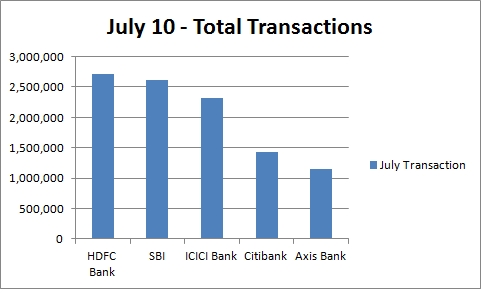

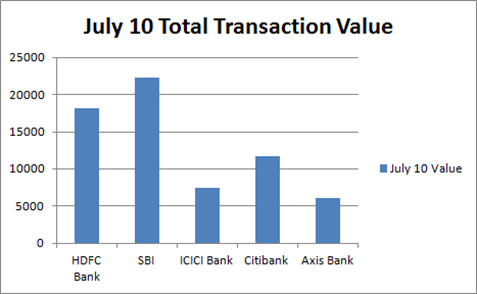

According to Bank Statistics monthly report released by RBI yesterday, HDFC Bank stands at number one position when it comes to number of e-transactions taking place in India, while SBI is ahead in terms of value of transactions.

ICICI Bank, even though has largest network of Bank branches in India comes in at number number 3 behind HDFC and SBI in number of transaction, while in value of transactions it is even lower that Citibank in India.

Top 5 Banks for E-Transactions

| Bank Name | July Transaction (nos.) | July 10 Value (in crore rupees) |

| HDFC Bank | 2,709,766 | 18252 |

| SBI | 2607379 | 22330 |

| ICICI Bank | 2313405 | 7488 |

| Citibank | 1421619 | 11734 |

| Axis Bank | 1145677 | 6106 |

I am not sure how many of you will agree, but the reason ICICI is not ahead in E-transactions is because there online banking experience sucks. I am a HDFC as well as ICICI customer for over a decade, but my 90% of online transactions happen through HDFC.

Infact, in last 6 months I must have used NEFT feature on HDFC over 50 times, while I don’t remember using it once on ICICI. In the name of security, ICICI bank has made the life difficult for its customers. Not only do they have strict guidelines on password (bordering ridiculousness), but they have different set of password for transactions as well as login. The ICICI bank is so slow, that it becomes painful sometimes. Even if you want to use ICICI Bank for online payment through different site, it is too difficult.

While ICICI Bank has grown tremendously over past decade, their customer experience (Online as well as offline) is below par.

On the other hand, HDFC bank’s experience has been rather pleasant, especially while carrying out E-Transactions. I guess, that probably is the reason why HDFC boasts largest number of transactions. Also, less transaction value per transaction also shows that HDFC is used more by individuals rather than corporates.

What’s your take ?

Yes, I do agree with this observations. I have been with HDFC Bank since 2001, nearly 10 years now, and my overall net banking experience with HDFC Bank has been a very pleasant one. Not a single security related or transaction related problem for me all these years, even though their password procedure is very simple. Bank's should work towards simplifying net banking procedures, so that more people come forward to use net or mobile banking which reduces workload and rush at bank branches. HDFC Bank is a good example.

Yes, I do agree with this observations. I have been with HDFC Bank since 2001, nearly 10 years now, and my overall net banking experience with HDFC Bank has been a very pleasant one. Not a single security related or transaction related problem for me all these years, even though their password procedure is very simple. Bank's should work towards simplifying net banking procedures, so that more people come forward to use net or mobile banking which reduces workload and rush at bank branches. HDFC Bank is a good example.

I am a customer of HDFC bank for the last few years. Yes, HDFC bank is far superior than any other banks in India when we talk on netbanking, e-money transfer, customer service etc. It is the only NextGen Bank in India. The only thing I regretted is HDFC bank has very less geographical coverage in India. Hopefully it will expand soon.

Dear Arun,

We would like to thank you for pointing out the problem and assure you that it has been looked into and resolved. Glad to have you as a customer.

Regards

ICICI Bank Customer Service Team.

As a matter of fact, banks are not actively promoting online banking.

Most of the banks merely put up a insipid poster, or a flex informing about e-banking facility and some of its advantages. However, the bank tellers and officer never speak to the customers to explain them details of advantages of online banking.

I run a small business where I allow my customers to pay by cash deposit, cheques, demand draft, online banking and NEFT.

I have come across m*r*ns who will sit for 1 hr in bank to get the DD but will not use NEFT even though it takes only 5 minutes. And all this after explaining them the benefits of NEFT.

From next year onwards, I have decided to scrap all together accepting paper based instruments such as cheques, dd, po, etc as less than 5% of my customers pay by these.

Rohan,

You have echoed my thoughts…and you are absolutely right on this…However, you have to keep in mind that less than 1% Indians are hooked on to Internet and most of them are uncomfortable doing transactions online…They prefer spending 1 hr to ensure that transactions happens successfully in front of their eyes..

It will take a few years before we a scenario when majority will do it online..It is a shift in mentality more than the ease of use…It is a comfort level that they have developed over many years…

Hi,

I am a customer of both the banks too, and admittedly have done NEFT transactions only through HDFC, but that portal too has it weaknesses with their reasons too bordering to ridiculousness. One cannot access bank statements older than 6 months and that too only 1 month at a time. Isn’t that ridiculous? Also if I want to change the primary email address, I need to submit a paper form at their branch unlike ICICI which scores over HDFC portal on both these counts.

Ashish,

I agree with you – But most Banks do not offer more than 12 months…Even in U.S, where I am a Customer of Bank of America, they give access to only 9 months of statement… It is surprising, but true..