What is the future of Rupee? Is Dollar going to appreciate?

These are the two questions I am hearing recently from Indians as well as their US counterparts. No one has answers to it, some say- the best days of Dollar are over and some are hoping for dollar to regain the past glory.

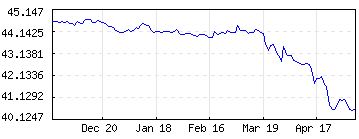

Look at these numbers: Rupee has appreciated roughly 9% in last 6 months alone and Dollar is at the weakest against rupee in last 10 years…!

For an Indian this could mean that he is richer by 9% without doing much and has gained much more purchasing power.

However, as one may imagine, the scenario is not too good for $9 billion Indian IT outsourcing Industry. The U.S. is the biggest market for most Indian infotech companies, accounting for over 60% of the revenues this industry generates by handling back-office and other operations. So the rising rupee is putting a squeeze on earnings and thereby reducing the margins drastically. They have also to fight out other problems like Wage inflation and resource crunch.

To add to it, the stock market has taken the note of this and the stocks have also come down at an average of 5% to 7% in last couple of months.

So, What’s pushing the rupee upward? Foreign investment has been pouring into India. Since January alone, institutional investors have pumped $2.5 billion into Indian capital markets. At the same time, the Reserve Bank of India has been trying to dampen India’s 6.07% inflation, and has raised interest rates five times in past 12 months.

Lets wait and watch this Dollar-Rupee fight :)

In the meanwhile you can vote your opinion in this poll

After 15 years, 40-80 rupees.

[…] USD-INR exchange rate is an important indicator of investor sentiment and can significantly impact not only the fortunes […]

thanks got my idia from reply of blow notings.

EXPECTING A FINAL CORRECTION IN RUPEE AGAINST DOLLAR, ONE MORE INVESTMENT OPPURTUNITY FOR BIG INVESTORS, WAIT FOR A DIP AGAIN TILL 4500 IN NIFTY.

hiiiiiiiiii laxmi what i have dooooooooooplz tell meeeeeeee//////////////

which type of agent uuuuuuuuuuuuuu any insurance and other

COMMODITY TRADER & BROKER

Is there any predictions that whether dollar will reach up to 55?

Predicting the future value of the rupee vs the dollar is a fool’s game. Do not try to do that.

Keep looking at the exchange rate and when it is in your favor: tranfer some dollars for your spending needs in India or to help your parents. Siblings should take care of themselves as giving them some money will only bring a request for more….

you are a young boy trying to act like grown ups.

Ha Ha

I am crying at the currency exchange rate at USD 1 = Rs 50.755. I may not be able to pay my children's fees in the USA. Why is it like this. Please help. Let the government make rupees stronger.

See our counterpart USD 1 = Chinese yuan 6-33 only.

The Great US dollar will decline further. Would it help Indian currency?

The Great US dollar will decline further. Would it help Indian currency?

What is the future of Rupee? Is Dollar going to appreciate?

yes

Dollar is again weakening and rupee is climbing. I do not think that dollar will appreciate as much as Indian Rupee.

Hi to all,

I am running a pvt. ltd. company in Chennai, India. Looking for investments for further expansion. Company will provide security bond. Interested people, may contact by email.

Rajinkumar

a.rajinikumar@gmail.com

hey.. again INR is becoming strong day by day. Anybody can predict abt dollar value will it be increase against INR. I hv some dollar wants convert INR shall I wait. Guys plz help……

What is keeping india from from free floating its currency against the Dollar ? Is it wise financially to tag our currency to the falling dollar ? who decides the exchange rate of indian rupee?

This discussion is exactly about what i need for my study work. Hope you don’t mind me to use a few pullouts :)

Regarts

I am a software developer. I do have good economics background. Iooking at the trend I strongly feel that the dollar rate will be falling down for the next month or 2. But if you consider next couple of weeks then I am sure it will decrease at a fluctuation of up and down. The dollar rate might get down to its least may be between Feb to Apr 2009.

