Koo, made lot of headlines when it positioned itself as an alternative to Twitter.

The Bengaluru-based firm’s Indian social media app remained in pre-revenue stages in its second fiscal year of operations.

It has generated a mere Rs 14 lakh of income during FY22 while its losses spiked 5.6X during the same period.

75% Growth in Operating Revenue

Its annual financial statement with RoC shows that as opposed to Rs 8 lakh in FY21, Koo registered 75% growth in its operating revenue to Rs 14 lakh during the fiscal year ending March 2022.

Founded by Aprameya Radhakrishna and Mayank Bidawatka in early 2020, Koo is a multi-lingual microblogging platform community-based questions and answers in vernacular languages under “Vokal” and a micro-blogging platform which enables its users to express themselves in local languages. The app was launched in Brazil last year, supporting Portuguese as well.

During the last fiscal, collection from the marketing services on these platforms was the only source of revenue.

Besides its operating income, Koo also earned Rs 4.74 crore from interest and gain on investments and other non-operating income which took its overall revenue to Rs 4.88 crore in FY22.

Its collections from the non-operational activities are over 97% of its operating income.

It allows users to interact via text, audio, and videos. It also allows influencers to connect with their community and have conversations with their fans. Koo is currently available in 11 languages and claims to have over 60 million app downloads.

Heading to the expenses side, advertising and promotional expenses turned out to be the largest cost center for Koo, contributing 61.4% of the total expenses. This cost shot up 18.8X to Rs 124 crore in FY22 from Rs 6.61 crore in FY21.

Speaking of the expenses, Koo’s largest cost center are its advertising and promotional expenses turned out to be the largest cost center for Koo. They contribute 61.4% of the total expenses. This cost shot up 18.8X to Rs 124 crore in FY22 from Rs 6.61 crore in FY21.

Koo’s Current Valuation & Future Plans

Koo was valued at around $275 million following its latest fundraise of $5 million led by Tiger Global. Entrackr had exclusively reported about the fundraise in November 2022. Koo’s other backers include Accel, 3one4 Capital, Kalaari Capital, and Blume Ventures.

In June, Koo acquired Nexus-backed Mitron TV in a share swap agreement. Entrackr had exclusively reported about the development. It also laid off 5% of its workforce in September 2022.

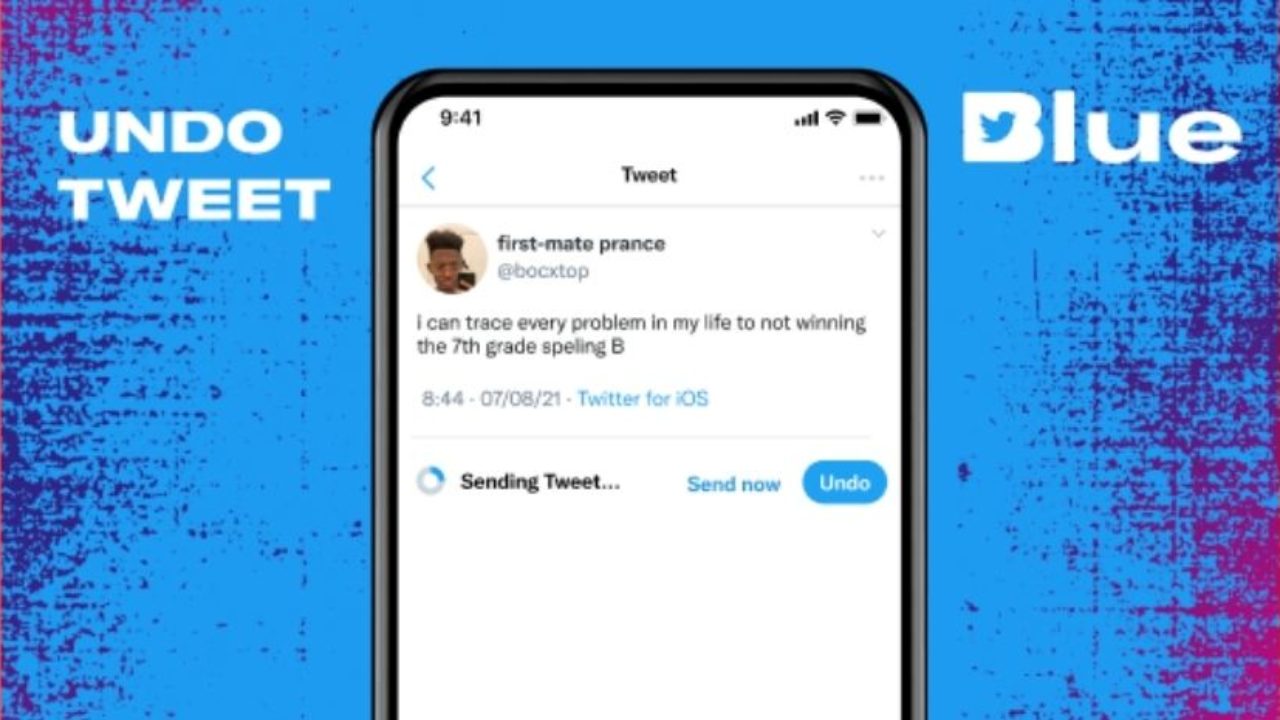

Koo recently said that it plans to move into a subscription and advertising model, and it will also work with creators in a revenue-share format. The company’s rival Twitter (India) registered 81.5% growth in revenue to Rs 156.75 crore in FY22. It also reported a net loss of nearly Rs 32 crore in the country during the period, as per its annual financial report.

As a moonshot effort from India, Koo has earned the right to be given time to make an impact, both within and outside India. But during this time, the numbers will have to keep rolling in, for its investors to be reassured of its long-term viability. Platforms like this basically enter the market to sell once they go past 100-150 million users. As we have seen with ShareChat, not much works before that. The odds however remain weighed against the app at this stage, short of a remarkable change in perception and more importantly, network effects. It remains to be seen how it seeks to change the narrative in its favor.