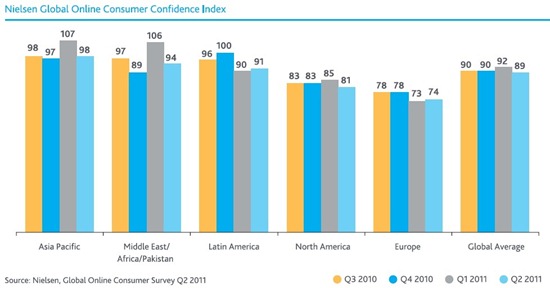

Global Consumer Confidence Index which harps on assessing consumer’s confidence in the status of their personal finances, job market and spending power has taken a hit in the recently conducted survey by Nielsen company. The extent of the fall is evident from the fact that the global consumer confidence in second quarter has fallen to its lowest level in 1.5 years.

The global consumer index’s global average was recorded at 89, the lowest since the fourth quarter of 2009. Noteworthy here is that 2009 was the year of a global economic recession and the consumer index would have obviously taken a large hit during that period.

Post 2009, global economies have been trying to get back on the path to recovery and barring few short-term positive trends, the overall economic recovery has not been as expected. There were speculations that the global economy would never be the same after 2009 and if consumer confidence is any indication, the speculations might have been true.

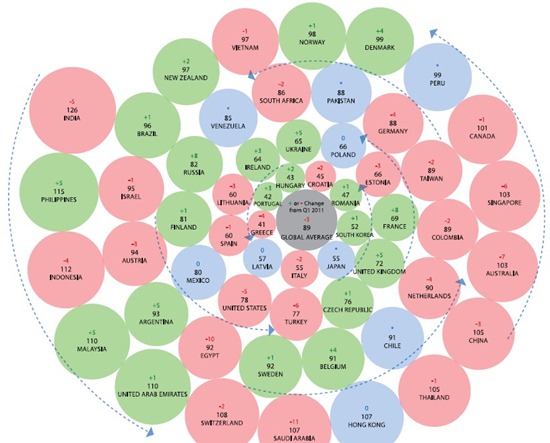

Global Consumer Confidence Change Q4 2011 (3 month trend)

Even as the global economy showed signs of recovery in 2010, 2011 seems to have seen a reversal of sorts. According to the survey, consumers across the globe intend to cut down on their spending be it investments, holidays or even making day to day purchases. As many as 31% of US consumers did not have any spare cash for discretionary spending as against 25% in Middle East and Africa and 22% in Europe

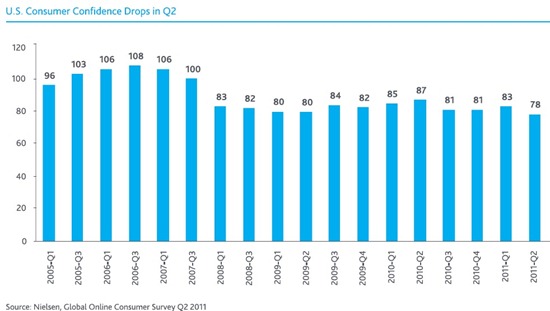

Consumer confidence in the United States cut a sorry figure this time around. Consumer sentiment was weaker than in the second half of 2009. United States was the epicenter of the economic bloodbath in 2009 and if the consumer sentiment has only worsened even after 2 years, one wonders where the US economy is headed. Personally, even as the overall industry growth and financial climate has improved gradually,high unemployment rate in the US is a serious concern. A weak job market can never instil confidence and trust in consumers over the health of the economy and that is reflecting in the negative consumer sentiment in the United States.

Consumer confidence in Europe does not reflect any positive trends either. Eurozone region is especially hit bad with a growing debt crisis. It is no surprise then that Greece came at the bottom of the consumer confidence index. UK and France were relatively better off and the consumer confidence increased in these two regions. With the Greece debt situation still shaky, the economic climate and the consumer sentiment is expected to remain on the lower side across major parts of Europe.

Indian Consumers Continue To Remain Bullish Even As Inflation Worries Loom Large In Asia

Indian consumer remain bullish resulting in a high consumer confidence index for India. Even thought at 126, the score represented a 5 point reduction from previous quarter. Contrast this with the average score of 89 and it suggests that consumers in India still maintain an edge over their western counterparts when it comes to confidence in the economy.

This also justifies the argument I made in the article titled Indian Firms Top Sales Growth Globally, Report High Profits As Well! on the high growth domestic markets and the renewed focus of companies in this market. However, things are not all good for India as well as other Asian economies as well. Rising inflation is a big worry across Asia and it is expected to negatively impact the consumer spending power.

The consumer confidence index is a key barometer to gauge the consumer spending levels and to a great extent what consumers feel about the economic health of their country. A fall in the consumer sentiment even after 2 years of the global recession is a cause of worry.

The difficult part is that the medium term trends do not hint at any major recovery in either the consumer sentiment or the overall economic health of various regions. The reasons plaguing the economies are contrasting as well. Where US battles high unemployment, Europe deals with the debt crisis, Asian counties need to tame inflation and maintaining the growth at the same time. The times are definitely going to be tough for the global economy and businesses going forward as their consumers keep their spending in check.

What are your thoughts on the decreasing consumer sentiment globally? Would this in turn hurt consumer businesses who depend on increased consumer spending for their growth?