Bharti Airtel’s first Salvo – Slashes Tariff rates by half in Kenya! And the Minute Factory has just started ticking…

Punch! Here comes Bharti Airtel’s first salvo from its acquisition of Zain Group’s mobile operations in 15 countries across Africa. In a lethal competitive move, Zain Kenya has announced a deep cut in tariff charges in a bid to capture new subscribers and drive the big volume growth business in the highly under-penetrated African markets.

Kenya’s second largest operator Zain has moved to halve its voice call tariffs and cut the price of text messaging by 80% across all networks, in a bid to gain market leadership in Kenya’s 20 million mobile phone market. The Zain consumers can now experience the benefits of low-margin volume game that Airtel had pioneered in India.

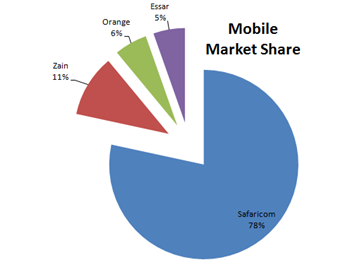

Kenya’s telecom market is currently dominated by Safaricom with a lion’s share of around 78%, followed by Zain at 10%, and 6% each by Essar and Telekom Kenya. The extent of fierce price-war can be gauged from this statement by Zain’s managing director Rene Meza,

“We don’t foresee Safaricom cutting its tariffs close to what we have done but if they do it we will cut ours further.”

With the reduced call rates from Sh6 per minute to Sh3 (3 shillings) per minute and rock-bottom text messaging charges from Sh3 to Sh1, Zain becomes the cheapest network in Kenya, leaving other mobile operators such as Safaricom, Essar and Telkom Kenya to shield for themselves by following the intense tariff cuts flagged by Bharti-led Zain operations.

Expectedly, Safaricom retaliated by lowering costs by rewarding pre-pay users on a graduated scale. For post-pay subscribers, the company has offered a flat rate of Sh3 on both cross and in-network calls. Further, Telkom Kenya announced reduced charges on net tariff of Sh2 and slashed its off net tariff to Sh4 of its GSM customers.

Bharti aims to bring down Zain’s high cost base and attract new subscribers by replicating its famous “minutes factory” business plan (low cost, high volume) pioneered in India, by working on infrastructure sharing and forge contracts on a network utilization-model.

By doing so they have actually tapped into the ordinary Kenyan Junta, who now know that such low voice call rates are possible. Also, with Zain coming down with pricing, Safaricom’s subscriber base is going to get eroded very fast.

The stage is set for an intense price-war in Kenya and it can only be more vicious until the large market share of Safaricom is diluted to a major extent. What’s your take?