The Reserve Bank of India (RBI), also known as the Central Bank of India, has recently increased the transaction limit for small-value offline digital payments from Rs 200 to Rs 500. This decision was part of the bank’s bi-monthly policy review and was implemented in accordance with Section 10(2) and Section 18 of the Payment and Settlement Systems Act, 2007 (Act 51 of 2007). The RBI’s announcement confirms that this change is effective immediately.

RBI’s Push for Rural Digital Transactions and Offline Payments – A Policy Overview

The RBI had previously introduced a framework called the “Framework for Facilitating Small Value Digital Payments in Offline Mode” in January 2022. The primary aim of this framework was to promote digital transactions in rural and semi-urban areas.

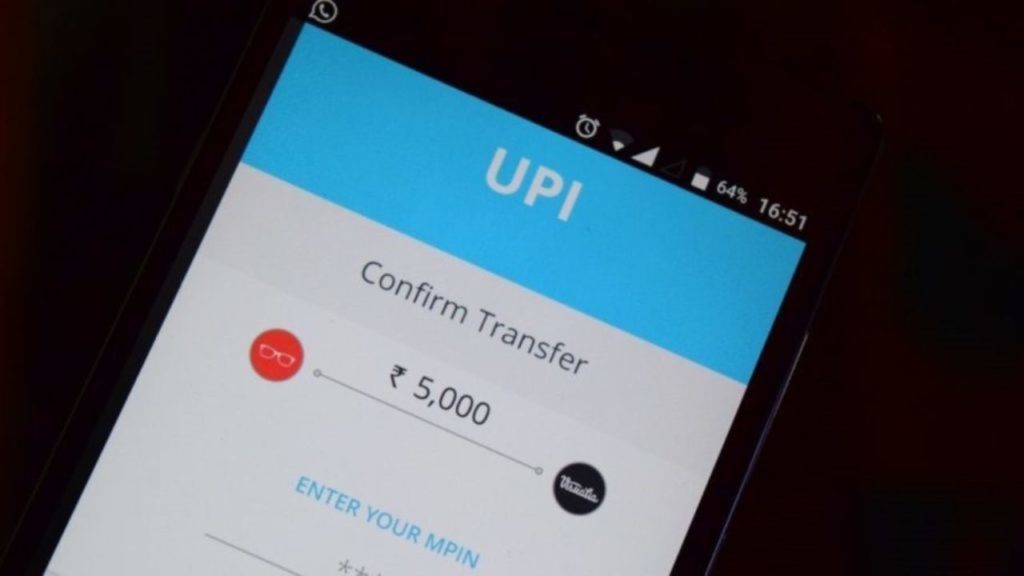

Offline digital payments refer to transactions that don’t rely on internet or telecom connectivity. These small-value offline digital payments can be conducted using the National Common Mobility Card (NCMC) and UPI Lite.

In offline mode, these payments can occur face-to-face, using various channels or instruments like cards, wallets, and mobile devices. Importantly, they don’t require an additional factor of authentication (AFA). However, because these transactions are offline, customers will receive alerts (via SMS and/or email) after a certain time delay.

The proposal to increase the transaction limit was initially introduced on August 10. This change was prompted by the recognition that many payments, such as restaurant bills or ride-hailing fares, often exceed Rs 200. The previous limit of Rs 200 had limited the broader and more frequent use of the platform.

RBI’s Evolution of Digital Payments – From Offline Mode Pilots to Nationwide Framework

The RBI’s policy emphasizes that by eliminating the need for two-factor authentication for small-value transactions, these channels enable faster, dependable, and contactless payment methods for everyday small payments, including transit payments.

In August 2020, the central bank proposed allowing a pilot scheme for small-value payments in offline mode. This scheme included built-in features to protect user interests and provide liability protection. Following this proposal, pilot tests were conducted using innovative technology that allowed retail digital payments even in situations with low or no internet connectivity (offline mode). These pilot tests were successfully conducted in various parts of the country from September 2020 to June 2021 and encompassed small-value transactions totaling 2.41 lakh in volume and Rs 1.16 crore in value.

Subsequently, in October 2021, the RBI proposed introducing a framework for conducting retail digital payments in offline mode across the country.