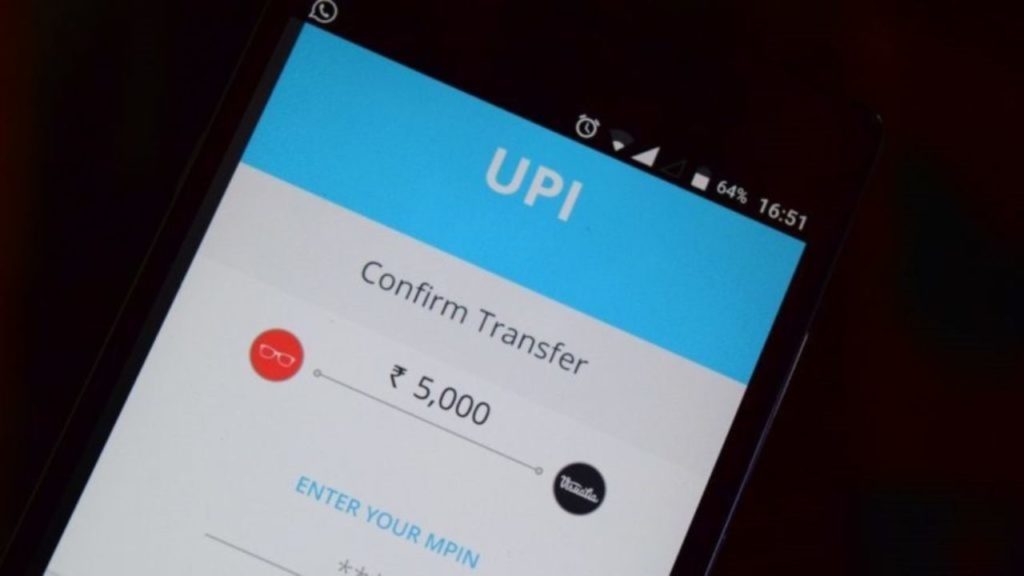

In a latest development, the National Payments Corporation of India (NPCI) has advised Prepaid Payment Instruments (PPI) fees be applied to merchant transactions on Unified Payments Interface (UPI) effective from April 1, according to a recent circular.

Prepaid Payment Instruments Fees

Further, UPI’s governing body said in the circular that for amounts over Rs 2,000, using PPIs on UPI will result in interchange at 1.1 percent of the transaction value.

Notably, the interchange fee is typically associated with card payments.

This fee is levied to cover the costs of accepting, processing, and authorizing transactions.

It is noteworthy here that the peer-to-peer (P2P) and peer-to-peer-merchant (P2PM) transactions between a bank account and a PPI wallet do not require an interchange.

But, the PPI issuer will pay the remitter bank approximately 15 basis points as a wallet-loading service charge.

This move of introduction of interchange is in the range of 0.5-1.1 percent, with interchange being 0.5 per cent for fuel, 0.7 per cent for telecom, utilities/post office, education, agriculture, 0.9 per cent for supermarkets and 1 percent for mutual fund, government, insurance and railways.

First Step Towards Change

The new pricing will come into effect starting April 1, 2023.

Further the circular said that NPCI will review the stated pricing on or before Sept. 30, 2023.

The broking firm, Equirus said that “this could be the first step; we may incrementally see interchanges being announced on other modes of payments as well,” in a media report.

Further, the broking firm stated that nearly 65-70 percent of P2PM UPI transactions are worth more than Rs 2,000.

Adding, “…there is adequate possibility for various stakeholders in the system. So, this should be seen positively for credit card companies as the risk of any cap on MDR actually reduces.”