India Beats US & China To Become World’s #1 Investment Destination: Report

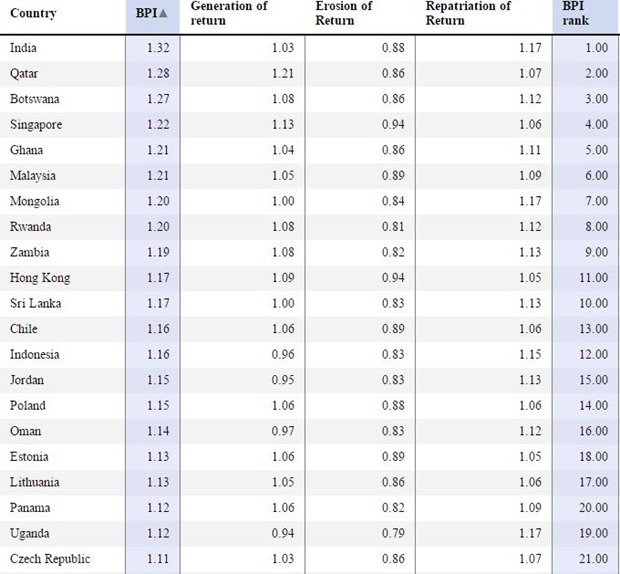

As per a ranking methodology formulated by acclaimed Economist and bestselling author Daniel Altman, India has been ranked world’s number 1 investment destination, overtaking economic superpowers US and China.

This ranking methodology, called Baseline Profitability Index (BSI) was created by Daniel in 2013, and it showcases the” attractiveness of investing in markets around the world”.

BSI is a kind of quick guide for the novice investor, who is trying to put his money into emerging economies and robust businesses around the world; Devoid of any complex technical jargon, BSI aims answer only three primary questions for any investor:

- How much an asset’s value grows

- The preservation of that value while the asset is owned

- The ease of bringing home the proceeds from selling the asset

Based on these parameters, and addition of key stats concerning financial stability, physical security, corruption, expropriation by government, exploitation by local partners, capital controls, and exchange rates, Daniel was able to create the ranking.

Compared to last year, India has jumped 5 places to reach #1 position in the BSI.

While explaining the ranking and the logic behind it, Daniel attributes Indian growth story to Modi’s governance as he said, “But the big story in the BPI this year is India coming out on top, with growth forecasts up, perceptions of corruption down, and investors better protected following the election of a government led by Prime Minister Narendra Modi.”

At #2 position is Qatar, which is the only country from Middle East in the top 10 rank. Botswana is at #3, Singapore is ranked #4 and Ghana is at #5.

USA has been ranked #50 and China is ranked #65 in this year’s ranking. Even Pakistan is ranked better than China at #58.

As per Daniel, several nations in Africa and Asia saw their ranking improved this year, because World Bank has introduced a new way to measure GDP (Gross Domestic Product) based on the purchasing-power-parity figures for all countries.

Hence, the ranking of countries like Indonesia, Jordan, Kuwait, and Zambia improved because BPI assumed that an investor’s money in these nations will increase significantly in the next 5 years, owing to the currency appreciation and improved purchasing power.

Globally, investment opportunities have tremendously improved, across the nations. Last year, the average BPI rating across all countries was 0.99, which has now increased to 1.03. Compared to US Treasury Notes, this jump is almost equivalent to 30% return on investment.

You can checkout the entire ranking of all 110 nations which were analyzed for 2015 Baseline Profitability Index here.

[Image Credit: Shutterstock.com]