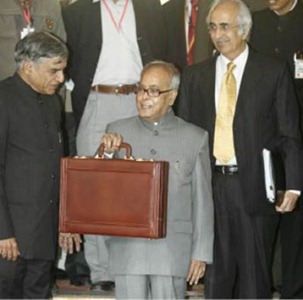

Finance Minister Pranab Mukherjee presented his career’s fourth budget and second straight budget for the UPA government this afternoon in the Parliament with a clear signal that India has notched a respectable growth coming out of the global recession.

At the same time, he stressed that now India needs to get back to the basics and ensure that the fiscal deficit is tamed and rolled-back to 5.5% in 2010-2011 and 4.8% and 4.1% in 2011-12 and 2012-13 respectively.

In the budget, the FM announced 46% of the plan allocation to be set aside for the infrastructure, stressing the need for the economy to meet inclusive and broad based growth.

Contents [hide]

Important Announcements of Union Budget 2010:

1) Aam Aadmi is Top Priority

Contrary to expectations, the FM has announced a major relief in tax slabs for the Indian middle class public at large as follows:

- No tax limit up to income of Rs.1.6 lakh.

- For income between 1.6 lakh to 5 lakh, the tax liability will be 10%.

- For income between 5 lakh to 8 lakh, the tax liability will be 20%.

- Individuals with income of above 8 lakh will have tax liability of 30%.

The government would allow of up to Rs. 20000 for investments in long-term infrastructure bonds in addition to exemption under Section 80C of IT Act. This measure of tweaking direct taxes in favor of tax-payers will ensure increased funds in the hands of public consequently leading to increased spending towards various goods and services.

2) Further Disinvesting stake in PSU

The government has managed to accumulate a whooping Rs.35000 crore by the way of disinvestments in public sector companies in the current fiscal. Further, the government aims to accumulate another Rs.25000 crore in the upcoming financial year. Slowly but steadily the government is moving forwards towards its plans of disinvestment and unlocking value in favor of the country’s economy in meeting its various social-sector demands.

3) No Oil Deregulation Yet: Excise Duty on Fuels

The FM has levied an excise duty of Re.1 per litre on petrol and diesel both and partial roll-back of excise duty on fuels to 10%. There was no policy announcement as to government’s stance of deregulation of crude oil prices as discussed in Kirit Parikh report. However, FM said that a decision would be arrived on the same in due course.

Breaking News:

Petrol prices to go up by Rs.2.71 per litre from tonight and Diesel prices to go up by Rs.2.55 per litre !

Interestingly, the news of fuel hike comes just within few hours of budget announcement by Finance minister Pranab Mukherjee. Was FM not willing to disclose all oil-related sensitive issues in front of the Parliament?

Why this Cat and Mouse Game??

4) Delay in Implementation of GST

The Government has promised the implementation of GST and Direct Tax code by April 2011. The earlier scheduled date of GST implementation was April 2010 which hints at a substantial delay for a major goods and service related reform which in turn would phase-out other major taxes like excise duty, VAT, service tax, etc.

5) Rise in Excise Duty

While FM retained the service tax at 10%, he raised the excise duty by 2% to 10% on all non-oil products as a part of the effort to withdraw stimulus and create sources of funds to bring down the extent of fiscal deficit situation. Consumers will have to spend more on products like fuels, cars, televisions, cigarettes, and tobacco on account of increased excise duty. Even precious metals like Gold and Silver were not spared by the proposal to hike import duty.

6) Banking Licensing for NBFC

RBI will issue more banking licenses for setting up banks in the country to Non-Banking Financial Companies which fulfill the eligibility criteria. Non-banking companies like Reliance Capital, IDFC, Indiabulls Finance, and IFCI are some of the non-banking companies which are likely to benefit by this big reformist initiative by the RBI and the government of India.

7) Nominal Hike in Defense Budget

The government hiked the allocation for defense budget from Rs.141703 crore to Rs.147344 crore. This nominal hike may not be enough with rising chances of terrorist threats over the country and infiltration from neighboring countries. Last year the government had allocated over 35% increase in funds allocation to defense industry.

8) Timely Aid to Exporters

The FM has proposed to extend the interest subvention of 2% for one more year for exports covering handicrafts, carpets and leather, handicrafts, hand-looms and SMEs. With the global economy witnessing a sharp recession recently and a subsequent stabilization signs, it may not be as bad an idea to give extended support to export oriented units for some more time to come.

