Indian PC Sales Drop 16.5% In 2014, Microsoft Holds The Wild Card In Tablet Market: IDC

Beating all expectations, phablets and smartphones have held their dominance in the gadget market worldwide. Such is the ripple effect of rising smartphone and phablet sales, that it is now directly threatening tablet sales and severely affecting personal computer market all over the world.

Personal Computer Market in India

As per IDC’s research, 9.6 million personal computers were sold in India during 2014, which is 16.5% less compared to PC sales in 2013. If we compare only revenues, then the industry witnessed a negative growth of -0.4% year on year.

Commercial PC sales (B2B) is the worst performer here as only 4.7 million PCs were purchased by business establishments in 2014, signaling a negative growth of -29.6% compared to 2013. The report mentions that the biggest buyer of computers: BFSI and IT sector didn’t show encouraging signs and there was no big orders from state governments or education sector.

Consumer PC sales were still healthy as 4.9 million PCs were lapped up with consumers in 2014, which is positive increase of 1.7% compared to 2013. Introduction of sub-$400 PCs with excellent features attracted consumers from India. Although the first half of 2014 witnessed slow PC sales, it picked up post elections when the political scene became clear and prices stabilized.

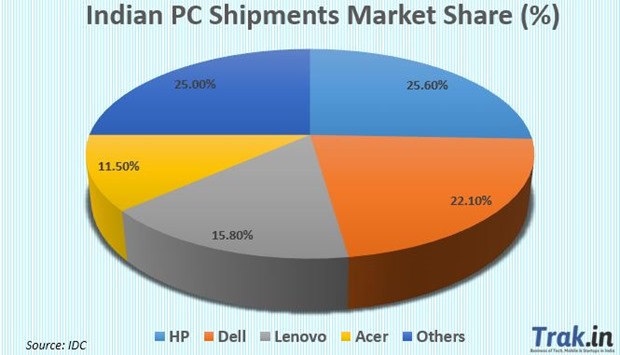

With 25.6%, HP emerged the top PC vendor in India for 2014 financial year, followed by Dell with 22.1% and Lenovo with 15.8%. Others, which include unorganized sector of assembled PCs had 25.06% meanwhile Acer had 11.5%.

Dell was specially mentioned for consistently clocking in 9% year on year growth, with a record 22.1% in 2014. Their biggest growth came from Tier 2 and Tier 3 cities, which is an encouraging sign for the entire industry.

Lenovo is also managing to showcase a consistent performance as they had 3.5% year on year growth in the last 5 years, with 15.8% in 2014.

HCL, which was considered as of the strongest Indian PC player shut down their manufacturing unit in 2013, which was a signal of the turbulent times ahead in this sector. Last year, Indian PC market witnessed 20% drop in sales.

Overall, it is being predicted that PC sales would increase in 2015, and globally it will touch 293.1 million. Interestingly, developed market will constitute 137.5 million units meanwhile emerging markets (such as India) will be responsible for 156 million units. In 2014, total of 308.1 million OCs were sold worldwide.

You can find the complete report from IDC here.

Global Tablet Market

Tablet sales continue to disappoint researchers worldwide. For the first time in 5 years, IDC was forced to re-calculate and scale back their estimations for tablet sales.

As per market projections, it is being estimated that 234.5 million units will be sold in 2015, which is an increase of 2.1% compared to 2014. By 2019, total of 269 million tablets would be sold, which is only a fraction of estimated 5.6 billion smart phones which would be in use by 2019.

The report from IDC clearly states that the rise of popularity of smartphones and phablets is the clear reason for declining tablets sales worldwide.

Last year, we had reported that Samsung is the top tablet vendor in India, followed by Micromax and iBall.

In terms of OS, Android will continue to hold dominance in the tablet market but the share of iOS will drop considerably in the coming years. In 2014, 154.7 Android enabled tablets were sold, capturing 67.3% of the market share; 63.4 million iOS enabled tablets were sold with market share of 27.6% and 11.6 million Windows tablets were sold with 5.1%.

By 2019, it is estimated that Android will hold 62.9%, iOS share will drop to 23%.

Worldwide Tablet plus 2-in-1 Shipments, 2014 – 2018 (Shipments in millions)

| Operating System | 2014 Shipment Volumes | 2014 Market Share | 2015* Shipment Volumes | 2015* Market Share | 2019* Shipment Volumes | 2019* Market Share |

| Android | 154.7 | 67.30% | 158.1 | 67.40% | 169.5 | 62.90% |

| iOS | 63.4 | 27.60% | 60.1 | 25.60% | 61.9 | 23.00% |

| Windows | 11.6 | 5.10% | 16.3 | 7.00% | 38 | 14.10% |

| Total | 229.7 | 100.00% | 234.5 | 100.00% | 269.4 | 100.00% |

The wild card is being held by Microsoft, as their share will increase to 14.1% in 2019, up from 5.1% right now. Microsoft is researching and coming up with consumer friendly features in their tablets, which has the potential to disrupt iOS market share.

IDC’s global tablet market report can be viewed here.

[…] Such is the ripple effect of rising smartphone and phablet sales, that it is now directly threatening tablet sales and severely affecting personal computer market all over the […]