In a recent survey by Financial Services giant Visa, Indians emerged as one of the least financially literate among 28 countries. Some of the reasons why Indians ranked low in this reports was the lack of household budgets, lack of money management discussions with family, financial education and overall understanding of money management basics.

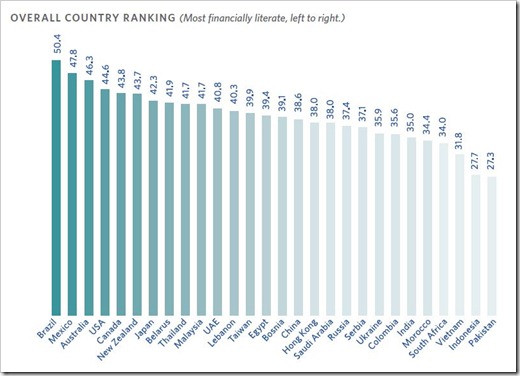

Visa conducted this survey in the period between February and April 2012 and interviewed 25,500 respondents in 28 countries including global superpowers like USA, Canada and Australia. Out of a possible score of 100, Brazil topped the charts with a 50.4 followed by Mexico with 47.8, Australia with 46.3, USA with 44 and Canada with 43.8 in top 5 overall country ranking. India ranked 23rd as the report termed only 35% of Indian respondents as financially literate.

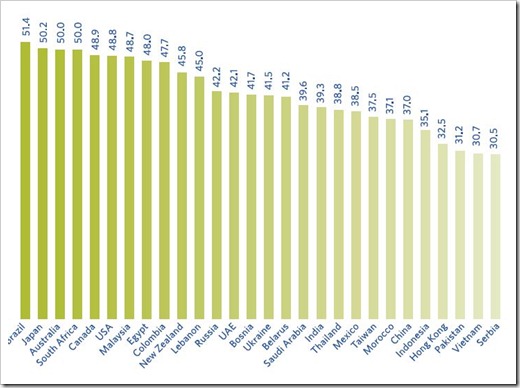

When it came to household budgets, Indian respondents were ranked 18th with a score of 39.3, well ahead of 10 other countries including Mexico (37.5), China (37) and Hong Kong(32.5). When it came to savings, Indians raked 14th with a score of 31.5. On an average, the Indian respondents had almost 2 months of savings in case of an emergency. 34% of Indian women said that they have no savings at all, while 29% of Indian men echoed the same.

Do you have and follow a household budget?

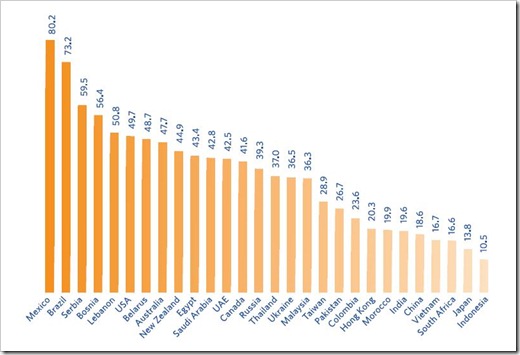

India took a beating when it came to ‘talking to your children ages 5-17 about money management issues’. Indians raked 23rd with a score of 19.6 out of a possible 100, with Mexico (80.2), Brazil (73.2) and Serbia (59.5) taking out the top 3 spots. Further results revealed that 43% of Indian women did not talk to their children about money management issues because a lack of understanding on their own part. Comparatively, only 20% of Indian men were of the same opinion.

For the lay person and beyond the confines of this survey, Financial Literacy is defined as the knowledge and ability of an individual to make informed and effective money management decisions. The Visa survey may have given Indian respondents a lower than average overall rank amongst the 28 countries. However, some of the key factors used by the survey to judge the financial literacy levels are in some ways intertwined with the social structure of an average Indian family.

Not all Indian women are working women and a majority are still caring homemakers, leaving them with little need to worry about finances.

This lack of requirement to understand basic money management issues could be the reason why 43% of Indian women respondents did not talk to their children about the same. It is also likely that the earning member of the family has the sole grip over issues like household budgets and savings.

How often do you talk to your children ages 5-17 about money management issues?

Indians were extremely confident that their teenagers and young adults had a strong grip over money management issues. Sentiments of Indian respondents in this regard ranked ahead of even leading economies like USA, Australia, Canada, China and Japan.

And with approximately 65% of the 1.2 billion Indian population below 35 years of age, India Inc is definitely building up a solid foundation for the years to come, if the results of this survey are anything to go by.

[Full PDF]

Very soon trend will change as more children are getting educated and will be in EM Schools.

worrying truth , Wisdom & Knowledge aren’t passed on to next generations.Which is & has been a huge loss.

This is an interesting post. The rules of life in the 21st century have definitely changed. Parents are still telling their children to study hard to get a good education, to get a ‘good job’. Here is the problem, this model no longer works. Education is key but not for traditional reasons. Today with the massive opportunities the internet brings its time we mastered new skills & strategies of how to make & manage money. There are no more excuses, you can even message me and I will even share a simple strategy. Its time to look at developing multiple income streams. Would you agree?

This is an interesting post. The rules of life in the 21st century have definitely changed. Parents are still telling their children to study hard to get a good education, to get a 'good job'. Here is the problem, this model no longer works. Education is key but not for traditional reasons. Today with the massive opportunities the internet brings its time we mastered new skills & strategies of how to make & manage money. There are no more excuses, you can even message me and I will even share a simple strategy. Its time to look at developing multiple income streams. Would you agree?

Considering the survey to be done , only with literate populace of india. This is quite disturbing , Financial product reach & discipline in financial planning has to be educated right from young age.

Banks should also go beyond pushing their desired products & do more.

worrying truth , Wisdom & Knowledge aren't passed on to next generations.Which is & has been a huge loss.

65 % is a huge and alarming number.This coupled with the unorganized and agent driven market for financial products in our country only makes this worse.Inspite of lacking knowledge of financial markets and products, a large number of people still are willing to entrust their hard earned savings in the hands of small time agents without adequate professional qualifications or skills just to avoid the advisory fees charged by professional financial planning outfits.

This stats represent a true view of Indians. Actually speaking, many poeple do not have their budgets, they do not discuss the financial issues, no one have particular goal to retire rich in life and so on. Actually, Indians are far back in financial literacy.

Very soon trend will change as more children are getting educated and will be in EM Schools.