Luxury and India’s Cautiously Rising Splurge Quotient!

Back in the 90’s a Porsche Cayenne, a fine dining experience at a Michelin Star restaurant, a shopping trip to Dubai, a Tag Heuer wrist watch or an ultra-luxury abode were awe inspiring acquisitions reserved for the elite. These are now commonplace with almost every household now reserving ~8% – 10% (middle income group) to 40% (high income group) of their monthly income for a dose of splurge! Cut to today to take a look at how the uber-rich in India spend their money and the changes in the luxury landscape in India:

- US$ 123 mn was spent at an Indian wedding

- Apple sold a whopping 800,000 iPhones in Q2-16

- 35,300 luxury cars were sold in India in 2015; ~1,000+ Mercedes cars were sold in a single month (Oct. ,’16)

- Jaguar, an erstwhile quintessential British brand is now owned by an Indian conglomerate the Tata group

- 111 – The number of US$ billionaires in India; following only China and USA

The above statistics point to the exuberance in the Indian luxury market. An Assocham study stated that the Indian luxury market is expected to cross ~US$ 18 bn by 2016 from ~US$ 15 bn growing at a CAGR of ~25%. As per Amitabh Kant, CEO, Niti Aayog, the luxury industry has the potential to grow 10-fold from and reach $180 bn by 2025.

Why is there optimism in a country where ~22% of the population lives below the national poverty line? A number of reasons support the exuberance of the luxury market:

- Number of ultra-High Net Worth households (HNH – with a minimum net worth of INR 250 mn, mapped over 10 years) increased from 137,100 in FY15 to 146,600 in FY16 – a modest increase of 7% – and is likely to touch 294,000 by FY21 with a combined net worth of INR 319 tn from the current INR 135 tn. Additionally, the average age of an Indian ultra HNI is reducing, and nearly 50% are now less than 40 years old. India’s start-up revolution has fuelled the rise of young and rich entrepreneurs and executives alike.

- Growth outside metro cities: While 55% of the ultra HNHs are from the metros 45% come from tier I and tier II cities including Bangalore, Ahmedabad, Pune, Hyderabad, Nagpur, Ludhiana, Surat, Jaipur, Kanpur and the like. Thanks to growing internet penetration in the country, brands are reaching out via their digital presence to tap the hidden potential of these smaller markets.

- Propensity to spend on luxury is growing: Luxury goods sales grew 25% in 2014 as compared to only 7% in China. As a result, brands are not differentiating between customers in London or Ludhiana and offer the latest collections across stores.

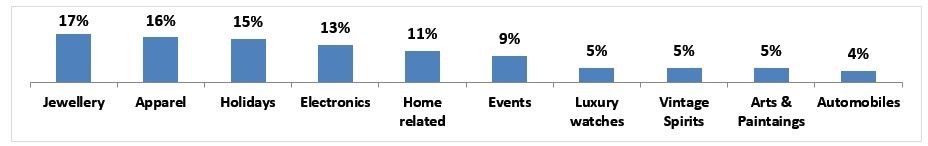

- Increasing appetite for luxury goods: Jewellery, apparel & accessories and luxury vacations account for ~50% of the luxury spending of India’s wealthy.

Source: Kotak Wealth Report, 2016

Source: Kotak Wealth Report, 2016

- Women become a force to reckon with: With increasing disposable income and on gaining financial independence women tend to make purchasing decisions around personal care and beauty products, spa treatments, apparel, footwear, bags and jewellery. Luxury personal care and jewellery are expected to witness growth of ~30-35% over the next 3 years. This is also driving an increase in the institutional capital being invested in the sector – For e.g. Nykaa (Luxury beauty products retailer) recently raised INR 82 cr.; Bluestone (online jewellery seller) raised INR 200 cr. in Series D funding in July 2016.

With an understanding of the growth factors of the sector, let’s also look at some of the key trends in India’s evolving luxury market and some of the roadblocks hurting the sector’s growth.

Contents [hide]

Key Trends

Customization

While money is not a concern for the affluent to splurge on luxury goods, the ultra-rich expect exclusivity in almost all goods and services they seek. To cater to the desire of the rich, brands offer customization services, limited edition collections and bespoke services.

Brand collaborations

International and Indian brands are now collaborating across product segments to create unique offerings for the ever-demanding luxury consumer. For e.g. Christian Louboutin and Sabhyasachi put together a unique line of shoes with Indian design and western aesthetics.

Domestic versus International Brands

Across most categories the affluent Indian consumer favours international brands be it apparel, electronic gadgets, watches or cars. Although there are a few exceptions where Indian brands stand tall and in some cases score higher than their international counterparts:

- Jewellery – Brands such as Nirav Modi, PC Jeweller, Gitanjali Gems (Nakshatra, D’damas) and Tanishq have made their mark both at home and internationally as well for gold and diamond jewellery. International jewellery brands like Cartier and Tiffany have minimal, if any, presence in India.

- Paintings and art – Indian artists including Husain, Mehta, Souza and Shergill are world famous and Indians splurge at auctions to get their hands on the limited number of pieces produced by these artists.

- Hotels – Brands like Taj and Oberoi have some of the best properties across the globe and are internationally recognised for the opulent experiences they offer.

- Ethnic apparel – Indian designers are the top choice for ethnic wear for the well-heeled Indian consumer. Brands / collections by Indian designers (Manish Arora, Ritu Beri etc.) are now worn by global Indians and international celebrities with equal panache.

