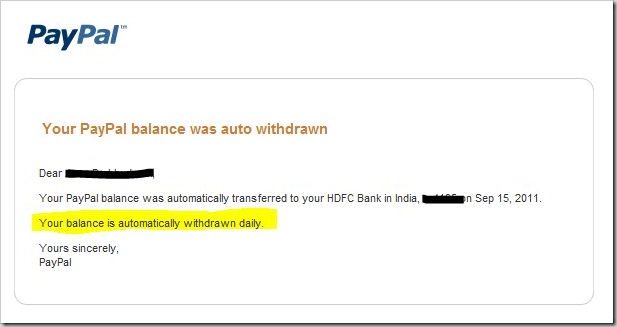

Update: Within an hour of writing this, PayPal seems to have notified the Indian users about the changes. Here is the Mail I just recd. from PayPal.

|

|

|

||

Honestly, PayPal is becoming a nightmare for Indian users. In last 12 to 18 months, Indian PayPal users have been forced with so many restrictions on their account, it has literally become useless!

Unfortunately, Indian users have to put up this sh** (Pardon my language, but that’s what PayPal account has become now) called PayPal for lack of an alternative. I mean its high time something is done about it.

Coming back to the new development – Paypal now forces Funds Withdrawal on Indian users. What that means is – you cannot park your money in PayPal account anymore. Whatever balance a user has in his paypal account on that particular day will be automatically be withdrawn / transferred to the bank account attached with your paypal.

Although, PayPal had put restrictions on using the Account Balance to make payments, a user was never forced to withdraw to his Bank account and he could do it at his own convenience (probably for getting higher USD vs Rupee exchange rates etc.). But with this new change, whether you like it or not, the remaining balance will be withdrawn/transferred on daily basis.

And, unlike previously, PayPal has not even bothered to send Indian users a mail informing them about this change. I came to know about it only because I got following mail from Paypal, AFTER the money was automatically withdrawn!

Prima Facie, I though it must be a default option that PayPal might have changed for user benefit, but its not! When I tried to remove “auto withdrawal to bank account” then you are greeted with a message

You can’t remove auto withdraw account, This is an Indian regulatory requirement and applies to all PayPal users in India."

So, auto withdrawal is forced on Indian users only – and like every time, the reason is the same – Indian regulatory requirement!

PayPal should shut shop in India…

Comments welcome..

[…] of payment. Now, all Indian users have nil balance in there paypal accounts – due to the auto-withdrawals that paypal has enforced […]

For all of us Indian users, this is one of the most clever options, being used by PayPal to sidetrack the strict rules and regulations imposed upon them by the RBI. They have been ordered to withdraw the amounts, within 12 hours, but they accidentally on purpose, forget to withdraw this money into the bank account.

Being an ex-banker, myself, I am going to tell you what they gain from not sending the money to us within 12 hours. Most of us are not going to take the time to go to the PayPal site and click the withdraw now button. The longer we take, the more time they have keeping our money in their bank, getting their own interest on that money.

Believe it or not, the Indian transactions in foreign currency through PayPal is running to billions of dollars and pounds. Imagine all that money being kept for 3 – 4 days without any auto withdrawal and getting all that interest. And then you remember that the money has not come to your account, because of course they did not send you any SMS message that you have received any money.

In fact I wrote to the RBI, giving them information about my last withdrawal being done on November 6. I received a very cringing apologetic letter from a PayPal employee, telling me that there was something wrong with their system and thus they could not withdraw the money automatically.

Interestingly enough, I went to other forums and found that people have been complaining about this since January 2 014. Also interesting that RBI did not take any stringent steps to stop this sort of unethical, unprofessional, barefaced piracy on the part of an American bank.

Also, let me tell you another thing. RBI had done this automatic withdrawal system so that nobody could hide their income through keeping it in an account abroad, i.e. PayPal. However, many of us have found that thanks to this automatic withdrawal not being done, we have plenty of balances, in our PayPal accounts and we can just shift that money quietly to our offshore accounts, in Switzerland. And the Indian revenue can go whistle.

Not that I have any, but I am telling you what is what.

