Contents [hide]

Indian Internet Industry post the Dotcom Bubble

After the dot com bubble burst happened in 2001, the US economy along with other major developing economies saw the internet and telecom stocks crash. Since then owing to the gradual rise and development in telecom infrastructure along with the increase in penetration of internet has led to a second round of internet boom in the world with the IPO of multi billion dollar Facebook, Groupon and Zynga.

In India, the year 2007-08 saw the inception of the current crop of Indian internet companies and by the beginning of 2011, e-commerce was a viable business activity. The number of people with access to internet is increasing at a rapid pace and several billion dollars of transactions have been executed till date for internet purchase.

With changing consumer lifestyle, increasing disposable income and the rise in middle class families in India, the country has seen people spending real money online. The dynamics of the Indian Technology is also changing rapidly. The PCs are also getting obsolete. Read how Apple is killing the PC market.

Major travel companies are earning serious bucks by selling products and services online. The banking sector which introduced banking on the go facility in the form of net banking, credit card, debit card and also facilities like PayPal have made the life of the people easier. The online method of spending is a cost-effective way and has saved a lot of time for individuals. It is a boon for the modern day people, who in today’s busy era cannot afford quality family time.

E-Commerce in India – Not a fad anymore

Ecommerce Industry as a whole has changed the shape of Indian economy and it has grown rapidly even n comparison to developed nations like US and UK. Comparing the purchase pattern now and two years ago, we see a totally different ball game.

Earlier no one was seen buying televisions online but today ecommerce websites like Flipkart, Egully, Infibeam, are competing with each other on selling number of LCD and LED sets on a regular basis. Looking at the core of the ecommerce Industry we see that the provision of making purchase online has been decades old and was followed mainly in west but due to inefficient supply chain management and improper logistics it was never implemented in India.

Two years of e-commerce has changed the face of industry drastically and the industry from being nothing years ago is worth billions now. Flipkart, within a small span of years has now become the Top most websites visited. With more than 30 thousand books shipped on a daily basis and with an availability of more than 11.5 million books, the company has emerged as a brand in the industry and has definitely given it a new shape.

E-Commerce Has Grown at a Stunning Pace in the West

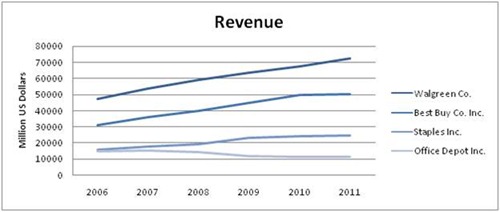

If we see the revenue generation for some of the leading ecommerce companies based in US we see that the revenue has been seeing a rising trend.

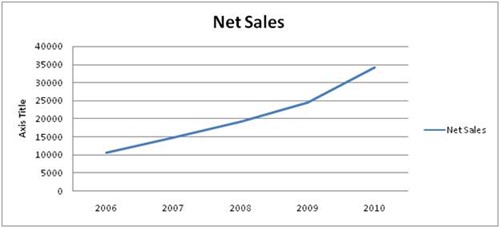

Looking at the financials of ecommerce giant, Amazon.com Inc. which is an American multinational e-commerce company and is the world’s largest online retailer we see that the sales of the company has been improving continuously as seen from the table and graph below.

Amazon Financials

|

|

2006 |

2007 |

2008 |

2009 |

2010 |

|

Net Sales |

10711 |

14835 |

19166 |

24509 |

34204 |

|

Net Income |

389 |

655 |

842 |

1129 |

1406 |

|

EBITDA Interest coverage |

5.6 |

7.9 |

10.8 |

16.2 |

21.3 |

|

FFO/debt |

30.5 |

32.7 |

58.7 |

130.3 |

124.2 |

|

Debt/EBITDA |

2.8 |

1.9 |

1.2 |

0.7 |

0.7 |

The company has been performing consistently despite the slowdown seen in the economy during 2008 when the fuel prices were sky high and consumer spending became volatile with less disposable income. The sluggish growth in the economy was not felt by the company to a great extent. The performance of the company was seen in positive as compared to previous years though with less magnitude.

Will E-Commerce Stocks in India follow the US trajectory?

Like the USA, India too will see many failures in the E-commerce space and a number of startups have already shut down or got acquired by others.

The current cash burn by many of the players is simply not sustainable and only the biggest and best funded companies will survive. Like the US, there will only be one or two winners like eBay or Amazon and some niche ecommerce sites like HealthMD and 1-800 Flowers.com.

For the rest Darwin’s survival of the fittest theory will apply. The e-commerce bubble will burst for many companies who have been targeting quick money, but for long-term players with good management, well known brands and sharp execution, the payoff will be large. The “me-too” models for the companies in ecommerce industry are not expected to prosper being knocked off by companies with superior differentiation and size.

While we have not seen any IPO till date, some companies are expected to raise funding from the stock market soon. Makemytrip saw a very successful listing in the US markets despite the overall market being quite dull.

This article is written by Sneha Shah, editor of Greenworldinvestor.com, a blog about Indian Finance, Renewable Energy industry and Technology.

I run http://www.HitPlay.in. We have no investors. But, have our own niche and are here to stay.