Mobile Wallet Issues: Paytm User’s Money Gets Mysteriously Debited; Mobikwik User’s Wallet Used For Unauthorized Pizza Payment

There is something definitely wrong with Indian mobile wallet companies, as user experience continues to nose-dive. Backed by VC funds, these wallet startups have been promoting their services aggressively across all platforms; but are they paying equivalent attention in safeguarding their database?

Paytm User’s Money Automatically Debited

A Paytm user from Noida, Uttar Pradesh has claimed that Rs 200 was automatically debited from his Paytm account. His SBI Bank saving account was attached with the wallet, and all of a sudden, without any OTP request, he received a message that Rs 200 has been debited.

The user shared his experience on Reddit India platform, without much detail. As per him (or her), mails have been sent to the management, and response is awaited. Considering that no OTP authorization was followed, this can also be a mistake on SBI’s part. But, in the end of the day, money was deducted from a Paytm wallet.

There have been similar cases in the past as well. For instance, a customer named Jigna Shah wrote on Paytm’s Facebook page that a sum of Rs 840 was used by someone to shop at an ecommerce portal. When she pressed the charges, the amount was reverted back.

Another user name Abhishek from Bangalore wrote on Paytm that Rs 680 was automatically deducted from his Paytm wallet, and despite 30+ emails to their customer support team, no response was received. Even his Facebook post had no response at the time of writing, despite the incident being almost 2 months old.

But why automatic deductions, without the consent of the user are happening in the first place?

Another user shared his details, wherein the cash back offered by Paytm was abruptly withdrawn.

Infact, this is not the one-off case. There have several instances, as shared here and here.

Such blatant compromise of user’s details and wallet balance can be a serious precedent and a major threat for more than 70 million Paytm users.

Unauthorized Pizza Payment From Mobikwik Wallet

Last month, a Mobikwik customer named Sidharth B wrote a detailed post on Medium, regarding a fraud he experienced, wherein someone else was able to successfully order a pizza using his Mobikwik wallet and the balance available there.

Although Mobikwik later refunded the amount, but Sidharth had to face much distress and tension due to the same. However, minutes later, his Mobikwik account was deactivated due to security reasons!

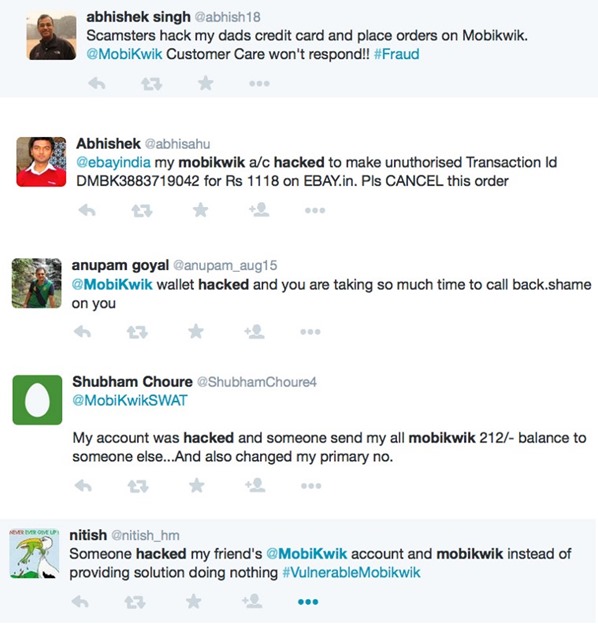

He even shared other instances of such unauthorized debit of funds from Mobikwik’s wallets:

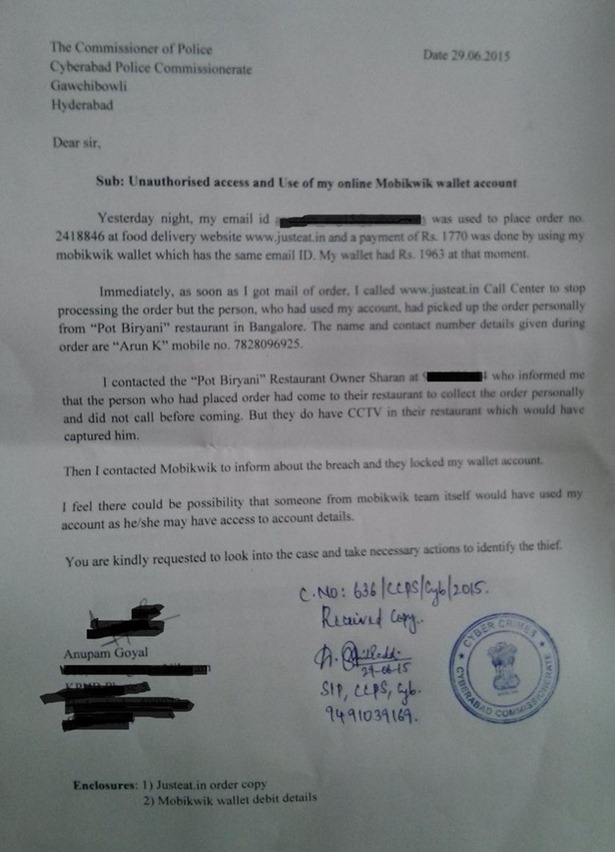

Even police complaint has been made against Mobikwik wallet:

At a time when mobile wallet companies are receiving tremendous amount of VC funds, and they are leaving no stone unturned to accelerate customer acquisitions at a break neck speed, it becomes their responsibility to safeguard their users’ financial data and money.

Maybe diverting some marketing funds to security norms would be a better idea.

Have you faced any unpleasant experiences from mobile wallet companies? Do share it right away!

Disclaimer: The author is a regular user of both Paytm and Mobikwik; and fortunately he has not experienced any such unauthorized debits as of now. However, the post was written to highlight the security flaws which unfortunately, remain true.

Yes that’s working Bro thank you.

[…] proof has been provided; nor we can deny the threat, as we have always reported how money is being mysteriously debited from Paytm’s wallet; how Ola cabs was hacked and credit cards details stolen; how cyber extortion is now becoming main […]

[…] We have repeatedly stated that using e-wallets of digital wallets in India is still insecure and full of security loopholes which can be exploited by hackers and anti-social elements, anytime. Money from such e-wallets are vanished without any trace, and unauthorized pizza payments are made all of a sudden. […]

Paytm has done same to me. My cashback also taken back. I raised complaint but did nothing.