I wonder if until now Indian users are still forced to withdraw automatically? This is something I wouldn’t like and nor love personally although there is nothing one can do to such rules and changes. Once its a government policy, its a policy to follow and so to PayPal in implimenting. Bravo the author, good post thanks.

i had autowithdrawed $0.12 on 7th may but didnt recive it in my bank account wats the problem i have also verified it but then too i m not reciving plz annswer me back its important……..help me indian users

I believe that this rule from RBI is quite acceptable. Otherwise people would “stock” their money in an overseas “bank” (may not be exactly, but very similar to one). To prevent such a collection, RBI has made a great decision.

And, don’t say Indians weren’t notified before the money was automatically withdrawn from your account – I did! More importantly, “RBI isn’t taking the money” from your account. They have just made it to be delivered to the owners of it, in time.

By the way, I’m not a fan of PayPal – neither of RBI. As a matter of fact, I don’t like PayPal. But I would like to admit I liked this great move by RBI.

Looks like all we can use paypal for, is a means of getting money to your bank account. The other main purpose (paying without revealing your CC info) is messed.

My Solution to Paypal – RBI issue.

I am Suresh Nair from Kerala. I have been using Paypal for the last 8 Years. They are one of the best payment processors. I cannot compare paypal with other payment processors like clickbank, 2checkout etc, because most of our sales are processing by Paypal. I have provided 2 payment options and 95% of them are choosing Paypal. So I cannot think about an alternative. The recent issues are because of ‘outdated’ guidelines from RBI. First of all, paypal is not a bank but a payment processor. So they have to make new rules/guidelines for payment processors.

Because of the new guidelines, we are facing the following issues:

1) Not able to use paypal fund to pay for domain, hosting, advertising expenses.

2) Not able to accept big amounts like USD 10,000 at a time, so we create multiple invoices for the same transaction.

3) Not able to process immediate refunds. Because, auto withdraws make the account empty. When somebody post an issue in paypal resolution center, they cancel the previous withdrawal and automatically deduct the foreign currency transaction fee. This is nearly $1.5 for every thousand rupees. This has already happened several times.

2 months back I found a real solution to this problem: I became an NRI and all the problems were solved. I registered a business in Malaysia and I have a Paypal account which is attached to my Malaysian bank account. Then the fund will be transferred to my Indian (NRE) account. No worry on paying Income taxes here in India since I am now an NRI and NO income tax in Malaysia for foreign income.

So Paypal doesn’t suck, but RBI sucks!

This policy got an update,, now I don't see see daily auto withdrawn,

PayPal shutting will be a heavy blow on many. But I do agree, this extreme form of regulations is really irritating!

Paypal is forced to do it by RBI. RBI is restricting above $500 transactions through Paypal, but not restricting the billions of rupees scams in India.

They are doing the right thing. They are doing what RBI tells them to do and I see no harm. For many years this money has evaded tax and its the right time to enforce it

I receive 200-300 USD/month. I am not complaining!!

I am still waiting response from Paypal, I sent 2 mails regarding the same, They never replied nor informed me abot these updates, I just confirmed after reading this blog,

I got mail “Thursday, September 22, 2011 4:51 PM” about Auto withdraw. and after that i sent 2 mails, still waiting…I think I got confirmation from this blog.

I will really stop using Paypal now!

@Arshi, Do you really expect Paypal to get back to you on this? They are too big to worry about a mail from one customer, that too an Indian!!

Thanks

Arun

Any how Its seems good to me………… I always forget to withdraw money from my PayPal Account.. Now I think Government and PayPal is doing for me…… Seems Like More One tension of Payment Withdrawing is also got reduced…. :) Sorry If I hurt any one Sentiments…. But what to do……

They are forced to do so as RBI is pressurizing them to do so. But they need to take care of their customers also. After this, I don’t think people will show interest in PayPal, but still we don’t have a better option.

I came to know about this only today when my PP funds got automatically transferred to my bank account in India. I was waiting for a higher exchange rate, but was quite surprised this morning when I got the email from PP informing me that my funds have been transferred. High time someone comes up with a good PP alternative!

Absolutely!! I came to know abt this through my another friend few days ago!!! Din know that u were having PP account!! Otherwise would've told u already :(

I just checked withdrawal funds cost. Before PP used to charge fees for withdrawing amounts less than 7000 INR right? It says "free" now, so that's not so bad :) Imagine paying fees on a DAILY basis for automatically withdrawing cash less than 7000 :P What a waste that would've been. Thank PP for small mercies ;) Though I wonder why I never got that email informing me about the changes :

hmmm :| NO withdrawal fees is a boon as you say :)

I would rather pay the Rs 50 than lose loads in interest rate conversion :P

Now if I have to refund money to a buyer, it has to be from my credit card costing much higher and our banks charge 3% for a foreign transaction. Is there any other site like paypal which is convenient ?

