell dollars is gradually driving the rupee prices lower. At the same time, in a risk-off kind of sentiment worldwide, latching on to the dollar is still considered a safer investment bet.

The rupee has depreciated 3% in past 6 days. This unusual fall in rupee value is likely to cost India $11.5 million a day extra against its cost of crude oil imports, which is nothing but a kind of imported inflation. India is equally dependent on imported energy and hydrocarbons.

Market pundits believe that more than weakening of the rupee fundamentals, it’s about strengthening of the dollar that’s playing out over here. People are already invested in Gold until neck deep levels – almost fuelling the price of the precious metal to bubble zone. So, trickling of fresh investments in Gold is much unlikely from hereon. Under such circumstances, it’s quite obvious that the next safely perceived investment destination would be dollar currency.

If rupee continues to slump in the same way for some more weeks, we aren’t far-off from touching the psychological 50 mark to dollar.

can anyone tell me is there any hope in touching months that rupee value will increase.

Today its 53 I guess! My goodness!

A strong rally by global markets behind the Eurozone debt crisis has instilled hope in Indian investors causing the rupee to close at 51.97 to $1 USD . Lets hope rupee will regain its strong position soon .

hiiiiiiiiii………..Manish Garg what the effect of this decrease on the market……….

hi

I share the same sentiment as you shared absolutely

why is the INR depreciating when the EU and US are tumbling down.

we just cant make sense of it.

This is suicide

OMG it closed at 49.57 a RS 1.32 decrease in a day. This is a tragedy . depreciating this much in one day

it has gone up to 49.35 today wonder what it will settle down in the near future.

it has gone up to 49.35 today wonder what it will settle down in the near future.

it has gone up to 49.35 today wonder what it will settle down in the near future.

OMG it closed at 49.57 a RS 1.32 decrease in a day. This is a tragedy . depreciating this much in one day

This is suicide

hiiiiiiiiii………..Manish Garg what the effect of this decrease on the market……….

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

The dollar appreciating against the rupee will bring the indian economy furthur down and will destabilise the indian buisness.

I hope this forecast comes true!!!!!! ! lol

Must Read for all working outside India…

Must Read for all working outside India…

I hope this forecast comes true!!!!!! ! lol

A good timely article Viral !!

For about a month I was wondering the reasons for the fall. In your last paragraph you mentioned the correct statement. It’s not the rupee which is weakening. Its the dollar which is streangthening. Now the question is why dollar is strengthening?

If you notice closely the rupee crash against dollar started more or less on the same time S&P downgraded US economy.

For any conventional wisdom, it is the currency of the downgraded nation that should fall. i.e. dollar should fall as it is the US economy which is downgraded. In complete contrast, since the day S&P downgraded US economy, it is rupee that is crashing against dollar !! Beyond my understanding.

Its like a criminal (US) commited a crime against a defendent (India) and the criminal (US) was booked by police (S&P). However the Judge (market) has punished the defendent (India) and rewarded the criminal (US). Does not make sence.

If you say, our so many internal problems (Current account deficit, increase in imports etc) which are leading the down trend, please note that they were there for a long time. The present crash in rupee is precipitated by S&P report. So why the market acting against conventional wisdom??

Just my two paisa :)

Altaf sir

As Viral has discribed above it depend on supply and demand.

firstly Dollar is currency which is kept as reserve by entire world and US economy is downgraded hence supply of dollar from US economy affected but demand is same so dollar is strengthened.

secondly Rupee is presently not been accepted by world market for trading which is still based on dollar hence we have to get high rated dollar from market so rupee looks weaker against it.

thirdly USA economy plays a vital role in world market, which contributes approx 23% of it, where as china – 3.5% and India rupee 1.5% only.

Mostly it remains around 45 but today it touched 48 mark. Can touch 50 mark but the way market is behaving, I am not sure about this.