UPI’s Future In The Hands of Paytm, PhonePe, Amazon, HDFC Bank, ICICI Bank As They Are Now NPCI Partners

The National Payments Corporation of India (NPCI) gets new shareholders as it assigns its equity shares of 4.63% worth Rs 81.64 crore.

Read on to know more…

NPCI Gets 67 New Shareholders?

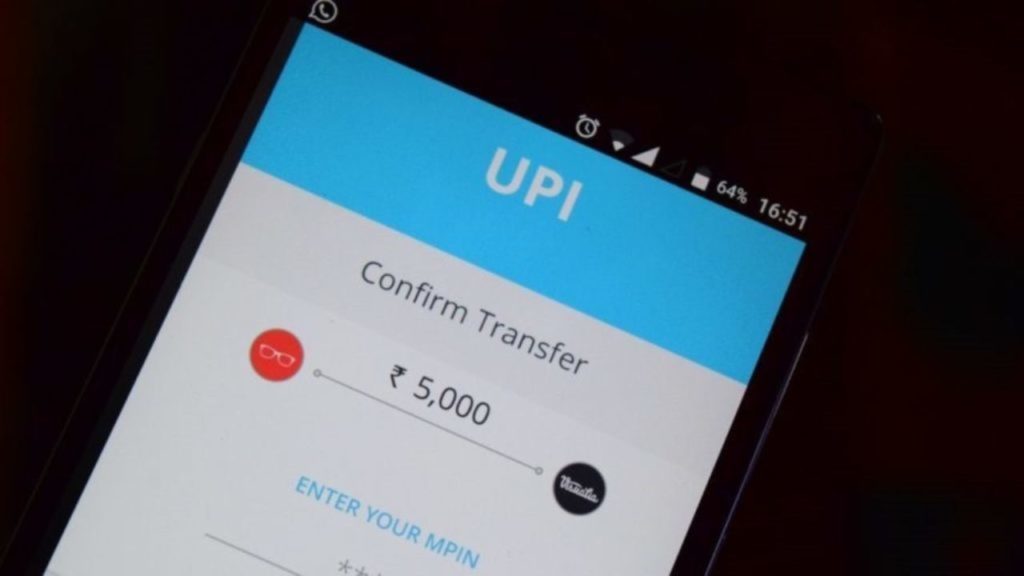

The Unified Payments Interface (UPI) and RuPay owner has allotted the 4.63% equity shares via a private placement to various banks and non-banking payment entities.

This development comes at a time when the Reserve Bank of India (RBI) is promoting the formulation of other retail payment bodies to set up new payment systems in the country. This move can be seen as the method of competing with NPCI.

SBI among other banks has shown interest in offering their own payment systems.

131 RBI-regulated entities were offered the shares by NPCI through a private placement method. However, only 19 of them that showed interest were assigned the shares. A few commercial banks, some small finance banks, and payment companies will also be the other shareholders. This takes the total count of entities to 67.

Who Are The Shareholders?

In the first round, mostly public sector banks (PSBs) had participated. The following tranche saw participation from some private banks. After which, the shareholding base got further divided.

Paytm Payments Bank, Mobikwik, PhonePe, PayU, Pine Labs, Billdesk, Sodexo, and a few others are among the shareholders in the retail payments body. Dhanlaxmi Bank, IDFC First Bank were some banks on the shareholders’ list.

Rupesh H. Acharya, chief of finance, NPCI, said, “With this, we have also broad-based our shareholding to include new categories like payment banks, small finance banks, and payment system operators in addition to the existing public sector, private sector, foreign, co-operative and regional rural banks,”

The board representatives in NPCI are State Bank of India, Punjab National Bank, ICICI Bank, HDFC Bank, Axis Bank, and Citi bank.

Comments are closed, but trackbacks and pingbacks are open.