Interest Rate Cuts On Small Savings Withdrawn After Public Outcry; This Is What the Govt Stated

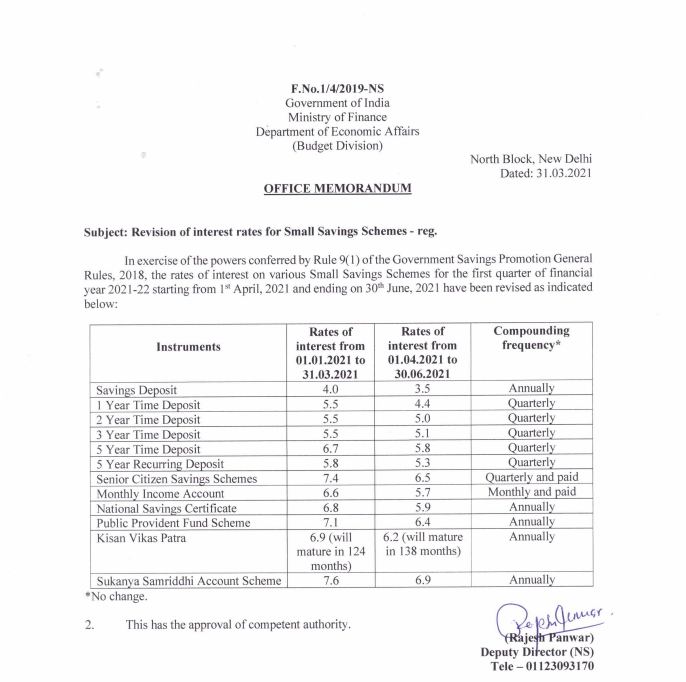

On Wednesday (March 31), the government had slashed interest rates on small savings schemes, including NSC and PPF, for the first quarter of 2021-2022, starting from April 1, 2021.

For the first time since 1974, the interest rate on PPF reduced from 7.1% to an absolute 6.4%. All the other ROIs too were cut by significant percentages.

However, just hours after issuing the notification of cutting interest rates on small savings schemes, Finance Minister Nirmala Sitharaman has issued another notice withdrawing the order.

Finance Ministry Withdraws Order

In an official notification issued on March 31, 2021, the finance ministry notified, “In exercise of the powers conferred by Rule 9(1) of the Government Savings Promotion General Rules, 2018 the rates of interest on various small savings schemes for the Q1 of FY 2021-22 have been revised.”

Govt cuts interest rates on small savings wef from April 1

— ANI (@ANI) March 31, 2021

Savings deposit revised from 4% to 3.5%,annually.

PPF rate down from 7.1% to 6.4%,annually.

1 yr time deposit revised from 5.5% to 4.4%,quarterly.

Senior citizen savings schemes rate down from 7.4% to 6.5%,quarterly&paid pic.twitter.com/x05Hko3vho

This came as a huge blow to middle-class depositors. The interest rates were declared to be cut by up to 1.1% for the first quarter of 2021-22, from April 1 to June 2021, as the rate of interest offered on loans and fixed deposits have been falling too.

However, Sitharama informed via a tweet, early on April 1, 2021 that the Government of India has decided to continue charging the earlier rates of interest on small savings schemes and that the previous order has been withdrawn.

She tweeted, “Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn”.

Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021.

— Nirmala Sitharaman (@nsitharaman) April 1, 2021

Orders issued by oversight shall be withdrawn. @FinMinIndia @PIB_India

Interest rates for small savings schemes are notified on a quarterly basis.

Comments are closed, but trackbacks and pingbacks are open.