Digital Revenues Of Indian IT Firms Breach $50 Billion; Infosys #1 In Digital With 42% Share Of Overall Revenues

Some 3 years ago, analysts studying the space of advances in technology in new digital areas like AI/ML, sensors and robotics, were convinced that Indian IT was not responding to these changes. Some prdecited demise of the Indian IT sector.

However, figures from Indian IT association Nasscom show that the new digital areas crossed the $50 billion revenue milestone last fiscal. That’s more than a quarter of the total revenue of $191 billion.

Read to find out more…

India’s Advances in AI, Robotics, Sensors Commendable!

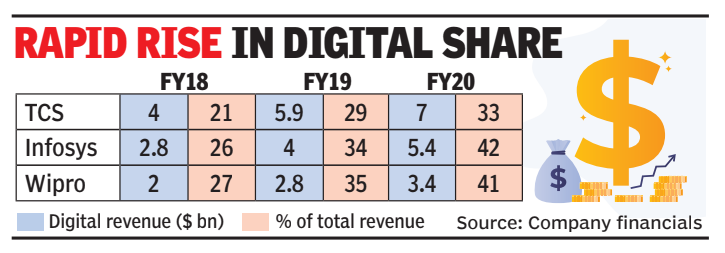

For some of the leading IT giants, the figures are even higher. For Tata Consultancy Services (TCS), Infosys and Wipro, digital accounted for 33%, 42% and 41% respectively of their overall revenues for the same fiscal year

Different IT firms define digital differently, hence these numbers are not strictly comparable. Nevertheless it is an indication of the amount of progress made.

Nasscom started breaking out digital from 2012 and in that year, digital was merely 4% of the sector’s revenue. In 2015-16, it was estimated at $16 billion to $20 billion, or 11%-14% of overall IT services revenue.

Experts’ Say In The Matter!

Phil Fersht, CEO of IT consulting firm HfS Research, said Indian IT companies have created a significant ‘permission to play’ through years of relationship and development of trust. He said, “Today, many of the Indian IT firms are genuine alternatives to the traditional integration firms such as Deloitte and IBM to perform high-level digital work, a lot higher up the value stack when compared to five years ago.”

He believes the secret recipe lies in any IT firm’s sheer tenacity, love of technology, and rampant entrepreneurship. He also said, “I credit Indian IT talent with a marked improvement in learning new programming languages and becoming strong at mastering low-code software, such as RPA, Salesforce and Pega.”

Nirmalya Kumar, Lee Kong Chian professor of marketing at Singapore Management University, said starting around 2010, the Indian IT industry had realised that they needed to change as their customers were transforming into digital enterprises. Instead of back office services for maintenance and support of legacy IT infrastructure, clients needed to ramp up dramatically their budgets to the front end problem of digitally connecting with customers through websites and apps.

He said, “Client focus had shifted to revenues and customer experience, which meant going digital had become a boardroom imperative.” And for Indian IT, to make the transformation, digital talent was the constraint, not budgets.

Moshe Katri, MD at Wedbush Securities, says during the past 3-4 years, Indian IT companies have aggressively invested in retraining employees in new digital technologies, recruiting onsite employees with knowledge especially in newer technologies, refreshing sales forces with a focus on digital and cross-selling digital-based projects into their existing legacy client base.

Vivek Wadhwa, distinguished fellow at Carnegie Mellon University’s college of engineering at Silicon Valley, was among those who were pessimistic about Indian IT. Today, he says if India’s IT industry had not woken up and reinvented itself, it would be in free fall. He said, “But it did wake up from its slumber and launch a series of new initiatives in new industries.”

In his upcoming book, Wadhwa talks about how companies that understand exponential curves can dominate the future and how legacy firms have an advantage over energetic startups and ‘big equals slow and stodgy’ is a myth. He said, “It takes a lot of effort to get them to move, as it did for Indian IT, but when they do, they can move mountains.”

Comments are closed, but trackbacks and pingbacks are open.