Did you know that about half of Indians do not have a simple basic saving accounts. While the situation is improving, still millions are households in India still do not have any financial inclusion.

There have been number of initiatives launched by the previous governments with little or no success in terms of financial inclusion.

But it seems, new PM Narendra Modi’s ambitious “Pradhan Mantri Jan Dhan Yojana” initiative may change all that. The ambitious plan includes offering every household with a basic bank account apart from benefits like debit cards, kisan credit card and free insurance.

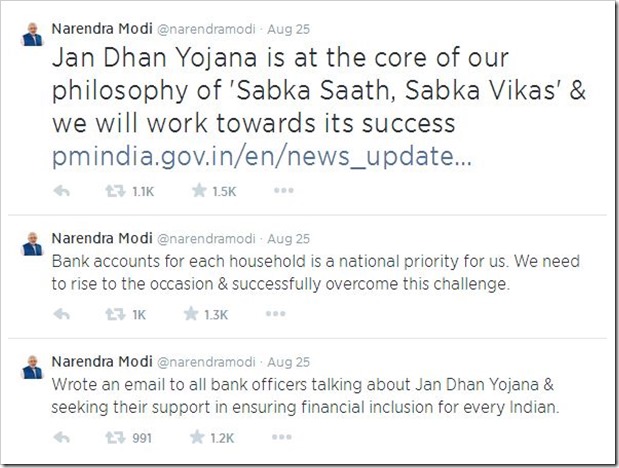

Jan Dhan Yojana is a brain child of Prime Minister Narendra Modi himself – PMO has sent 7.25 Lakh emails to bank officers informing them about the scheme. In his email he pointed out that Jan Dhan Yojana lies at the core of their development philosophy of Sab Ka Sath Sab Ka Vikas. He added,

“As we move rapidly forward in this knowledge era with modern banking and financial systems, it is untenable that a large majority of our population is deprived of basic banking facilities. I sometimes wonder whether we have made matters so complicated that the poor and the marginalized are those who are trapped in a perpetual cycle of exclusion and deprivation. We need to break that cycle and the Jan Dhan Yojana is the first step in that direction. With a bank account, every household gains access to banking and credit facilities. This will enable them to come out of the grip of moneylenders, manage to keep away from financial crises caused by emergent needs, and most importantly, benefit from a range of financial products.”

Here are some of Narendra Modi’s Tweets in last few days that points to the amount of importance PM is giving to Jan Dhan Yojana.

Not Yet Another Financial Inclusion Scheme

Financial Inclusion for all has been a priority for some time now. Policy makers have come up with various schemes and initiatives but with little success till date. However, Jan Dhan Yojana already seems to be on the way to success because of the way it is being implemented.

On the first day of launch of Jan Dhan Yojana, over 1 Crore new bank accounts are expected to be opened – and these are not just empty numbers, the plan has already been mobilized. Bank officers across India are actually visiting slums and villages to meet people to sign-up for Bank accounts.

I was speaking to a friend yesterday who had just made a visit to his bank. He found all the bank officers jaded and tired – upon asking, they said that they have been visiting places for last few days to get people to sign-up for bank accounts under Jan Dhan Yojana.

Under this scheme, bank account holders will be given 1 Lakh accident cover, Rupay Debit cards and Kisan Credit Cards (for farmers). Over time, insurance cover and pension products will also be added to these accounts. These accounts will also be offering overdraft facility to each of upto Rs. 5000.

How Will Jan Dhan Yojana Help?

Jan Dhan Yojana is just not about financial inclusion, but goes far beyond that. With every family having a bank account, the Government aims at paying benefits under various Government schemes directly into the bank accounts. This will ensure that any form of corruption is wiped out when it comes to disbursing benefits under subsidy bill.

Financial inclusion of farmers and under-privileged citizens will also mean that loans from informal financing channels (moneylenders) will be diminished. These moneylenders often charge very high interest rates, which keeps borrower under the financial burden for long.

Who can Open Accounts under Jan Dhan Yojana?

Anyone and everyone can open bank accounts under this initiative. Even people who do not have officially valid Identity documents can open it. However, they will have something called a “Small Account” that can opened by submitting self-attested photograph and either a signature or thumb print in the presence of an official of the bank. These accounts will have limitation of the amount of credit they can receive in a year (Not more than 1 Lakh p.a.). These accounts will be valid for 12 months and can be further extended after submission of valid ID and address proof documents.

Officially valid documents for KYC purpose include: passport, driving license, voters’ ID card, PAN card, Aadhaar letter issued by UIDAI and Job Card issued by NREGA signed by a State Government official.

Jan Dhan Yojana definitely looks promising and is sure to go a long way in bringing the much needed financial inclusion in India.

What is your take?

[…] Pradhan Mantri Jan Dhan Yojana, launched in August, 2014 with an ambitious target of opening bank accounts for every Indian, has right now enabled opening of 22 crore new bank accounts pan-India or around 4 lakh new bank accounts were opened every day in the last 18 months. […]

[…] Modi’s ambitious plan to include all Indians under banking system: Jan Dhan Yojana, has been featured in Guinness Book Of World Records. A new world record has been created as Indian […]

This scheme definately looks promising. In the longer run the Govt can now think of giving subsidies as cashbacksto respective accounts. Also a health insurance cover of 30k and personal accident insurance of 1 lakh will be a boon to the bpl community.

Also announcing is one thing and implementing this at such a speed is another. The Govt definately needs a praise here. looks like ????? ??? ???? ???? ???? ???

that was hindi typed in unicode..

acche din dhire dhire aa rahe hai…