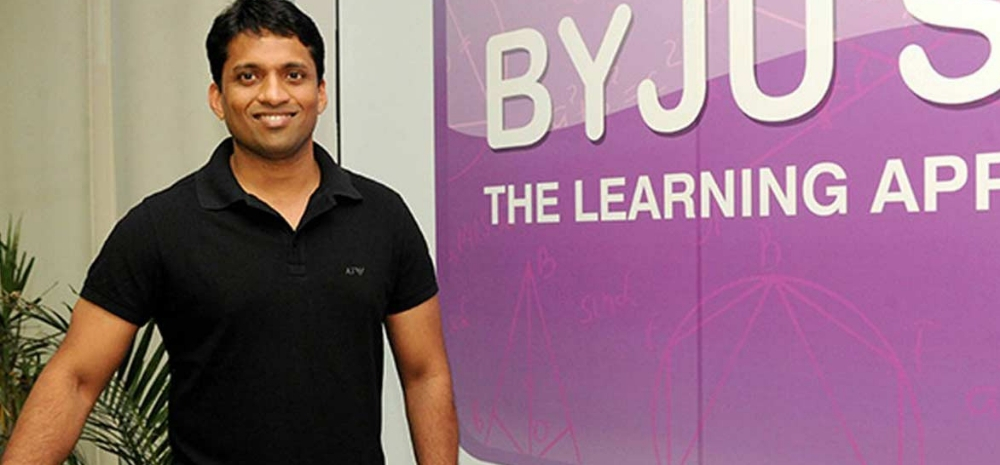

In a major legal setback for edtech giant Byju’s, the US Bankruptcy Court for the District of Delaware has ruled that Byju’s founder Byju Raveendran, suspended director Riju Ravindran, Camshaft Capital, and the parent company Think & Learn orchestrated a global fraud. The court confirmed that $533 million was fraudulently transferred from Byju’s Alpha Inc., the US subsidiary, in a scheme that the lenders described as deliberate theft.

Breach of Duties and Missing Funds

The court found Riju Ravindran guilty of breaching his fiduciary duties as a director of Byju’s Alpha. According to the lenders, the leadership of Byju’s not only failed to disclose the location of the funds but also repeatedly avoided providing financial records and basic information. The judge further noted that Think & Learn had established the US subsidiary with the purpose of committing fraud, reinforcing the seriousness of the allegations.

Legal Battle Intensifies

While the US court’s ruling strengthens the lenders’ efforts to recover the missing $533 million, the legal fight is also escalating in India. The lenders, represented by Glas Trust, are actively pursuing the case in the National Company Law Tribunal (NCLT). In January, Glas Trust and Aditya Birla Finance were appointed to the creditors’ committee of Think & Learn, which signals increasing pressure on Byju’s management.

Camshaft Capital’s Controversial Role

A significant part of the missing funds was transferred to Camshaft Capital, run by William Cameron Morton, an inexperienced fund manager in his mid-twenties. The hedge fund has no notable track record, and Byju’s has not provided any valid reason for sending such a large sum. The court had previously ordered Riju Ravindran to pay $10,000 daily until he cooperates in locating the missing funds.

What’s Next for Byju’s?

With multiple lawsuits in the US and India, and the financial future of Byju’s hanging in the balance, the company faces serious challenges ahead. The recovery of the missing $533 million and the resolution of the fraud charges will determine the next chapter for India’s once-celebrated edtech unicorn.