Damn! I wanted to buy some domains via paypal, I even verified my bank account and now its no use : :(

Again this is more frustrating news for all indian paypal users. Here the blame is not only paypal, RBI also has its own rules which is not suitable and s#%t for web payment users like us and paypal.

According to RBI,

– they never allow Money Wallet service – ie dont park the money in any form – must transferred to bank acc with in 7 days – money wallet is the preferred option from paypal by indian users.

– Should pay interest if you keep more then 7 days to the users or others money.

– RBI insisted Paypal to become a banking entity in india to follow the rules and money disbursement. Bur paypal evades to this for various reasons.

Finally Paypal is USELESS for indians by two arrogant and stupid entities, which made us jokers.or fools :(

It's actually not "regulatory requirement". It's the opposite – To escape being regulated by RBI, PayPal screws users! As long as Paypal remains just a "payment intermediary" – they can escape RBI regulations. But, Paypal has no qualms about being regulated by European regulators (like Luxembourg bank authority) – they just want to escape Indian regulations!

As long as there are stupid laws made by RBI saying that terrorists are using PayPal to transfer money to India, Indian users can not get peace using PayPal. PP was good earlier until RBI meddled and poked them with the middle finger saying that you need to shut shop. All in all, we, Indian PayPal users are being shown middle finger again and again by lawmakers. When they can't restrict black accounts, they block every authentic account. Simple! All our arses are burnt to hold off a few arses.

This actually is not RBI's but PayPal's fault. They refused to follow simple reporting guidelines in India that they are forced to follow in the USA, and this lead to a lot of tax evasion, finally forcing RBI to take some steps.

I think Paypal has read your article.

I just received an update from them as below:

——————

Hi Parag Parulekar,

As communicated earlier this year, we are working to implement RBI’s Guidelines regarding the processing of export-related payments. As a result the following changes will be made to your PayPal account:

• Effective 26th September 2011, you will not be able to receive overseas payments exceeding US$ 500 per transaction into your PayPal account.

•Any balance will be auto withdrawn out of your PayPal account daily.

We understand the impact this may cause to your business and seek your support and understanding as we continue to work together with the RBI. We will keep you updated as our conversations progress.

In case you have any queries, please log into your PayPal account and click on Contact Us at the bottom of any PayPal page.

——————

I am not sure if we can blame paypal, if our country's system is pretty Rigid.

I only pray this is stop gap arrangement.

I think Paypal has read your article.

I just received an update from them as below:

——————

Hi Parag Parulekar,

As communicated earlier this year, we are working to implement RBI’s Guidelines regarding the processing of export-related payments. As a result the following changes will be made to your PayPal account:

• Effective 26th September 2011, you will not be able to receive overseas payments exceeding US$ 500 per transaction into your PayPal account.

•Any balance will be auto withdrawn out of your PayPal account daily.

We understand the impact this may cause to your business and seek your support and understanding as we continue to work together with the RBI. We will keep you updated as our conversations progress.

In case you have any queries, please log into your PayPal account and click on Contact Us at the bottom of any PayPal page.

——————

I am not sure if we can blame paypal, if our country's system is pretty Rigid.

I only pray this is stop gap arrangement.

Yeah… I got this mail too 5 mins back… Updated the article with it..

It’s that screwed up, f***ed u, babu run govt bank of India!!

They are taking India back to license raj.

All I can say is, RIP Paypal!

I think even PayPal knows that it’s as sh** move, but then its hands are tied up by RBI. Slowly, PayPal is inching closer to its closure (in India).

Yes, RBI may have some rules and regulations – But if PayPal was inclined I am 100% sure they can do it. See the issue is because most of the money is foreign Exchange… and it is putting all the issues on its users… Instead they can just have a proper paypal bank account in India and operate users from that account…and let them take care of forex issues…

See, if they want to do it – they definitely can… It is just that India is not a big market as US and Uk and hence they are not concentrating. If India was their biggest market I am sure they would have done something about it…