Swiggy and Byju’s investors have marked down the value of their holdings in the firms by 25% and 48%, respectively, continuing the trend of valuation markdowns of unicorn startups.

Sinking ships?

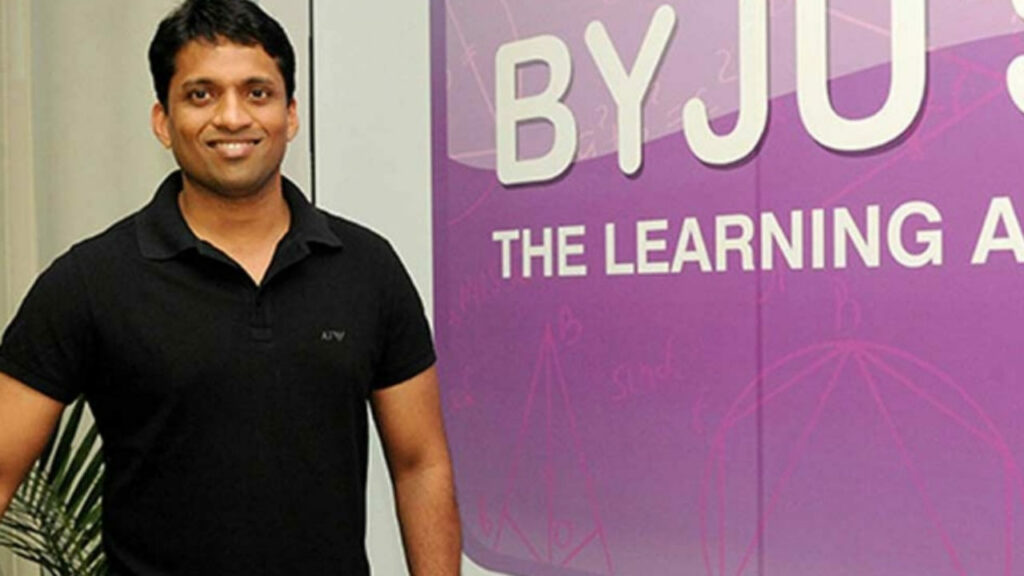

TechCrunch reports that BlackRock has slashed Byju’s valuation, India’s most valuable startup, to half — from $22 billion to $11.5 billion.

Invesco has cut the valuation of Swiggy, India’s most valuable food delivery startup — from $10.7 billion to about $8 billion.

Other startups, including OYO, Snapdeal, Shopclues, Quikr, Hike and Paytm Mall, have also fallen victim to valuation cuts in the face of the weakening global economy.

OYO

Last September Softbank, the largest shareholder in OYO, cut its estimated value for the firm to $2.7 billion in the June quarter.

The figure earlier stood at $3.4 billion.

The revision was made after benchmarking it against peers with similar operations.

This is quite the turn of fortunes- OYO’s valuation had reached $10 billion in a 2019 funding round.

Investors themselves no exception

When SoftBank reported mediocre June quarter results last year, it marked down fair valuations of more than 280 of its portfolio firms, which mostly included private startups.

Back then Financial Express had reported that this would set a concerning precedent for Indian fund managers and venture capitalists.

What’s going on?

The markdowns come at a time when the current global economic climate has gone south due to shaky markets and a funding freeze in the startup ecosystem.

India’s startups are no exception, with many having to scale back operations, cut costs, and conduct mass layoffs to stay afloat.

Funding

Edtech giant Byju’s recently raised $1 billion in funding from investors, including BlackRock.

Swiggy, meanwhile, has diversified its business into grocery delivery, and had also secured large funding worth $700 million led by investment firm Invesco in January 2022.

Firing after securing funding

Both firms laid off staff this year, with Swiggy recently firing around 8-10% of its 6,000-strong workforce.

Similarly Byju’s laid off 900 employees in February, making it the third round of firing in the last year.

Impact

It’s too early to say what this will ultimately result in, however, both companies were expected to go public soon.

This will likely be pushed back in view of ongoing market conditions.

A prolonged funding winter combined with a crash in growth and late-stage deals, may turn out to be a double whammy for unicorns which may have to give up their title as they lose their billion-dollar status.

Unicorns no more

Private market tracker Venture Intelligence reports that around seven Indian startups have lost their unicorn status in the last five years.

From CY18 to CY22 (to date), around 105 startups had attained the unicorn status which has now come down to 84 active unicorns.

This can be due to several factors, including seven losing valuations due to investor markdowns and another four getting acquired.

Then around 10 startups were listed in the public markets in the last five years and so were excluded from Venture Intelligence’s unicorn tracker list.