Challenges of the Indian Luxury Market

Complex regulatory environment: Duties ranging from 40% to over 100% are imposed on most luxury goods ranging from leather accessories to high-end cars in India. High duties make a lot of the luxury shoes, bags and accessories, 15-30% more expensive than elsewhere, sending Indians to buy the same products from Dubai, Singapore or London. Restrictive regulations such as a minimum 30% domestic sourcing requirement for allowing FDI in single brand retail. This requirement makes it difficult for international brands to set up shop in India. Earlier, ~40% of luxury goods (jewellery, leather goods and accessories) purchases were made using cash. The requirement to furnish the PAN number for purchases above INR 1 lakh has further added to the woes of the luxury industry.

Lack of quality real estate for luxury retail: High street malls and other high end retail infrastructure have limited presence in Indian metros and are virtually non-existent elsewhere. This forces luxury brands to launch boutique outlets in hotels through JVs with local distributors eroding already thin margins due to high rental costs.

High operational costs: Most luxury brands housed in locations with high rentals also incur high maintenance and upgrading costs to continue to meet the defined standards of the brand and attract the demanding luxury shopper. Another example is the luxury hotel industry, where upgrade costs and capital expenditure are the norm to attract top dollars from both the high end business traveller and the discretionary leisure traveller.

Lack of experienced partners: A few foreign brands which entered India could not get their partner strategy right and were forced to exit. Maserati entered the country in 2011 through a partnership with Shreyansh Group (Ferrari’s erstwhile partner as well), which went sour in 2014 as the domestic partner was negligent in providing after-sales service and, in some cases, failed to deliver cars after accepting payment for the same. Maserati has since re-entered India with new partners in 2015. Writing instruments brand Maison Montblanc, menswear brand Alfred Dunhill and the like are other examples where local partners were unable to help scale operations of those brands due to declining demand and difficult market conditions. Although, in certain cases the Indian partner may not be the reason for the relationship going sour. Mohan Murjani, Chairman, Murjani Group, announced the termination of the group’s JV with Gucci, Bottega Veneta, Jimmy Choo and others citing unfavorable terms of trade. He stated that most foreign brands offer a one sided agreement wherein they partner with the Indian owner only for the profits and royalty that accrues to the brand and not for the losses.

Lack of an India specific strategy: An understanding of spending habits across regions and states of India is essential for luxury brands to succeed at the micro market level in India. Louis Vuitton (LV) closed its Chennai outlet as discerning Chennai customer, although well acquainted with luxury does not believe in an ostentatious display of wealth unlike say Delhi or Mumbai. As a result, LV and other international brands have been unable to attract enough takers in the city.

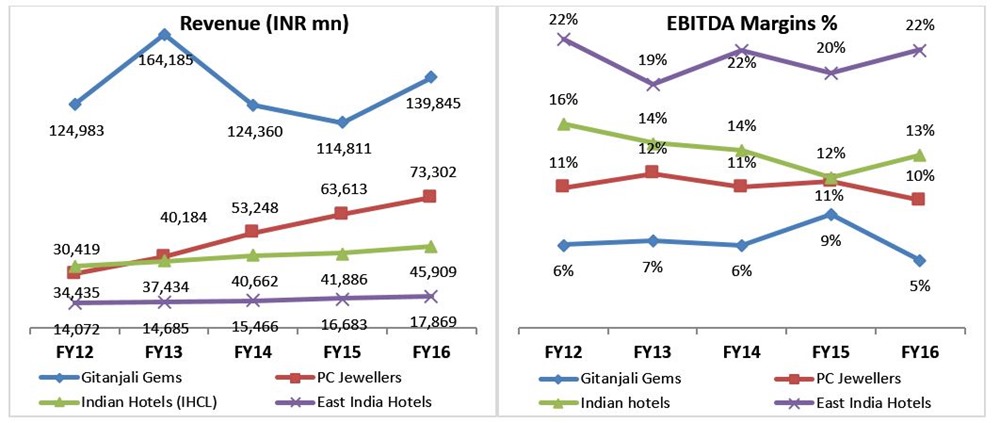

As a result of these challenges the performance of luxury brands in India is also impacted. Let’s take a look at luxury companies across two categories – Gems & Jewellery and Hotels / Tourism – which account for significant luxury spending.

Source: Company Annual Reports

Source: Company Annual Reports

Growth of all these companies has been muted or even declining, as in the case of Gitanjali Gems, in FY14 and FY15. This decline in was due to the fall in gold jewellery sales resulting from the government measures introduced in 2013 to curb gold imports. Hotels major IHCL (Taj Hotels) experienced low single digit growth rates in room and F&B sales in FY14 and FY15 on account of low demand and difficult market conditions. The capital intensive nature of the hotel business puts additional cost pressures as servicing the increasing debt load is not cheap. As can be seen above, macro-economic environment, regulatory hurdles, high maintenance costs and CAPEX costs have a material impact on the performance of the luxury goods companies.

What does the future hold?**

In certain cases, the government may ease regulations (e.g. relax the 30% domestic sourcing limit) which is likely to boost FDI and enable more brands to enter India. International brands which did not do well earlier are re-entering the country with a renewed strategy to capture a portion of the burgeoning but difficult luxury market. Improvement in the luxury retail infrastructure will augur well for the growth of the sector. New brands are leveraging the internet and using private sale events to test waters before investing substantial amount of money. Additionally, Indian brands are also gaining recognition both at home and abroad.

As a result of the global mobility of the affluent Indian, who is picking up trends and is demanding the same experience and the same brands back home, the luxury sector is likely to scale further, rising slowly after battling the competitive and difficult environment.

** At the time of this article going to press, the Indian government demonetised INR 500 and INR 1,000 notes. Since a lot of luxury goods purchases in India are paid for with cash, such a move could severely affect the growth of the market in the short to medium term.

[This article has been contributed Shweta Jain, Executive Team Member at Aurum Equity Partners LLP]