Paytm Postpaid Wallet Is Illegal? Delhi HC Asks Paytm, RBI To Respond Based On PIL

As though Paytm hasn’t had enough, there is yet another problem now surfacing the digital payments company. There has been a Public Interest Litigation (PIL) filed on Paytm by financial economist Abhijit Mishra, which has now gained traction and has issued a notice by the Delhi High Court Division Bench.

The PIL Filed

The financial economist Abhijit Mishra has filed a PIL on Paytm Payments Bank to the Delhi High Court alleging that the service provided by Paytm Post Paid Wallet is in violation with the Operating Guidelines for Payments and Guidelines for Licensing of Payments Banks, as issued by the Reserve Bank of India.

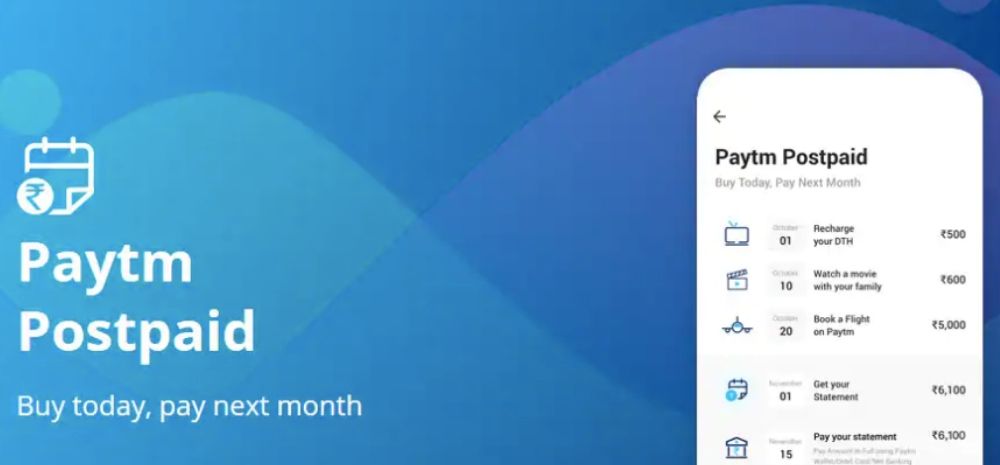

Paytm ‘Post Paid’ is a credit facility offered by the company to its customers. Using this, customers can recharge mobiles, book movie, travel tickets and shop on Paytm, while repaying by the following month and a week at zero interest. Mishra says that it is illegeal, as it offers credit and lending services to its customers, which violates the regulations put forth by RBI on the scope of operations of payments banks.

The guidelines of RBI do not permit any payments bank to offer a credit product, or disburse loans to customers in any form or kind, not even to its own board of directors, without prior approval of RBI.

In response to the PIL, the bench, headed by Chief Justice Rajendra Menon and Justice Brijesh Sethi, has issued a notice to RBI and Paytm Payments Banks Limited, asking them to clear their stand on the matter. The next date of hearing is on September 3.

There’s Another Loophole Too

The filing doesn’t just end at this reason. In his filing, Mishra further states that the postpaid facility of Paytm Payments bank is wholly handled by a third party vendor, named Clix Finance India Private, providing unmonitored and unauthorized access of its customers’ private financial information to a third party, thereby clearly violating the constitutional right to privacy.

The petitioner whole-heartedly requests RBI to look into the matter and take punitive actions against the Paytm Payments Bank Limited under the provisions of 47A of the Banking Regulation Act and to turn in all the profits the latter has earned, into the Prime Minister’s Relief Fund for the welfare of the nation.

In response to the PIL, Paytm said on its website that the credit facility was being offered by ICICI Bank and that the company only acted as a facilitator for the service. It is not yet clear if the postpaid service falls under Paytm’s digital wallet division, or is incorporated under the Payments Bank service, giving rise to confusion.

With the history of events Paytm has been associating itself to, the path doesn’t look very smooth in the very near future for the digital payments company.

Comments are closed, but trackbacks and pingbacks are open.