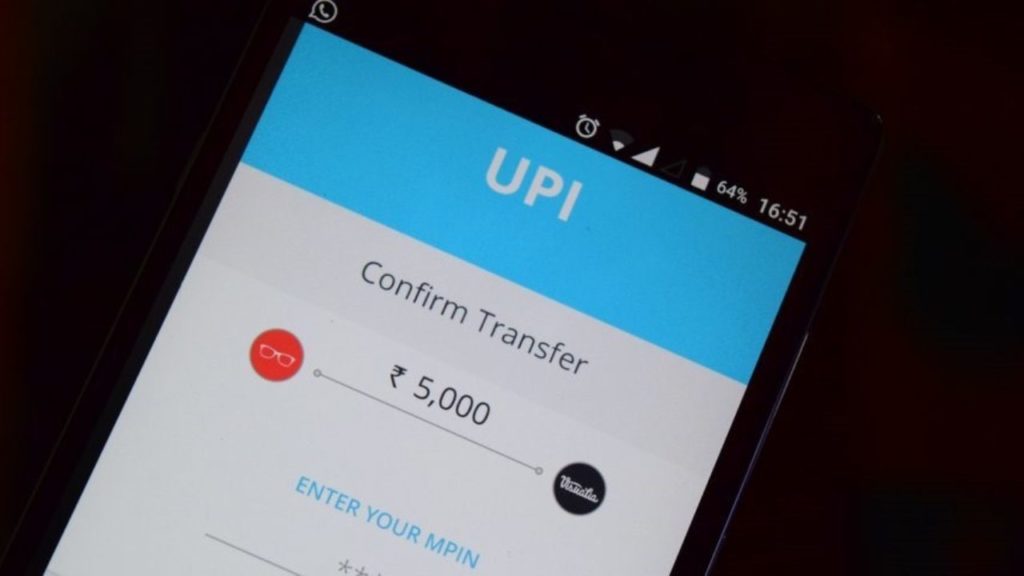

UPI Crosses 100 Cr Monthly Transactions, But IMPS Is #1 In Value Of Digital Transactions In India

On Thursday, a new report said that Unified Payments Interface (UPI) remained the most preferred mode of payment in terms of volume followed by debit cards, Immediate Payment Services (IMPS) and credit cards.

Contents

How Did This Happen?

In 2019, the report from payments company Worldline India (WI) said that UPI recorded a transaction volume of 10.8 billion, a year-over-year increase of 188 per cent.

While the “India Digital Payments Report 2019” said that “UPI is perhaps the fastest product to hit 1 billion transactions-a-month in 2019 since its inception in August 2016,”.

Also, the findings of the report suggest that in India, digital payment products are being primarily utilised for person-to-person (P2P) transactions than person-to-merchants (P2M) transactions.

If we consider in terms of value, UPI facilitated transactions worth ?18.36 trillion, up 214 per cent from 2018.

Also, the Government-run Unified Payments Interface (UPI) has achieved a new milestone by processing 1.3 billion transactions in February 2020, its highest ever number of transactions ever since its inception in 2016.

According to National Payments Corporation of India, which owns and runs UPI, the interface processed transaction value of Rs 2,21,995 crore in the last month.

Not only that, the interface has also gained the status of most preferred mode of payment in terms of volume in 2019.

Why Did UPI Got Such Response In India?

Throughout the year, nine banks were added in the UPI ecosystem, bringing the total number of banks providing UPI services to 143 as of December 2019.

The major factors that powered UPI’s transactions growth in 2019 are adoption of UPI 2.0 features by banks, enabling payments for IPO applications, facilitating Foreign Inward Remittance service, supporting donations for several relief programs, and numerous cashbacks and discounts offered by banks and non-bank players, said the report.

What About The Other Players?

Apart from UPI, Immediate Payment Service (IMPS) recorded 55 per cent year-over-year increase by facilitating about 2.3 billion transactions in volume.

Also, it recorded ?21.8 trillion in terms of value, up 41 per cent from 2018.

It on-boarded 165 banks under its ecosystem in 2019 and brought the total number to 559 banks providing IMPS services to the customers by end of 2019.

The report said, “In terms of value, IMPS attained the ‘numero uno’ position throughout the year followed by UPI. Value of debit and credit cards remained nearly the same throughout the year,”.

According to the report, UPI, debit cards, IMPS and credit cards together recorded a combined transactions volume of over 20 trillion and combined value of over ?54 trillion in 2019.

What About Aadhaar Enabled Banking Services?

A full range of Aadhaar enabled banking services is witnessed by the country through AePS over the past few years.

The total volume of Aadhaar Enabled Payment System (AePS) transactions (ONUS, OFFUS, DEMO AUTH and eKYC) stood at 2.3 billion in 2019.

Further achieving year-over-year growth of 12 per cent. While, the value of transactions achieved a milestone of Rs 1 trillion in 2019 with year-over-year growth of 31 per cent.

The Worldline analysed transactions available in public databases for the research as well as transactions processed by the company in 2019.

Basically, Worldline India (WI) is wholly owned by Worldline SA, a leading payments company in Europe that is listed on Euronext Paris.

They had entered India in 2010 with the acquisition of Venture Infotek followed by the acquisition of MRL Posnet in 2017.

Comments are closed, but trackbacks and pingbacks are open.