9) Rise in MAT

While exporters benefited from interest subventions scheme announced by the FM, the IT industry remains negatively impacted export-oriented outsourcing firms as the much anticipated extension of STPI benefits did not come through. That apart, the rise in MAT from 15% to 18% will more so impact the small and mid-size IT companies.

10) Beyond the Realty

FM announced concessions to developers for seeking tax concessions on existing projects and relaxed norms for built-up area. I feel rather than allowing real estate players in sustaining the high property prices by allowing concessions, the government should ask them to bring down property prices and increase their sales in the bid to clear-up over-supply in real estate market.

11) Healthy Allocation

The government allocated Rs.22, 300 crore for the health sector for the upcoming financial year 2010-11, a 13.5% hike since last year’s allocation to the growing needs of fast emerging health sector. The FM said that the country was set to conduct a national health survey next fiscal.

12) Rise in Education Funding

Pranab Mukherjee announced a rise of about 15% in allocation to the expenses related to Education at Rs.31, 036 crore as against Rs.26, 800 crore previous year. However, the minister confirmed that a major part of this funding would go in to implementation of the Right to Education Act.

13) Allocation towards Developmental Plans

Centre has allocated Rs.40, 100 crore towards spending on National Rural Employment Guarantee Scheme which finds only a nominal rise from allocation in the previous year. Allocation for urban development has been upped 75% from Rs.3062 crore to Rs.5400 crore. Allocation for Bharat Nirman is announced at Rs.48000 crore.

Thus, a subdued effort by the government in upping the incremental spending in social sector programs (except urban development and power utility) shows FM’s concern towards high fiscal deficit which needs to be tamed at the cost of social sector schemes.

14) Service Tax Exemption for News Agencies

Finance minister announced the exemption of service tax for the specific news agencies like for instance the accredited news agencies which provides news feed online thus providing yeoman services of disseminating news. This will give a boost in the arm for genuine news agencies involved in loyal news distribution.

Other Important Highlights of Union Budget 2010

- UID authority given Rs.1900 crore.

- Funds for power allocation raised from Rs.2232 crore to Rs.5132 crore

- Government to facilitate 20000 MMW of solar power by 2022

- Government to provide Rs.300 crore for agriculture impetus.

- Nutrient based fertilizer subsidy scheme to come into force from April 1.

- Five mega food parks to be set up.

- Rs.500 crore for Clean Ganga mission.

What got Expensive & what’s Cheaper Now?

Imposition & Roll-back of Excise duty has made certain products expensive while leaving others products cheaper than before. Let’s have a glance at the products which have been hit and benefited by measures announced by FM:

Cheaper than Before:

- Mobile Phones

- Agricultural Equipments

- Set Top boxes

- Toys

- Books

- Medical Equipment

- CFL Bulbs

- Compact Disc (CD)

Dearer than Before:

- Consumer products like TV and AC.

- Large Cars, SUVs and MUVs.

- Petrol and Diesel

- Cigarettes and Non-smoking Tobacco

- Gold and Silver

- Flying by Air

Union Budget and Stock Markets

The FM has managed to allay fears of the stock markets & Foreign Institutional Investors on account of rising fiscal deficit at 6.8% of GDP (add off-budget subsidies) by announcing that the deficit would be brought down to 5.5% next fiscal and further lower to 4.8% and 4.1% in couple of years following there after.

The equity markets gave a standing ovation to the government in seeking to address the long term concerns of the economy with transparent targets and measures needed for next few years. The BSE Sensex recorded a smart 175 points rally on the bourses today, to close at 16430, up 1.08% as compared to yesterday’s price.

- Reliance Capital, IFCI (Up 8%) – NBFC looking for banking license

- Moser Baer (Up 7%) – Compact Discs getting less expensive

- Hanung Toys (Up 3.5%) – Toys getting cheaper

- Bata India (Up 13%) – Leather products to get cheaper

- REC (Up 5%) – Doubled power sector allocation with rural bias.

- LIC Housing Finance (Up 4%)– Governmental thrust on housing finance.

- GMR Infra, L&T (Up 2-3%) – Governmental thrust on Infra Spending.

