You Need To Pay Income Tax On UPI Transactions, Cash Back Received Via e-Wallets

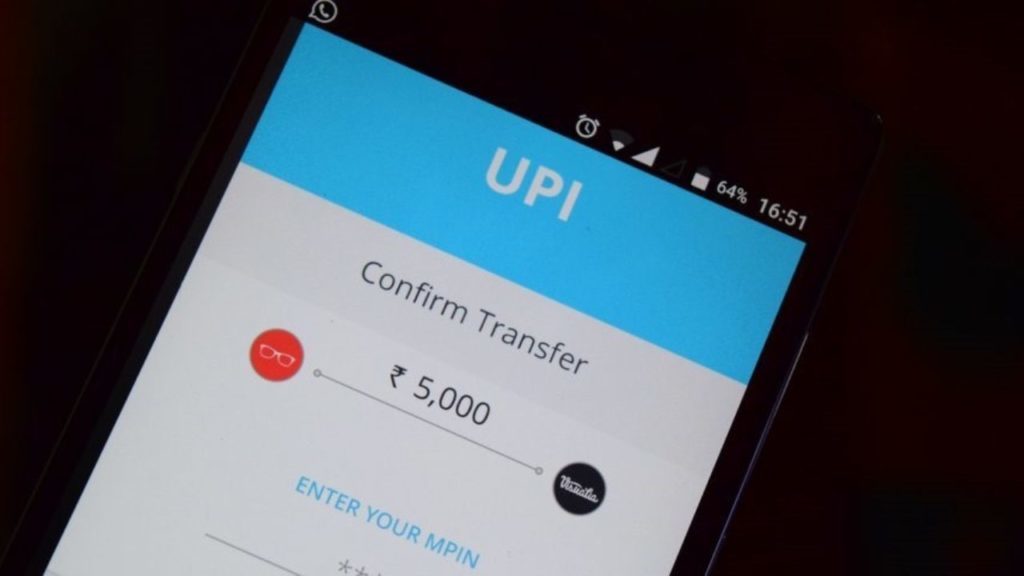

With the volume of transactions via e-payments and UPI gaining exceeding traction, especially during the past few months.

Factors like restrictions in terms of withdrawal from the same bank ATM, limit on cash transactions, charges incurred on withdrawal of cash, among others have contributed to a majority shift in cashless transactions, along with the use of digital wallets and UPI payments.

However, the people using these sources of payments must keep in mind certain implications to be added while filing their income tax returns.

Income Tax Rules on Cashless Payments

Most people choose to conduct cashless transactions like UPI payments and those made through online wallets, as they provide them with certain cashback rewards and the process too appears seamless, compared to traditional bank transfers.

However, it is important to understand that UPI and e-wallets attract tax too. The funds transacted through such electronic modes are taxable under the Income Tax rules too.

Just like income from sources like mutual funds or fixed deposits attract taxes, so do UPI transactions.

- E-wallets allow you to win cashback rewards. These reward amounts are credited directly to the linked bank accounts. Under Section 56(2) of the Income Tax Act, if the cashback reward amount exceeds Rs 50,000 in a financial year, it becomes taxable.

- The most sought option for transferring money from one bank account to another is using any UPI app. The maximum limit set for transferring money on a UPI app is Rs 1 lakh. However, if the transfer exceeds this set limit, the amount is subjected to tax.

- In case of vouchers given by employers of a sum exceeding Rs 5,000 through UPI, a tax is charged under the Income Tax rule-3(7)(iv).

- Furthermore, if friends or family sends a gift voucher(s) exceeding Rs 50,000 in a financial year, the amount is taxable under the category ‘income from other sources.’

Comments are closed, but trackbacks and pingbacks are open.