7th Pay Commission: Child Allowance Is Linked With Dearness Allowance; Find Out How Much You Get?

The Centre has brought about some changes in the pay structure and allowances of the central government employees.

These changes encapsulate different salaries and allowances like the:

- Dearness Allowance,

- Travel Allowance,

- House Rent allowance,

- Children Education Allowance, and

- Hostel Subsidy Allowance, among others.

Hence, it becomes very important for such central government employees to be updated with the new DoPT norms, under the 7th Pay Commission.

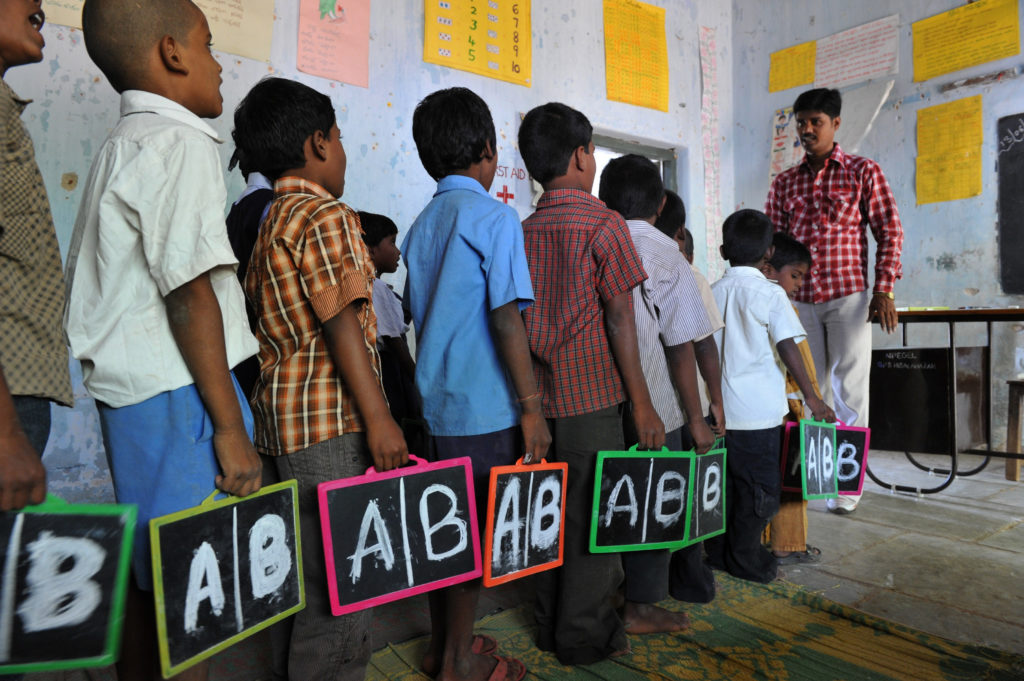

Today, in this article, we will cover the latest changes in the Child Education Allowance (CEA), linked with the Dearness Allowance (DA) of a central employee.

CEA Goes up as DA Increases

Central employees are eligible for and receive Child Education Allowance for each of their children, per month.

However, not many central government employees know that their CEA is directly linked to the Dearness Allowance they receive.

This means as the DA increases, so does CEA.

Each Child to Receive Rs 2,250 Under 7th Pay Commission

Under the 7th Pay Commission, every central government employee is given a sum of Rs 2,250 for each child, as the Children Education Allowance (CEA) by the government.

According to the norms set by the Department of Personnel & Training (DoPT),

- The CEA of a central government employee is eligible for only two children.

- For a disabled child, the CEA received will be Rs 4,500 per month.

It is to be noted here that according to the DoPT, as the DA of a central government employee increases by 50%, his/her CEA increases by 25%.

“The amount for reimbursement for Children Education Allowance will be Rs 2,250 per month per child. This amount of Rs 2,250 is fixed irrespective of the actual expenses incurred by the Government Servant.”

How Old does the Child need to be for Claiming CEA?

Apart from CEA, a central government employee is eligible for a monthly hostel subsidy of Rs 6,750 as well.

In a family, if both the spouses are government employees, the CEA sum will be applicable for only one of them.

Speaking of the age limit, the CEA sum is applicable for children (not more than 2) of central government employees of the following ages:

- Upper age limit: 20 years, or until passing 12th class, whichever is earlier,

- For a disabled child, the upper age limit is 22 years.

- There shall be no minimum age for claiming CEA.

Comments are closed, but trackbacks and pingbacks are open.