- Suzlon Energy, Websol Energy (Up 5-7%) –Budget’s thrust on renewable energy.

- All 2 and 4 Wheelers (Up 4-6%) – Increased spending capacity in hands of consumers

What’s your take on Finance minister’s Budget proposal?

[…] Pranab Mukherjee has proposed new tax slabs for the so called ‘aam aadmi’ in the Union Budget 2010. The tax slabs have been revised upwards for various income groups and thus providing windfall […]

Good article about budget 2010, Really this one is so Good and very useful information related to business purpose. I want to share my views with all of you. every business is depend on budget/ fianance. how much tax relaxation and other facitlities announced in budget 2010. this budget is just average , a major relief in tax slabs for the Indian middle class.

Viral,

Thanks for simplying the tax code for our understanding. Do you see any impact to NRI’s in this budget?

Dear Madhav,

NRIs will benefit from the lowering of income tax rates announced in this budget if they file their returns in India. Apart from that Pranab Mukherjee’s Union Budget has no exclusive benefit directed at NRIs.

Hi Viral,

Thanks for clarifying that.

Cheers.

Modernizing food chain :

More than 10% of our food grain in our country are lost due to soaking in rain, pilferages, rats in warehouses, (to name a few) factors.

Similarly more than 40% of fresh fruits / vegitables are lost due to unscientific handling systems.

If we are producing 200 million MT foodgrains today 20 million MT is lost and only 180 million MT is reaching ppl. Imagine that there is no loss, we add 20MT more to the national resources. Thats like increasing food grain out put 10%. Same with fruits and vegitables.

Imagine if we have 10% more food grains, sugar in country than what we actually have now, will prices go up? All this is because of old handling systems.

For Foodgrains we need Silo structures, for fruits and vegitables we need cold storage system. Imagine if Govt starts building this infrastructure, how big the asset will be for country. It gives a boost to infra sector and final asset will take care of losses.

In India we have 625 districts (correct me if I am wrong) Some big, some small. We need 1000 warehouses covering entire nation. If there is shortage in one grid area for any item, immediately they can be covered from sorrounding grids. On line tracking systems will make the effort effortless.

We normally see Silo structures in song and dance scenes in Hindi movies where hero and heroine travel to West to picturise. That means the Silos are intermingled with natural sorroundings so they are not eye sore.

As Highways have taken care of fuel efficiencies and reduced traffic jams, this system will take care of food for the nation.

There are two sides to the issue of “Common man suffering” One is tax slab relaxation and the other is increase in prices of everything due to hike in petrol / diesel rates.

For the ppl under slab of 1.6 lakhs, in tax terms there is no change but he will suffer becasue of price increases due to petrol / diesel rate hike. No positive but added negetive.

Same with those between 1.6 lakhs and 3.0 lakhs slab. tax rates same but suffer due to price rise. No positive but added negetive.

For slab 3.0 lakhs to 5.0 lakhs, tax rate reduced from 20% to 10% but suffer due to price increase. One positive and one negetive.

Similarly for more higher slabs.

The bottom line is ppl in small slabs will suffer where as ppl in higher slabs will have no big impact as positives will take care of negetives.

Govts in the past 50 years have thought about this and created PDS system to compensate poor for the imbalance. So we have to look beyond tax slab rates etc to real problem.

But as we live in an inefficient society, the corrupt PDS ppl will take what rightfully belongs to poor.

The solution :

Modernize the PDS system from the start to finish.

1) The warehouses have to be modernized and Silo systems to be build across the country. In fact every district should have one gaint Silo system for all food items and all Silo systems should be connected through grid system. The investment made in Silos can be claimed back with reduction in spoiled food. If Govt has no money, they can invite private sector participation in this on BOT (build, operate, transfer) basis.

2) Packaging food : If Govts decide to give 10 Kg or 20 Kg rice / wheat, pack them in ware houses so that ppl get full 10 or 20 Kg. If weighed in PDS stores ppl will get only 8 Kg or 15 Kg due to malpractices of PDS. Same with oil, dal and any otehr item depending on region. The cost of packaging is less than loss due to present handling system.

3) Register PPL in online systems for PDS system : This will bring transparency and Govt can monitor data to take action in time.

