Sensex @ 20,000: What Indian stock markets hold for 2013

Before I start, let me tell you that I am not a stock market expert. However, I have been dabbling in equity investments and stock trading for nearly 10 years and I have had my ups and downs.

The article below gives a perspective of what I think is in store for Indian stock markets in 2013.

Contents [hide]

Sensex at touching distance to psychological 20k mark

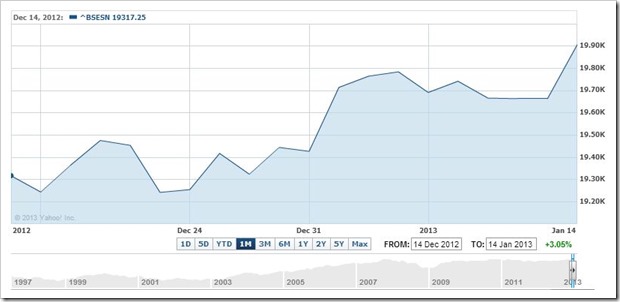

2013 has started well for Indian stock markets, last few days saw Sensex rising steadily and now stands at touching distance of 20,000 mark. Unexpected stellar results announced by Infosys on Friday and TCS has pushed Sensex to 19933 just 67 points shy of that psychological mark.

The market sentiments were also buoyant due to 2 other reasons – Inflation, which has been perpetually in double digits for past couple years, fell to 3 year low of 7.1 percent. Secondly, GAAR (General Anti-Avoidance Rules), the controversial bill that was aimed at tax evaders, has been deferred till April 2016.

These bunch of positive factors coupled with expectations of better economic growth this year have created favorable conditions for stock markets, atleast in the short-term.

Where will Stock Markets be at the end of 2013?

While the year has started quite well, will it remain the same over the course of next 12 months? That’s obviously a very difficult question to answer as no one can really predict what is going to happen.

However, most analysts are of the opinion that this stock market rally is expected is continue well in 2013. Here are some of the reasons why…

Pro-Industry Policies

Government has announced slew of pro-industry policies over past few months including opening up FDI into various Industries. This has brought about a positive sentiment among domestic as well as foreign investors. Over past few years, the center has been repeatedly blamed for being on the fence and not taking tough decisions, but with the some of the announcements made in recent past, they have shown their ability to take a stand.

The recently announced policies have brought back sectors like retail, media and aviation back into reckoning, for whom FDI has been opened up. Domestic and Investors are sure to pour more money into these

Inflation & Interest Rates

Inflation has been the achilles heel for a very long time for Indian markets, and after a very long time, inflation seems to coming under control. The Inflation is at its lowest in past 2 years, currently standing 7.1 percent making a strong case for lowering of interest rates.

Lowering of interest rates is surely going to have a positive impact on the growth of various sectors like Auto and real estate; and at macro level on the entire economy. Signs of Economic recovery is sure to work its magic on the stock markets pushing it higher!

Rupee to trump Dollar in 2013?

Better Economic factors, rising stock markets, lower interest rates, rise of foreign investments in India, are all going to affect the Rupee dollar equation. Dollar has been very strong through-out 2012, however, the tide is expected to turn in 2013. In first couple of weeks itself, Rupee has already strengthened against the dollar and is at Rs. 54.66 at the close of markets yesterday.

However, one also has to keep in mind that dollar-rupee exchange rate will largely be dependent on global factors. If Indian economy performs as expected, I do not see any reason why Rupee Dollar exchange rate cannot reach sub-50 rupee mark by the end of the year.

Monsoon – A lot depends on it

Now, this is a factor which is not in our hands, but a good monsoon this year is sure to push GDP growth rate even higher and thereby stock markets. The opposite of it is also equally true. so lets hope that we have a good monsoon this year!

Sensex by December 2013

So the big question is where do I see Sensex by end of 2013. Given the factors stated above, I am pretty confident that 2013 may turn out to be a great year for Indian stock markets. On a personal level, I am hoping that Sensex will rise about 15 to 20 percent by the end of year and may probably touch 24,000.

I withdrew my money from stock markets earlier in 2012 and have been sitting tight for the tide to turn, and I think it is time to get back to the markets to make some money!

Would love to hear your thoughts on stock market performance in 2013

Nice post. But I personally feel that one can neither invest nor predict returns or stock market trends over such a short term perspective of an year. Especially from a fundamental analyst’s perspective..fundamental research has proven that how the stock prices move over short term periods say 1 year have very little or zero co-relation to the fundamental valuations.

I would say, a few things went unnoticed recently which helped Indian economy.

First and foremost, Chidambaram replacing Pranab.

Nobody noticed the difference other than Pranab becoming President and the slot filled by another guy.

If you notice Chidambaram, he is moving minor bottle necks since his induction. The situation also helped. When opposition was crying for PM’s head, Cong. throw ace in the form of Petrol price hike which every economist is begging the govt. Subsidies on fuel was the biggest CAD factor in our economy. Slowly he is removing every bottle neck.

Today he approved gradual increase of diesel prices also. The best part is opposition is no tin a position to make it a big issue to overthrow govt. With diesel price going up (slowly & gradually) the pinch can not be felt. And govt gets some cushion in CAD.

Dont think all problems are sorted out.

The biggest policy reform is needed in mining, infra. Once these are sorted out, Industry will grow (at this moment it is posting negetive growth). Once it posts positive growth and if mansoon turns good next year, there is no stopping Indian economy.

So many ifs to consider before we can say India growing once again.

The ifs to look out for –

Will mining policy bring clarity? Will clear policy allow mining to grow? Will increased minerals support Industry (coal, iron ore, bauxite, oil& gas)

Will the mansoon be good next season? Will food grain be more than last year?

Will food grain export policies be modified? WIll sugar be decontrolled? Will unlimited exports allowed for rice, wheat?

Will inland waterways be developed to decongest road / rail networks?

Will all district head quarters be connected by 6 lanes?

Will Indian economy support our IT industry (which is depending to a large part on exports)?

So many “Will they do it? If yes when”

If the positives since Chidambaram continue, the 2013 biginning Sensex 20,000 can be supported. Otherwise the year will start with 20,000 and end with 16,000.

Just my two paisa :)

noone can say where the stock market would lead to at the end of the year 2013.Stock market is now influenced by world economy and USA is sitting on huge fiscal debt..whenever its effects would start then our stock market would also start to sink..yes,according to technical analysis,nowadays market is going up…but for many days..noone can predict…

good new for share market investor

It should record years for the stock market in India as international funds make there way to the country!