Digital Payments Witnesses Record Growth Worldwide, May Potentially Cheques & Cash: Capgemini

Capgemini, a global leader in consulting, technology and outsourcing, in association with it’s banking partner BNP Paribas published it’s 12th edition of “WORLD PAYMENTS REPORT”. The report brings out some very interesting findings about non-cash transactions and the use of Fintechs and other regulatory softwares to help banks in the ever transforming digital world. The company has surveyed each continent separately and reasonable conclusions have been drawn.

The major findings of the report are:

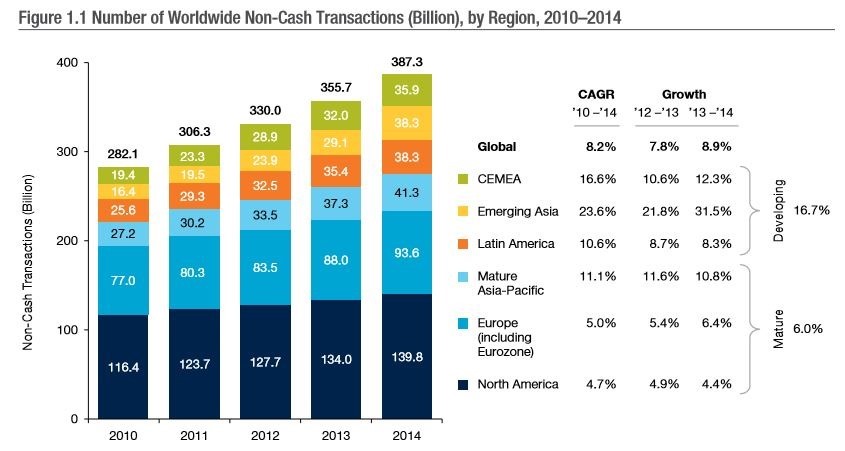

Non cash or digital payments have been growing exceptionally since the last decade and the report points to the fact that non cash payment volume stands at a record of 426.3 billion transactions in 2015 from 387.3 billion transactions recorded in 2014 ie a 10.1% growth.

The 10.1% increase in non-cash transactions are majorly attributed by

- Emerging Asia -31.9%

- Central Europe, Middle East and Africa- 15.7%

- Mature Asia Pacific- 11.6%

The exceptional growth has to be attributed to strong economic growth in developing countries, government policies favoring such non cash payments, ease in using digital wallets, improved security measures to curb digital mishaps, reduced processing time of payments, lower fee charged by banks for online transactions and other axillary benefits of using e-payments.

The huge bulk of such non cash payments happened in developed countries (which grew at 6%) whose share is 70.9% of total non cash transactions but what catches your attention is that developing markets grew at 16.7%

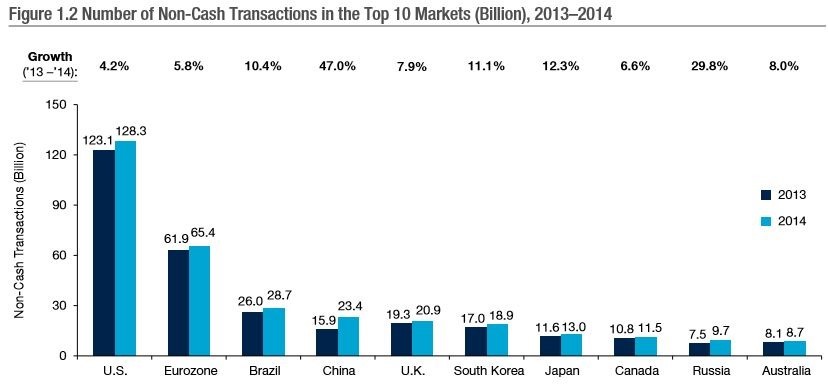

China has now beaten UK and South Korea in digital transaction volumes.

The top 10 countries to have highest non cash payment volumes were

1. USA

2. Eurozone

3. Brazil

4. China

5. UK

6. South Korea

7. Japan

8. Canada

9. Russia

10. Australia

Cards have still not lost their sheen as people used debit cards predominantly for most non cash payment transactions. Though the credit card usage was noted to be growing, the growth recorded has slowed down from the last year.

45.7% of the global non cash transactions were done using the debit card and debit card usage grew at 12.8%, making it the fastest growing payment instrument.

Immediate payments through debit or credit cards are enabling merchants and business houses to preform without fund shortage. Cash and Cheques are now being replaced with cards and online banking. The usage of cheques has declined considerably since the last 13 years.

The report also brings to our notice the banks still reluctant to catch up with new technologies that facilitate efficient, secure and faster transaction process. The banks need to adapt to the ever changing markets and deploy state of the art FinTechs to meet the customer’s expectations. The usage of Application Programming interfaces (APIs) help in monitoring and opening the bank’s internal systems. Enforcement of RegTechs can help banks attain a holistic approach in fulfilling the regulatory requirement and compliance.

Regtechs and FinTechs are 2 essential needs of the banking sector for they help in automating tactical compliance tasks in order to achieve holistic compliance. The report also states that 78.6% of bank executives view FinTechs as bank partners. Also the report points at the integration of interbank innovation was witnessed for SWIFT GPII.

The mobile phones, though being used for almost everything, the banking on smartphones has been a slow transition.

World Payment Report certainly brings out some interesting insights about the banking world and the ever increasing usage of non cash payment instruments. Cards and online payment options are here to stay and cash payments may soon come down drastically and hence our wallets will be online, so carrying a card holder may replace your fashionable wallet or clutch.