Stock Broking At Paytm Money Starts: Find Out Features, Charges, How To Start Trading?

Stock Broking At Paytm Money Starts: Find Out Features, Charges, How To Start Trading?

On August 10, Paytm launched a new feature of stock trading services on its Paytm Money app.

Read on to find out about the features and more…

Contents [hide]

Key Features of Paytm Money Stock Trading Service!

The stock trading services can now be accessed by the android user however the company is still working on making this service available for ios users. Following are the key features of the service-

- 100% Paperless Account Opening

- Digital KYC process

- Setting up of Account and KYC process takes place within 24 hrs

- Set Price Alerts and Create Multiple Watchlists

- Track Real-time Price Changes of upto 50 Stocks

- Get Details on Market Movers Based on Top Gainers, Top Losers and Mover By Volume and Value.

How To Open The Trading and Demat Account?

The setting up of the account and the KYC process is quite an easy task and takes place within a few minutes.

To open an account –

- Install the ‘Paytm Money- Mutual Funds & Stock Investment’’ app from Google Play Store.

- Open an account using your mobile phone number. You will get a confirmation via SMS.

- Complete the KYC process wherein you need a few documents like PAN and Aadhar details.

- Your investment account will be ready to operate within 24 hours.

What Are the Charges?

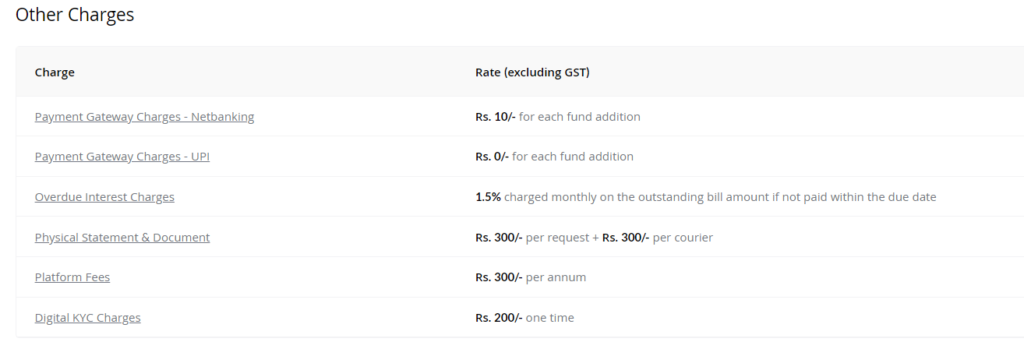

Paytm Money charges between Rs 300 per annum as platform fees and Rs 200 for digital KYC. The digital KYC charges is a one time fee.

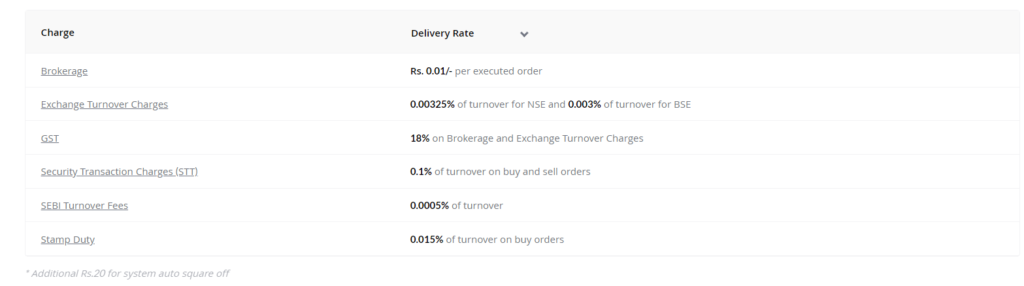

Trading Charges- Delivery Rates

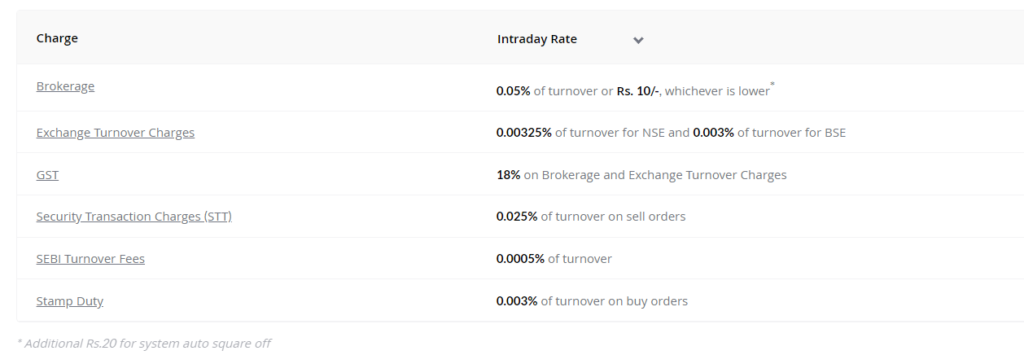

Trading Charges- Intraday Charges

Image Sources: Paytm Money?

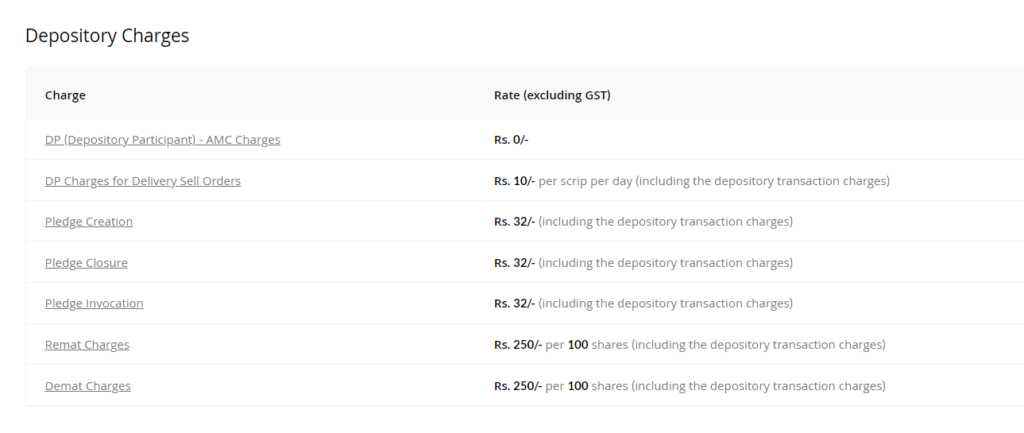

Depository Charges

Image Sources: Paytm Money?

Other Charges

Image Sources: Paytm Money?

More About The Paytm Money Stock Trading Feature!

India’s largest wallet company already had the Mutual Funds and National Pension Scheme (NPS) on its Paytm Money app.

In December last year, Paytm Money received a go-ahead from the Securities and Exchange Board India (SEBI) to start stock broking.

Comments are closed, but trackbacks and pingbacks are open.