I dont have lots of knowledge from stocks but I live in USA so I am predicting from the happenings here.

I am an exporter, my business pretty good because of rise in dollar rate. how long will this trend continue?if i want to quote the price of my product for one year,on average what dollar rate should i consider?

I am a trader importing and selling in india. I have to remitt some payment in USD. And Iam worried about the raising dollar rate. Any advice whether it will come down in coming week.

All,

If you have a better opinion please email me at quest.dba@gmail.com.

Here is mine.

After all this turmoil in US and world economy and the decision of US congress to pump 700 Billion dollars this is going to get worse. 700 Billion is nothing compared to the actual problems and figures. It goes in trillions. So where they are going to get the money when they have budget deficit of a trillion and national debt of around 12 Trillions. They are going to get this out of thin air which is the worst case scenario. Instead of market correcting itself they are making sure the collapse of dollar. Inflation will rise, dollar is going to get weak and the whole world will feel the heat.

Now where is rupee comes in picture, of course when dollar weakens rupee benefits, but at the same time inflation will rise, crude will rise and everything we buy with dollar is going to get hit.

All I can say is that hold on to your dollars once it starts falling down. Dont spend money at all. Dont invest anywhere except for gold. Save every single dime. If you want to send dollars to India send it now or in coming 2 3 months when it will be at its pick. We are going to face the worst time of our time, there will be a solid recession followed by depression. So hold on to it and save everything that you have.

Thats just my gut feeling…

Open for you comments and suggestions.

You will see Rs reach 49-50 near the genral elections. so wait and watch

In my opinion, future of Rupee will be better after 4 months.

Hi Kelvin,

I think you should get your dollars exchanged towards the end of this month. coz during the end week of the month oil companies need dollars to repay to their oils stocks. Hence rupee depreciate most in the last week of the month. Dont wait for rupee to depreciate substantially in future. RBI may intervene any time and you may end up in exchanging @ 42!!!

so, guys …please help out… can anyone tell me wat will be the trend like in the next 2-3 months(tats upto dec 2008), as I hav some USD need to convert to INR, is this (Sept) the right time or should I wait till next month?Thanks…

Hi,

We are the Distrbuters doing trading Buisness. We have to transfer fund in USD. As the USD crosses 46. Our landing prices of materials are getting increased by 10% As I was expecting the USD at 42.

Â

So could anybody forecast & tell about the Appreciating US Currency.

Pl Help us.

Regards

Venkat

Today $/Re crossed 43. I think it would continue it’s upward trend definitely through the summer since there is no way oil prices are coming down any time soon. It might reach 45 during this time frame. But I am uncertain what would happen after that. A lot depends on what happens to oil and how $ behaves. Any predictions?

Friends,

The appreciating Rupee hurting the IT companies and export oriented companies is only side of the big picture. I am an NRI and I feel the pinch when I send money to India. There are lot of pros to the appreciating rupee, IMPORTS – technology, raw materials etc. get lot cheaper. Think of Oil and the growth that brings to a nation. With Oil trading close to $130, think about India’s plight if the rupee was week, petrol would cost us Rs75/lt, higher inflation and that would spiral the growth downwards. India has strong economy and it continues to grow at a good pace, further strengthening the rupee. If RBI does not put the brakes on the appreciating rupee, it would be probably trading at Rs32/1$ today. My prediction is it will be close to 30 in the next five years.

Jai Hind

Hi,

Today Dollar crossed 41 mark… What is the immediate forcast about INR to $ comparision?

I have some $ and was thinking is it the right time to remit to India or to wait some more…

If we see in light of all the fundamentals Indian Rupee will appreciate in comparison to USD. But we are also well aware of the ramification it can bring to service sector and specially IT so RBI intervention will always be there to dampen the rise.

