Rs 1.2 Lakh Crore Worth Digital Payments Will Be Made By Indians in 2014: IAMAI

In a recent study conducted by Internet and Mobile Association of India (IAMAI); National Payments Council of India (NPCI); IMRB, it has been found that Indians will spend Rs 1.2 Lakh crore worth of Digital money by the end of 2014.

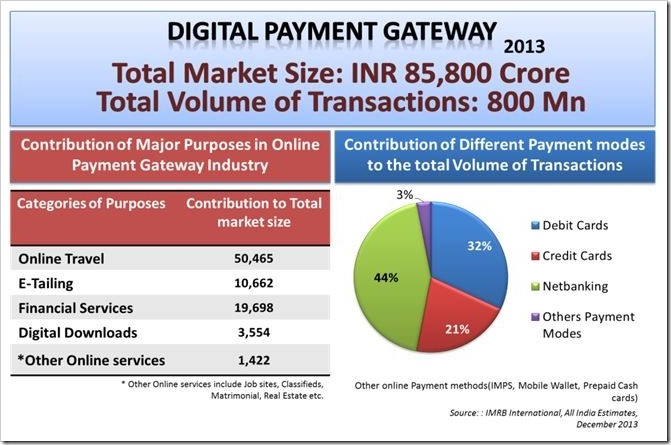

Last year, digital payment industry was pegged at Rs 85,800 crore, which has increased 40% this year. From 2010 to 2013, it was found that the industry grew at 10% CAGR (compounded annual growth rate).

Digital Payment Market in India [2013]

Interestingly, the four metros: Mumbai, Delhi, Kolkata and Chennai contributed 60% of the total digital payment gateway market all over the country. The study tracked and researched digital payments made by credit cards, debit cards, mobile wallet, internet banking and Immediate Payment Systems (IMPS). Online remittances from abroad and inter-country money transfers have not been included in the study.

Some interesting highlights from the report:

- 60% of all digital payments were done for travel related transactions

- Financial services such as insurance premium etc contributed 23%

- eCommerce was responsible for 12% of all digital payments in India

- 80% of all online payments were made from desktop and laptops

- By 2020, 30% of all online payments would originate from mobile and tablets

- Bangalore, Hyderabad, Ahmedabad and Pune contributed 25% of all digital payments

- Total 800 million online transactions were made in 2013

- 53% of all online transactions were made by credit card and debit cards

- 44% of all online transactions were made using Internet banking

- Rest 3% of all online transactions were made using Mobile wallet, Prepaid payment cards etc

- Digital downloads such as eBooks, music and movies contributed 4%

- 2% of all digital payments were made for online services such as matrimony, jobs, real estate offers etc.

The stats clearly show that Indians are increasingly getting comfortable making payments online. Also, travel & ticketing Industry has the lion’s share when it comes to online payments, with IRCTC undoubtedly at the top.

While Indian e-commerce is growing rapidly, only about 12 percent payments are made digitally, which means CoD (Cash on Delivery) is the most popular method for Indians who buy goods online.

Another interesting fact from the report is that rather than metros like Mumbai and Delhi, the cities like Bangalore, Pune and Hyderabad have higher percentage of digital payments. This in all probability has to do with the fact that these cities are software hubs of India and tech guys are more comfortable making digital payments online.

In another report by RBI, it was found that as of now, there are total of 350 million debit cards and 19 million credit cards active in India. This study once again demonstrates the fact the today’s new age Indian is not hesitant to use digital payment gateway, and the scope of usage will only increase with time.

[…] of activity in the last few months, resulted in 8% of all payments. Last year we had reported that 20% of all payments are being done on mobile devices. Hence, with 8% share of mobile wallets in the overall online […]