Google Tez Launched in India – Everything You Need to Know

Google Tez integrates UPI for security and uniformity

We had reported last week that Google was planning to launch Tez, a mobile payment system with UPI integration.

From paying for movie tickets and utility bills to transactions online as well as offline, Google Tez can do it all. The digital payment scenario in the country already has experienced a major boost since the government is encouraging people to go cashless. Global rivals Amazon and Facebook are also trying to get into the action.

Contents

What Is Google Tez?

Tez means ‘fast’ in Hindi.

Google Tez is a digital payments app powered by UPI and is available on Android and IOS. The app will let the users link their phones to their respective bank accounts to pay for goods and services in a secure manner. It will work for online as well as offline transactions, and also allow to make person-to-person money transfers.

Google Tez Is Simple and Easy

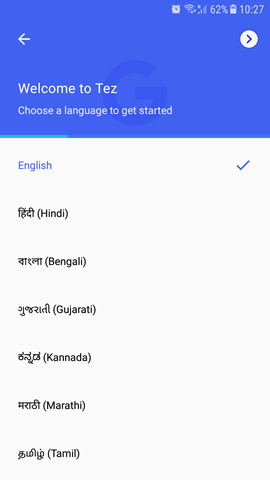

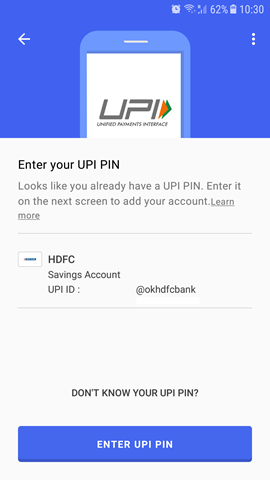

Google Tez supports majority of local languages like Hindi, Bengali, Gujarati, Kannada, Marathi, Tamil and Telugu. It has a very simple and straightforward interface. You will simply need to link your bank account by verifying your credentials. The app will send a text message from your registered phone number to confirm the registration on Tez app. Once verified, you need to add a UPI PIN, and you can start making transactions immediately.

Bank Support

Google Tez features a ‘Cash Mode’, which allows you to make person-to-person payments to people who are in close physical proximity. It achieves this by transmitting ‘audio’ waves which are inaudible to human ears. It identifies the person nearby and will let you to pay to or receive money from the user. Tez has partnered with HDFC Bank, ICICI Bank and State Bank of India for backend processing.

Not A Mobile Wallet

Tez is not a ‘mobile wallet’ like Paytm or Mobikwik. Here, money does not need to be stored in the app, as the user can transact directly from their bank account. Tez allows you to link your phone with your bank account and lets you use your smartphone as a way to make transactions straight from your bank account.

Transaction Limits

Although Tez is linked directly with your bank account, there are transaction limits. For money transfers, the limit is Rs. 1,00,000/- per day across all UPI apps and 20 transfers in a day. For a valid transaction, the minimum amount needs to be Rs. 50/- per user. For current accounts and merchants, the limit is Rs. 50,000/- per month with UPI for free. After the limit, transactions will be charged banking fees.

Partnership With Utility Services

Tez has exclusively partnered with some popular utility services like RedBus, PVR Cinemas, Domino’s Pizza, Dish TV and Jet Airways to boost their acceptance. Users are being suggested to look out for Tez logo in their favourite services, to check compatibility. The company has also introduced “Tez Scratch Cards” with special offers and deals.

Exclusive Business Channels

Tez offers an exclusive business channel within their service like the recent WhatsApp business feature and similar to one Paytm is working on. These channels will help users to easily find services with special discounts which can be availed from within the Tez app.

Enhanced Security

All the transactions happening through Tez will be guarded by Tez Shield to detect fraud, hacks and to verify identity. Tez has been specially built to provide appropriate security throughout the payment process, from customer to business and vice versa. It supports additional PIN security to protect against unauthorized usage. It even supports Touch ID on IOS.

Google Is Late, But Not Too Much

The Search Engine giant is the latest international entrant in the ever-growing digital payments market. Samsung already has their homegrown payment service in India since last year. Amazon and Facebook are also gearing up to come up with their versions of UPI enabled payments soon. The competition is definitely going to intensify for Google. Google’s Search, Maps and Android have a tremendous reach in the country, which gives them a distinct advantage of having a successful ecosystem that will help them to stay ahead.

Google as a company has invested the most in localizing technological for Indian consumers. From their localized search features, to free Internet at public areas and providing educational services in far-flung areas, the company has been increasingly pushing the reach of their services in India.

How To Use Tez?

Let us take a step-by-step look at how to activate and use Tez on your smartphone.

1. Download and install the Tez app from Play Store.

2. When you open the app for the first time, you will be asked to choose your language.

3. The next stage is verifying your mobile number, which will be done via an OTP.

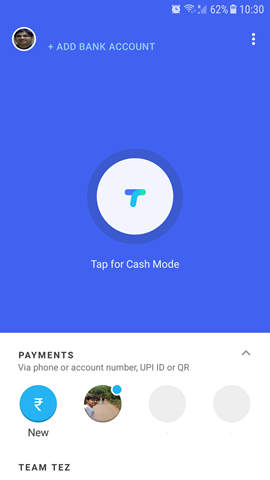

4. Once the mobile number is verified, you will be taken to the main screen of the Tez app. Here, you will also be able to see the contacts in your list who have downloaded and installed the app.

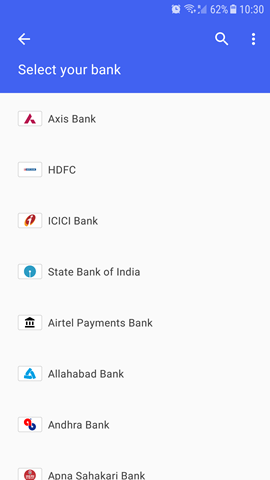

5. The next step would be to add your bank account to the app. Click on ‘+ADD BANK ACCOUNT’ option which appears below your name at the top. Select your bank from the list. Your UPI ID will be generated.Enter your UPI PIN to confirm and proceed.

That’s it! You are all set up to make transactions directly from your bank account using the Tez app.

Let us know your experience of using Tez. Did you face any issues or has it been smooth sailing all along? Sound off in the comments below.

Good application but needs some refinement. Too many bugs for a google-backed app. Stuck on searching for banks. Had to wait for a day to get it done. Interface is nice and simple. Not better than PhonePe. #TrakinTechGiveaway

Minimum amount FIFTY??!! And here I was, thinking I could use it to pay bus fare or auto fare…. :( …and I don’t GET what this thing is: if money is being transferred directly from one BANK to another, then where does GOOGLE come into the picture?? Why can’t you just transfer from your bank’s website/app?? ( and haven’t I heard about UPI transfers being possible on even FEATURE phones??? I might have read it right here!!……)

Tez having some issues during payments. But hope it will be sorted out soon. Now may be it will grow because it has started a new referral program.

Tez need more improvements…. Phonepe is far more better than this at present, As it is a new app there is not much expectations from users. In future if Tez is not customized as per users expectations it would become redundant like other UPI apps in market.

Tez need more improvements…. Phone pay is far more better than this at present, As it is a new app there is not much expectations from users. In future if Tez is not customized as per users expectations it would become redundant like other UPI apps in market.