Also let’s see from different angle. If dollar depreciate then export will be less so does GDP growth will be less also so the Indian stock market will be in downturn so FII will be taking there money(dollor) out and this cycle will automatically stop appreciation of rupee. We are in opinion that Rupee will remain in range 34 -42 per USD. But to be remembered that Rs34/USD will bring step downturn in IT sector and there will not be any engineer on bench they will be at home. New college grads will not get jobs for months. But one thing to understand here even if this will happen it will not last for 9-12 month and again a upward cycle will start.

-ArthSutra

http://www.ArthSutra.com

the most precious resource of a country is its human resource. if u can make use of it efficiently in distribution of labour, then there is no question of the country being not at the helm of the world economy. In that sense Asia stands at advantage.. now its china.. in next decade it will be India.. provided India makes inroads into transforming itself into knowledge society.. i mean.. if quality of labour is equal as in west , then logically speaking asia is at the helm in this century.. as quantity is more.. but these currency markets are so manipulated like holding a beach ball under water.. and when released for free market to correct itself.. u would know the correction in global imbalances..

may i know the future of IT in TCS

as i got offer from and i have to join after few months

We need to understand that the dollar inflows to our country is controlled by RBI, so the decisions taken by Dr. Reddy is of atmost importance. In the recent past, Dr. Reddy has done an excellent job by moderating the flows of dollar and keeping the rate fluctuation in control.If we are saying that within a few months, rupee will become 30, that is a change of 25%! The Governor certainly will not let this happen as it will put a lot of Business houses in dis-array. The process of rupee appreciation needs to happen gradually and that’s one of the responsibilities of RBI.

Hello everybody

I am done with my GRE and TOEFL and planing to fly to US next year (aug 2009). I’ll be attending a 2 Yr. MS program and then planing to settle there with a job….and who knows may be I could make US my home.

But with the current Rupee-Dollar tussle, I pretty bothered about my plans. I have 2 questions.

1—– The Invetstment (from India) that my parents would make in my education would be around 10-15 lacks. would I be able to clear the debts (education loan) within two years after my MS, assuming I get an average salary of 50-70 thousand $ a year?

1—– Would American life standards still be better than Indian, after 10-15 years from now, Even if the INR get so very close to $? I mean to say, would American still be able to consume cheap commodities, realestate, automobiles,etc

Any answers would be appreciated

THNX

i have a querry here and it is about the dollar- Indian Rupees- Nepali ruppes relationship? how far it is true that india is planning to appreciate its currency against dollar? will it be good for indian economy? what would be its impact on nepal?

Hello,

The American economy has been hit badly and a big recession is going to follow soon. What this means ? There will be another recession similar to what had happend post 9/11. Dollar will come down more and its predicted that it will hit below 35 pretty soon than expected by industry analysts. There is no more DOLLAR dreams.

For more details take a look at the link below

http://infowars.com/articles/economy/china_uncle_sam_your_banker_will_see_you_now.htm

Suresh

Hi Reeti,

At least in the near future dollar will stay above 30.

Hi Sunita,

My best advise is to liquidate your dollar in Rupee AS SOON AS POSSIBLE. There is no visible chance of Rupee going down in future. It would be a double edged sword – dollar will keep depreciating in 2008 and Rupee appreciating. So take quick action. I have also done the same just this week. I had this chance a year back in 2006 July when dollar was around 44. Now it is 39. By 2008 Dec the prediction is that it would be around 35. So good luck.

R.C.Kaushal

rckaushal@yahoo.com

Hi,

I had some savings in $ n was waiting for ruppe to deprreciate but unfortunately it kept appreciating. I was wondering how far the rupee appreciation might go. I have been waiting for almost a yr. Is there any chance of rupee hitting to even 40rs/$ in next 2 months?

