7 Year Jail For Illegal Usage Of Bank Accounts; IT Dept Cracks Whip On Deposits Above Rs 2.5 Lakh

The surgical strike against black money continues with full force, as banks are now overflowing with deposited money, even as black money hoarders are discovering new ways to convert their wealth into white.

In order to stop the illegal ways (some of them which we discussed last week) of converting black into white money, Govt. has initiated several new initiatives in the last few days.

7 Year Jail For Illegal Usage Of Bank Accounts

Cash under Rs 2.5 lakh can be deposited in any bank account, while showing an ID proof. No proof of income is required, as Govt. is assuming that cash under Rs 2.5 lakh is the savings of a typical Indian housewife.

Misusing this privilege, several black money hoarders are hiring poor people, who have a bank account (mostly under Jan Dhan scheme), and depositing their black money into their account. Once deposited, they transfer the amount into their own accounts, or make an arrangement with the actual account holder to take back cash later.

Such illegal ways to convert and deposit black money will now come to screeching halt, as Govt. has decided to impose Benami Transactions Act, under which violators of bank account can face upto 7 years jail.

In fact, both the parties: The one who deposits the cash and the one who allows the usage of his bank account, would be charged under this law, and can be sent to jail for 7 years.

A senior official from IT Dept. said, “”The person who deposits old currency in the bank account shall be treated as beneficial owner and the person in whose bank account the old currency has been deposited shall be categorized under this law as a benamidar..”

Explaining the dangers of using others’ bank account to deposit black money, the official said, “The benami amount in the bank account deposited post de-monetisation will be seized and confiscated and the accused will also be liable to fine which extends upto 25 per cent of the fair market value of the benami property..”

IT Dept. Cracks Whip On Cash Deposits Of More Than Rs 2.5 Lakh

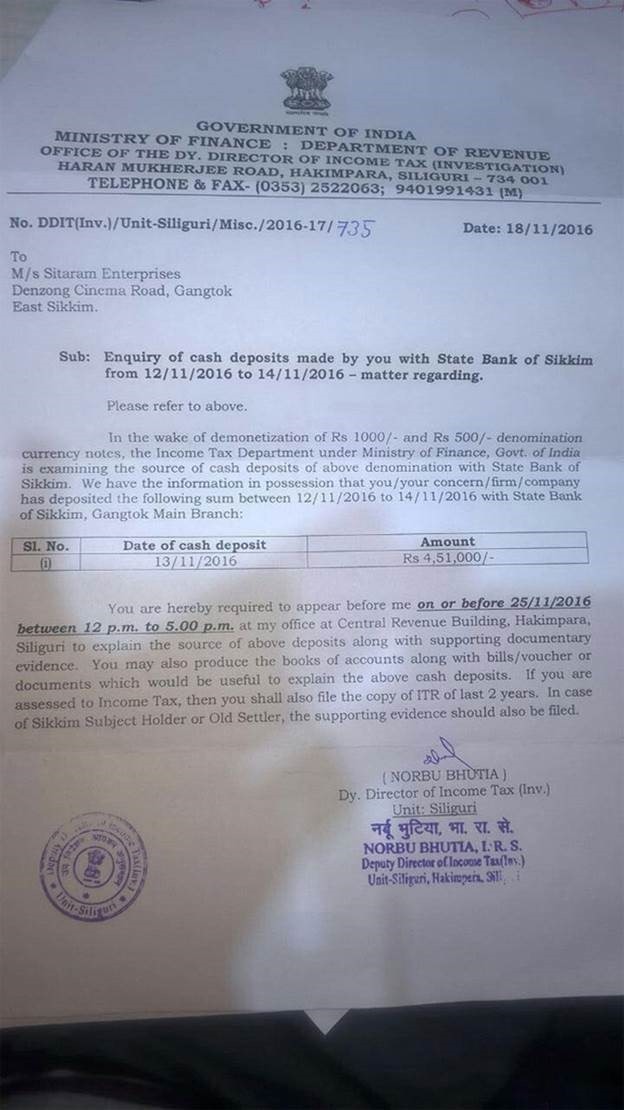

Meanwhile, for those cash deposits, which are more than Rs 2.5 lakh, and done without any concrete income proof, IT Department has started sending notices to the bank account holders.

In one such notice, Income Tax Dept. from Siliguri has sent notices to bank account holders of State Bank of Sikkim, who deposited huge amounts of cash between November 12-14.

Special financial investigation units have been formed, which are investigating all such deposits, and monitoring the transactions.

(Image source: IndiaTV)

For showing the income proof, the notice clearly says, “You may also produce the books of accounts along with bills/ voucher of documents which would be useful to explain the cash deposit..”

Meanwhile, due to stranded trucks on highways, and complete shutdown of several agricultural markets due to lack of cash, a retail body has slammed the demonetisation move by PM Modi, and has asked the Govt. to reverse its decision.

Mumbai based Federation of Retail Trade Welfare Association has issued a statement, wherein their Chief Viren Shah has said, “The Union government seems to have not done its home work properly before announcing the decision to demonetize Rs 500 and Rs 1,000 currency notes..”

The comments are being seen as politicized, as this retail body has issued statements right after meeting Shiv Sena president Uddhav Thackeray. They are also demanding scrapping of VAT and Income Tax on their members.