The Reserve Bank of India said that the overall volume of currency in circulation rose 4.4% year-on-year to 13,621 crore notes in the financial year 2023.

Increase In Currency Circulation In India

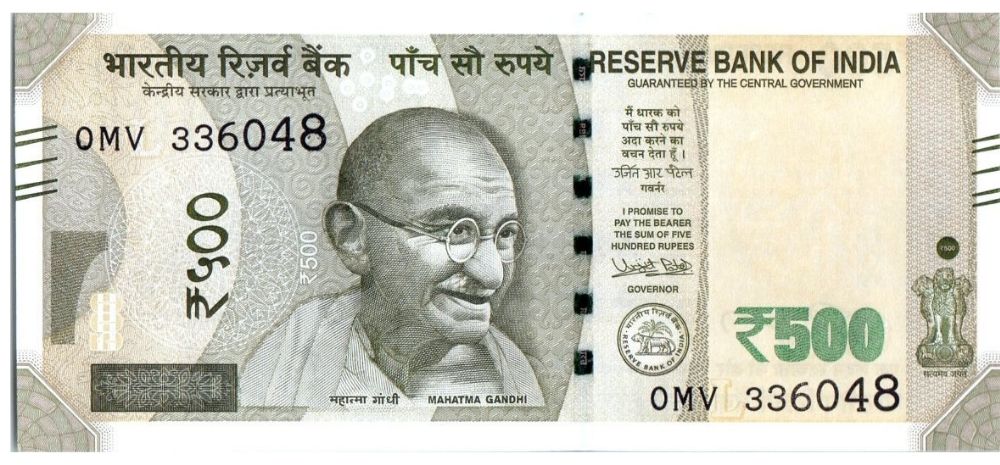

So far, the Rs 500 notes are the most voluminous, with a total of 5,163 crore notes in circulation as of FY23, among the notes in circulation.

It is followed by Rs 10 and Rs 100, with 2,621 crore and 1,805 crore notes in circulation, respectively,as per the central bank’s annual report.

If we go by value then Rs 500 notes account for the largest chunk of the total value of currency in circulation having a share of 77% out of the overall Rs 33.48 lakh crore.

Further the RBI’s report said, “In value terms, the share of Rs 500 and Rs 2,000 banknotes together accounted for 87.9% of the total value of banknotes in circulation as of March 31.”

Despite a majority of denominations witnessing a dip in their overall volume in circulation during FY22 and FY23, Rs 500, Rs 200, and Rs 20 notes registered an uptick.

While denoting a year-on-year growth of 9.2%, the volume of Rs 20 banknotes in circulation grew from 1,101 crore in FY22 to 1,258 crore in FY23.

In the similar manner the volume of Rs 200 notes grew by 4.6% year-on-year to 626 crore.

Individually, the Rs 500 notes made up the highest share by volume of banknotes in circulation, accounting for 37.9% of the total volume.

Followed by Rs 10 banknotes while accounting for 19.2% of the total banknotes in circulation as of March 31, 2023.

Discontinuation Of Rs 2000 Note

Contrary to this, Rs 2000 notes have been steadily falling out of circulation, with their overall share in volume falling to 1.3% in FY23, down from 1.6% in 2022.

The RBI announced that it had decided to withdraw the Rs 2000 notes from circulation earlier this month.

In this regard, the central bank had released a statement saying those holding them could get the notes exchanged for currency of other denominations or deposit them into their bank accounts.

Besides this, the county’s central bank had also launched pilots for India’s central bank digital currency in late 2022, i.e., for both the retail and wholesale versions of the digital currency.