4) Prequalify all PDS operators : PDS licence to be given only to qualified ppl. They should have sufficient store, have crates for storing goods, pellets for stacking crates and trolleys to handle pellets. This will reduce losses to zero.

Though the above will look like socialist programme in moden society, this is inevitable till ppl come above BPL (below poverty line).

Altaf Rahman

Dear Satish Padmakar… noble thoughts. But we cannot wish away Defense allocation (even if wars are ruled out), on account of increasing threat from terrorists and rising efforts by neighbouring countires to capture and claim India’s border areas.

Dear Amay P… As rightly pointed out by you on government lacked enough efforts to ensure curb of rising food inflation. In fact, the FM has put the onus of food inflation on bad monsoon.

It needs to be seen how government tackles the situation of rising food prices in times to come.

Yes…Suhasini,

The tax slab exclusively favours tax-payers with income above Rs. 3 lakh. The higher the income, more beneficial to that tax payer. I will try to unravel this aspect of direct tax proposal too, in my subsequent posting, if possible.

Thanks for the comment.

Have you seen the tax slab here, again the common man is going to suffer because of this.

Dear Suhasini,

FInd my new posting related to direct tax proposal as yet another article on trak.in. Click here: https://trak.in/tags/business/2010/02/27/budget-direct-tax-slab-proposal/

The biggest issue as commented by you has been spared a thought by me in my detailed article. But, will FM spare his thought to this issue?

I suspect, if aam-addmi’s delight is limited to increase in income tax slabs, especially with inflation rising everyday, I was more keenly looking for some financial announcements where through some monetary or fiscal arrangements rising food prices could have been curbed.

Under present announcements, its like Government is saying – we have set you up for increasing food prices by extending the income tax brackets for you.

Tto sum it short, I believe Governement policies should be good mix of increase in savings and decrease of expenses, which is what is going to empower aam-aadmi.

Rise in stock prices seldom denotes sentiments of general public.

The above comment is directed to Ravi Karandeekar. I forgot to mention his name in above comment.

Sure.. government’s can not direct builder’s to educe property prices.

But take the example of RBI and monetary policy. Just as, RBI regulates the Banking sector, but it does not control the bank rates on behalf of individual banks, which is for banks to decide for themselves based on demand-supply equation of funds. However, RBI sets a benchmark regarding prevailing rate situation & leave on the banks to decide on themselves.

Similarly, I am not asking the government to directly control the stance for builders to lower their property prices. But the message should be sent out clearly that rates are way above from what could be called as ‘Affordable Housing Proects’. It needs to be more realistic well with in the reach of middle-class consumers.

This shows that property prices have no cooled-off substantially even after a sharp slowdown in past 2 years. I have no doubts that there is a huge supply overhang in the system in the form of idle properties, with prevelant high prices. More so, only the property market in Mumbai is self-sufficient to the meet the high demand prevailing over there. Other areas, I fear, could be witnessing demand-supply mismatch, with bias towards over-supply.

But, since builders are provided enough ammunition to fight through this demand-supply match, they can scrape through with higher prices and demand trickling at a slower pace.

1. Policies should be framed so that Small local companies and young enterprenuers should get imputus and support to stand against and compete with multi national companies.

2. Proper infrastructure should be developed of agriculture marketing so that middle men squizzing farmers and end consumers should be kept in control of making unethical profits on most necessary commodities like food grains.

3. Huge spendings on military should be revived and rethought as this govt. do not carry guts to open war any time in future. What ever we spend on defence should be spent on research and development in the area and not on importing wepons.

” the government should ask them to bring down property prices and increase their sales in the bid to clear-up over-supply in real estate market.”

Government job is to collect taxes on the financial transactions and the profit earned. Not to increase or decrease your income. So, how can government ask the builders to reduce the property price?

Who says that sales increases if the property price is reduced?

Real estate is a local business. There are many local markets in India. In Delhi NCR there may be over supply, but not, for sure, in any Indian local market.

The budget was pretty good and all industries and every individual is being benefited from this budget. Pranab Mukherjee stated that the fiscal deficit will be reduced year after year, but he failed to tell us what exactly he is planning to cut costs. I guess the government would monetize their assets instead of cutting costs.

I think it was a good budget from the Finance minister but their should be more emphasis for the young entrepreneurs.

One more point to focus is not showing benefit for the people whose incomes are very low.