Can BRIC Economies forge a New Global Reserve Currency?

The 2008 recession has turned the global currency picture upside down. The impact of the slowdown has been felt harder on the advanced economies such as the US, UK and Europe, leading to substantial drain in their currency strength and prospects.

Prior to the great recession, economists had pegged Euro as the next global reserve currency which could give tough competition to the US dollar for its decades of dominance. However, the recent spate of Greece-led turbulence in the Euro zone had almost brought the euro on the brink of breakdown, if not for the $1 trillion rescue package announced by the EU-IMF bailout deal.

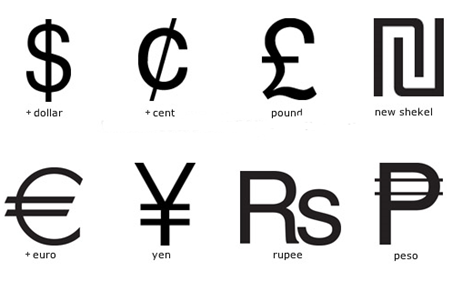

With both the dollar and the euro looking weak now, the balance tilts towards the currencies led by emerging market economies such as China’s yuan, India’s rupee and Russia’s rouble. However, the above statement is far away from concluding them as a reserve currency.

China’s yuan is no divine. China has humungous amount of reserves denominated in dollar terms which renders its fortunes susceptible to the fluctuations of the US dollar and store of value in it. The world needs a global currency which does not rely on the US dollars as the single major reserve currency.

Reports indicate that the pace of recovery in the US and Europe is unlikely to witness a sharp bounce back in the near term. In fact, some analysts are as well predicting a double-dip recession in the US. With both the US and Europe still under the wraps of recession, the global GDP is unlikely to witness a fast-paced growth.

According to the IMF data, the US dollar’s share of reserves dropped from more than 62% in the previous quarter to a 10-year low of 61.5%. Meanwhile, the euro’s share fell from 27.3 per cent to 27.2 per cent. In fact, even China is diversifying away from dollar at $3.7 trillion unallocated reserves.

In fact, the euro and the dollar are losing their sheen off late. This view can be supported by the fact that their share in the global foreign exchange reserves have decreased in the Q1-2010.

Sparkling among the lot of BRIC economies is Indian currency – The Rupee.

The Indian economy has emerged relatively unscathed from the global slowdown and leading the curve. In fact, India leads the charts in terms of inbound inflows by the way of FII and Foreign Direct Investment (FDI), being amongst the top out-performers on the global podium.

Mirroring this trend, the Indian Rupee has appreciated sharply from the lows of Rs.50 per dollar during recession to the highs of Rs.45 more recently, currently around Rs.47 against a dollar. However, it cannot be pegged as a global reserve currency as Indian financial markets are highly susceptible to the volatility in the global flow of funds, as witnessed during the recent recession.

Economists are of the view that the new global reserve currency should not be based upon a basket of currencies, but the special drawing rights (SDRs) which would be controlled by IMF.

More over, even Russia wants rouble to be one of the world’s reserve currencies. Russia has renewed its push to reduce dollar’s dominance. In fact, the Russian president Dmitry Medvedev opines that the world may need as many as six currency reserves rather than relying solely on the fundamentals of any particular currency as a global reserve.

Any guesses…which will be the next global reserve currency in future?

Any country will invest in global currency only if its very confident of the currency. Recession, economic condition & balance is trade have clearly shifted the tide against USD & Euro.

There is also a study by Asian Development bank and writen a brief in my blog as well. http://indian-amps.blogspot.com/2010/07/alternative-reserve-currency.html about alternative reserve currency.

Chinese Yaun has the potential, but very early date to predict. However interestingly in the BRIC countries, the RIC countries are neighbours, hence they can forge a trilateral alliance.

Hello Guha Rajan & Altaf Rahman,

As Altaf has pointed out that none of the BRIC currencies have reached a stage where they can stand alone as a global reserve currency. At the same time, his view that the world economies should again latch-on to Gold, to fix the prices of their domestic currencies in terms of specified amount of Gold, is also not going to happen anytime soon. Probably, he means to say that the Gold standard should be adopted again.

But, that leaves a big question in the mind of people – Isn’t money intrinsically useless and, currently, it forms only a medium of exchange?

In fact, this is what has allowed some of the leading western economies to print more currencies without any fall-back support from intrinsically valuable asset (like Gold). Today, if the Gold standard would have been existent, the undue leverage couldn’t have been possible and people would have been discouraged to play beyond their networth.

With all due respect to the emergence of BRIC economies specifically India, I beg to defer.

None of the BRIC economies has reached a stage where they can be accepted for international trade. Imagine Burkina Faso and Fiji trading in Indian Rupees!! Its not possible.

8 out of 10 people on the planet have seen a dollar. I doubt even 1 outy of 100 people outside India have ever seen a Rupee.

Dollar has been a currency of international trade for 6 decades (since 1945, second world war). Rial, Rouble, Yuan, Rupee are not fully convertible. In such situation, none has the spine to be a world currency. However there are remote possibility of British Pound or Jap Yen getting attention.

Inspite of all above, I prefer that GOLD be the world currency once again. No one has anything against GOLD and its supremacy even over dollar. Gold has been international currency since men got civilized. Even now when ever any international event heats up, nations and investors hide behind Gold for protection.

I prefer that every nation should trade only in Gold and peg their currencies to Gold instead of Dollar / Euro. If everybody trades in Gold, we can teach a lesson to the arrogent West.

if not 6, atleast 3 currencies, viz. USD, INR & Chineese Yuan! ……we are going to have a bipolar world soon [US & china],…….& well, eventually a tri-polar one [US+India+China]…..by, may be 2030!!! :)

Agreed… Nikhil. The only negative for the world being investors keep flocking to dollar for safety purpose during times of turbulance instead of doing otherwise. Thus, it is a viscious cycle in which the world can not come out of the dollar deluge. But, at some point of time in longer duration, dollar will have to give up.

When will that time come is a billion rupee question? Oops! how does it sound when I say ‘billion rupee’? Let me replace it with ‘billion dollar’ :D

reminds me of the Panchtantra story of Too Big To Fail… link–> http://www.facebook.com/#!/note.php?note_id=402198342026

~maybe thts the reason why people flock to US……..they know its very big, & there would be some1 who’ll come & bail US out…….like the UN or the world bank……..maybe, somebody we might also pay for it!

PS:- unfortunately, ‘billion rupee’ doesn’t leaves the effect of ‘billion dollar’! :| ~……….not yet………may be in 2030! =)