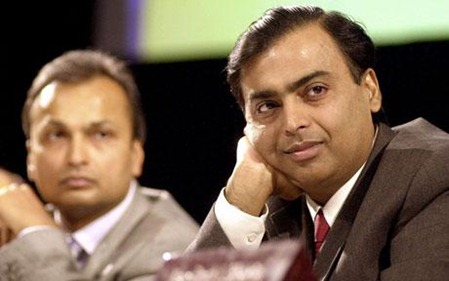

Markets betting on Ambani Brothers truce – ADAG Stocks Rally Hard

The reconciliation between the estranged Ambani brothers was followed by the scrapping of the non-compete agreement allowing both the group companies to foray into newer industries (except that Mukesh-led companies should not venture into gas power plants till 2022), where either of the two Ambani bandhus already have their active presence.

The only apprehension in the mind of shareholders of Reliance Group companies would be as to why was this amicable solution not reached before the tussle in the court of law?

This would have certainly saved crores of investor’s money that went into litigation purposes and paying those fat cheques to the most-admired legal representatives of both the group companies.

Now, that the patch-up is in place, ADAG stocks have flared up smartly during the last 15-20 sessions on the bourses. Let’s compare the stock prices from the intra-day lows of May 21 to the closing levels as on June 16 for all the ADAG counters.

Reliance Capital has surged from lows of Rs.611 to Rs.758, a rally of 20%. In fact, Reliance Communications has rallied 40% from the trough levels of Rs.133 to a whooping Rs.187. Reliance Power had zoomed from Rs.138 to Rs.175 to register a gain of 27% from the lows. RNRL has spurted from Rs.44 to Rs.68, an up-tick of 55% from the depressed levels.

From the frenetic evidence of the sudden surge in stock prices of ADAG counters, it is clear enough that markets are factoring in an amicable outcome for the settlement of the gas price dispute between RNRL and RIL.

The market participants are sensing that both the brothers will co-operate with each other and may also pave the way for a collaborated growth journey in synergies with each other whosesoever possible. ADAG stocks such as Reliance Capital and Reliance Communications have provided negative returns to the investors since the market recovered post global recession.

More recently, the stock of Reliance Communications has gained on the back of news that the company is looking to spin off its tower business. The cash-starved telecom company is eyeing a strategic stake sale to global telecom majors which would top-up the company’s requirements for funding 3G expenses and infrastructure.

Also, the AGM of Reliance Industries is scheduled on Friday and expectations are galore that some positive announcement may come up on this occasion. Speculation is rife that younger sibling shall attend this meeting and, probably, Mukesh-led RIL will announce minority stake in a couple of ventures of the ADAG.

Will Ambani brothers bite the bullet?

Well this is all high level business politics which Ambani brothers were playing with stake holders. Because the price of the shares are booming like anything at the moment in no time. no one expected this much boom in their stocks when all the world markets are going down.

Hello Sheetal,

It is entirely possible that there could have be more than what meets the eyes. Here are some possibilities regarding high-level business politics that you’re referring to:

Option 1 – Both the Ambani brothers are living under the same tower (not same houses though) as of now. They may be having normal relationship with each other as brothers, even as both of them find themselves at loggerheads with each other in their capacity as respective Group honchos, post demerger.

But, this scenario seems unlikely as both of them parted ways from the parent company, due to difference of opinion on management rights (and, also, various internal politics played between both the brothers then) before demerger.

Option 2 – Both the brothers enjoyed good relationship at personal levels. However, their professional set-up urged them to fight against each other in the court of law to settle the gas pricing dispute case.

This scenario is quite possible and that both the borthers were one from within, but had to show otherwise in the public domain.

Option 3 – Both the brothers had good relationship even during the gas price dispute. However, when the junior Ambani started the promotion campaign in the media against Mukesh Ambani-led Reliance as being practicing unethical ways to price the gas higher, the relationship ties between both the brothers actually went soar, even on personal terms.

bOption 4 – Both the brothers could not forge an out-of-court settlement on the gas pricing dispute. At last, the case was adjudged in favour of RIL as per the Supreme Court verdict. Now, Anil had no option but to give-up on this count.

As an after thought, it clicked to both the brothers that the share prices of both the Group companies were under-performing big time on the local bourses, to the discredit of the millions of loyal shareholders.

They decided to give some and take some, so that the verdict statement does not go absolutely against ADAG. In return, Mukesh-led RIL got opportunity to deploy its huge cash reserves and diversify it’s busines structure across newer verticals.

Anil seemed content to settle with balanced pricing on gas dispute, what with his his group company losing most of the fortunes with an adverse judgement of the Apex court. ADAG can also venture into Oil and Gas space in future. It was considered win-win situation for both the groups.

Probably, more favouring the interests of RIL, as it was able to foray into the telecom space at the perfect time – during the BWA auction process. It forged a successful acquisition of Infotel which won pan-India spectrum with RIL support. Thus, opening the door to tap the sophisticated technology at the right moment with full-fledged presence across India.

Now, will both the company’s look to forge newer synergies with each other to over-come other obstacles? Will they re-write the history in their unique way?

I think the option 2 is possible in their case. Its very easy for them to create such situation and show them to public because they know that because of the public only they have reached at this level.

I totally agree with your views. I liked your article.