Google Pay Beats Paytm, Becomes #1 Payment App; Google Says No Law Being Broken

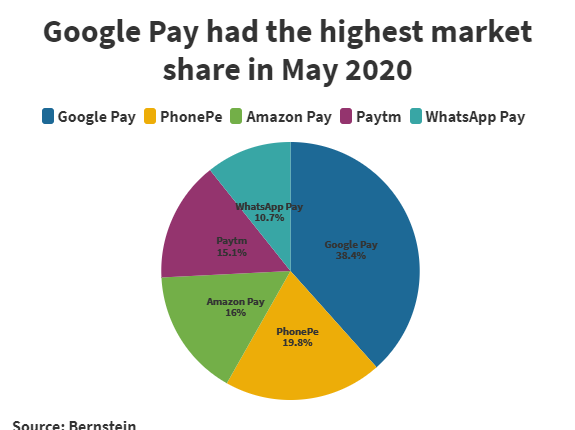

Google Pay has topped the India’s payments market over its rivals PhonePe, Amazon Pay and Paytm.

Although, its biggest challenge is yet to come!

Read to find out more…

Google Pay Leads the Indian Payments Market!

According to the reports. Google Pay had 7.5 crore transacting users in May, 2020 while PhonePe had 6 crore users and Paytm had 3 crore users.

One-time payment market leader in India, Paytm is facing pressure from its peers as according to reports its monthly active users in December 2019 stood at 4 crore as opposed to 4.5 crore the previous year.

Paytm told Business Insider, “Paytm Wallet & other payment methods (net-banking, cards MPS etc) available on our app has continued to grow and we register a huge number of transactions. Overall, Paytm continues to dominate digital payments and has over 50% market share of mobile payments to merchants. We have the largest offline merchant network in the country with over 17 million (1.7 crore) merchants.”

The spokesperson added, “Paytm has over 10 million (1 crore) daily transacting users and our overall user base is much more than the combined UPI base of all players.”

According to a TechCrunch report which cited data from National Payments Corporation India (NPCI), GPay had 54 crore UPI transactions while PhonePe and Paytm saw 46 crore and 12 crore respectively.

Another report saw a rapid growth in UPI transactions of Amazon Pay with 6 crore UPI transactions.In April, Amazon launched the pay now, buy later option for its users.

According to NPCI, the total UPI transactions in May, 2020 stood at a whooping 123 crore.

However Paytm clarified that, “UPI consists of just a minor percentage of all digital payments happening in the country. The largest majority of payments made on wallets, cards, and net banking.”

PhonePe claims to have 20 crore registered user base and is slowly increasing its hold on the merchant user base as well and now has over 1 crore merchants onboard. It has also diversified to financial services and offers travel insurance as well.

Meanwhile, Amazon Pay too, is ramping up its operation by offering more to its users.

Google Pay’s Challenges In India!

Google Pay’s operational validity as a third party app is currently under scrutiny by the Delhi High Court. A buzz on social media over issues arising while transferring money through Google Pay are not protected by law as the app is unauthorised led to the investigation.

Google Pay on June 25 said it works with banks to allow payments via UPI, and all transactions made through its platform are fully protected by redressal processes laid out by guidelines of RBI and NPCI.

A Google spokesperson said, “Some quotes on social media, wrongly attributed to the RBI, claim that issues arising while transferring money through Google Pay are not protected by the law, since the app is unauthorised. This is incorrect and can be verified on NPCI’s website.”

Earlier this month, the Reserve Bank of India (RBI) had told the Delhi High Court that Google Pay is a third party app provider and does not operate any payment systems. The spokesperson added that RBI has stated no such thing either in the court hearing or in its written response to the High Court.

Therefore, its operations are not in violation of the Payment and Settlement System Act of 2007, RBI had told a bench of Chief Justice D N Patel and Justice Prateek Jalan.

RBI had also told the court that since Google Pay does not operate any payment system, it does not find a place in the list of authorised payment system operators published by the National Payments Corporation of India (NPCI).

Furthermore, the spokesperson said, “Google Pay operates completely within the law. Google Pay works as a technology service provider to partner banks, to allow payments via UPI (Unified Payments Interface). UPI apps in the country are categorised as ‘third party apps’, and are not required to be ‘payment systems operators’.”

The spokesperson highlighted that all transactions made via Google Pay are fully protected by redressal processes laid out by applicable guidelines.He stated, “All transactions made via Google Pay are fully protected by redressal processes laid out by applicable guidelines of the RBI/NPCI, and users can reach out for any help 24/7, through Google Pay customer care.”

WhatsApp Pay Can Be A Tough Competition For Google Pay!

Facebook’s Whatsapp Pay has over 40 crore monthly active users in India. WhatsApp Pay’s chances of success can be owed to its deal with Reliance-Jio deal.

Analysts at Bernstein expect WhatsApp Pay’s penetration to increase to 30% (from the current 10%) by FY25.

WhatsApp is conducting trials in the country since 2018 but facing a lot of regulatory hurdles from Reserve Bank of India (RBI), NPCI. Although, with its massive user base it will be easy for the messaging platform to gain a hold on the payments market of India.

According to Bernstein’s hypothesis, WhatsApp has already amassed 10.7% of the market in the first phase of rollout since the approval came in February. The subsequent phases will be much bigger and a lot more competitive.

The Bernstein report also stated, “Payments remains the missing link, the tie up could be a potential game changer with WhatsApp Pay integration with JioMart.”

Comments are closed, but trackbacks and pingbacks are open.