Android Pay is Coming to India This Year! Google Starts Testing UPI on Its App

Google Android Pay recently got expanded to five new countries, including Brazil and Russia. India has become an attractive destination for companies to launch digital wallets, and now Android Pay is coming to India this year.

Samsung Pay got launched only a couple of months back, which will make India a more mature market to accept such technology. This will allow users to make payments in the app or online using their registered credit or debit card.

For India, Google is making an effort to launch Android Pay by 2017, through Government’s UPI(Unified Payment Interface). UPI has been lauded by the industry and it allows transaction between two entities in the most simple manner without letting out any details.

Google has already started testing Android Pay platform through UPI in India. If you remember, WhatsApp was also keen on integrating UPI on its app because of the simplicity of the architecture.

The California-based tech giant is banking on the fact that a lot of users will take up UPI in the future, and banks will start integrating UPI on their apps.

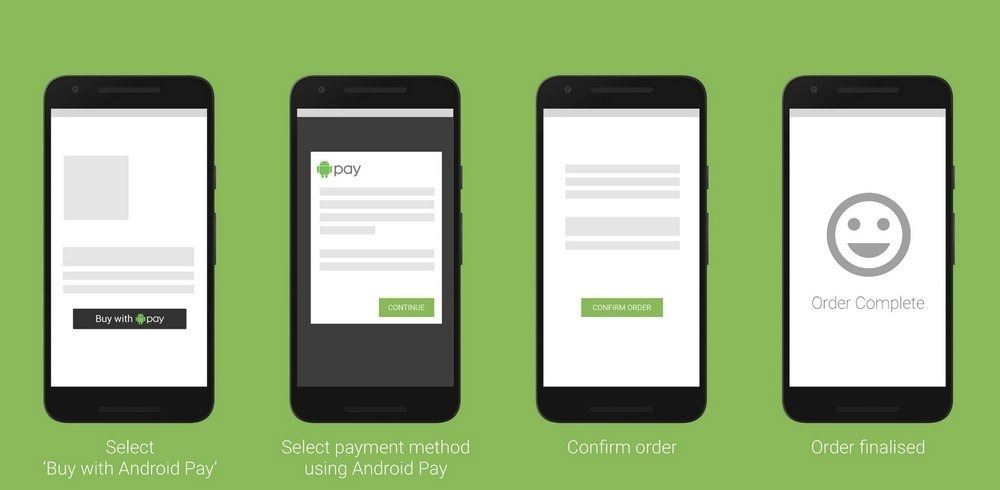

How does Android Pay work?

Much like Samsung Pay, Android Pay will also work with a virtual repository of your debit or credit cards. You will now also be able to add your bank account details directly through UPI integration.

When you want to make a payment, open the Android Pay app and select the payment method of your choice. The transaction will be contactless, usually through NFC but a magnetic strip can also be scanned. There are no hassles with getting banks to register on this app because of UPI integration.

Android Pay also allows merchants to offer discounts and sales to attract customers. Even though NFC technology in India is not very advanced, it will become bigger with the launch of Google’s own wallet. It might also make way for other services like Apple Pay.

The problem will India still remains – with the launch of payments banks in India, why would anyone want to use Android Pay? The answer lies in the fact that merchants can manage the incentives they want to offer to customers through Android Pay and other wallets.

Truecaller also launched Truecaller Pay for Indian users, but such services do not take off as expected. Lack of marketing and knowledge can sometimes not let these features grow as expected.