Thanks,

Sunita

Sure … maybe rupee value will be equivalent to that of dollar.

or it maybe that a rupee value will become more than that of dollar.

hi all of u people…..

i m a doctor and would be going to america soon.wat i wish to know is when i would be returning after ten years or so from america wat would be the rate of dollars then….i dont wish to know the rate in near future but i wish to know in next 5-10 years,if anybody could guess….

Hi , friends, anylists

what could be the dollar drop expected in the next 3 months any idea plese clarify me ?

I have good no of dollars earnings but the protection is not been made and facing the drop of dollar sevierly.

Also,

————–

US President George W. Bush predicted in an interview Tuesday that the battered US dollar will get stronger because the US economy is robust.

“If people would look at the strength of our economy, they’d realize why, you know, I believe that the dollar will be stronger,” Bush told the Fox Business Network.

“We have a strong dollar policy, and it’s important for the world to know that. We also believe it’s important for the market to set the value of the dollar relative to other currencies,” the president said.

Bush cited low US inflation figures, modest interest rates, job growth, and gross domestic product growth and declared “the underpinnings are strong.”

Asked whether he was satisfied with current exchange rates, Bush replied: “I am satisfied with the fact that we have a strong dollar policy and know that the market ought to be setting the exchange rate.”

The dollar has been weakening against the fast-appreciating euro in recent months. In European trade Tuesday, the euro climbed to 1.4599 dollars, compared to its rate of 1.2806 dollars a year ago.

—————

Yes,

I think this is happening like someone already told.

1 Dollar = x INR

x = (39 – 40), Oct 07

= (39.5 – 40.5) , Nov 07

= (40 – 40.75) , Dec 07

= (40 – 42), 2008

Let dollar go up…

I think dollar will gradually grow in the next year. We need to understand that the downfall of dollar is due to the huge pour into local market. When the investors start taking of that dollars back rupee will eventually come down.

Another point to note is that Rupee is not getting stronger, dollar has become weak. Rupee is not gaining anything againg pound or euro.

My guess, dollar will reach upto 42 and stays there.

Thank you guys, for ur helpful sugesstions.

The value of dollar will definately rise when FII will pull back. As the american economy is not in good shape it has to book some profit in the emerging economy like India and china. At present the Indian economy is rising at 9 10 % yearly, year after year this growth is not posible for any economy due to verious reasons like – lack of manpower, infrastructure ect. and inavitably a brake will come and the share index and the value of dollar will come down.

Correction – Dollar will not rise much but will get betwen 41 to 43 again in another 5 months…..

I think dollar will go up by Mar’2008, as rupee has to be corrected….The indian share market is booming because of all the money of foreign Investors….

some BPO’s will be closed, if rupee will rise further.Exports already impacted.Dollar will rise much but will get betwen 41 to 43 again in another 5 months…..

the good reason for RBI I meant was that Inflation is under control

Something for the exporters to smile … ok lets hold on for one last time to get the right forex,…. else its just our fate. The report below seems very logical and practical to me ….. India is presently growing on exports be it IT or any other stuff…. and US is our major destination. … so the central bank cannot keep ignoring this ‘natural growth’ …. now that they have a very good reason to pull the plug on FIIs ….. this is my thought …. and here is the news report suggesting that.

http://www.iht.com/articles/2007/10/23/bloomberg/bxatm.php

Can any body suggest me that I’m holding some dollars but as per markrt rate its present value is 39.10 by HAWALA. I want atleast 1$=41 INR. What will be probability to reach $ up to 41 INR in nearest future. Should I wait till Jan 2008 as US finance will be active in Jan 2008 OR Mar 2008 as Indian budget will be announced. Friends What Do You Think???

I am very optimistic! I have also read many reports (IMF, WB, ..) which point towards a stronger rupee. I am hoping, it would touch 35 to a USD by Dec 08! All the Best, Rupee!

This is a very interesting subject. The variables are so many, its next to impossible to make predictions. But I do wish to discuss my thoughts. I have been observing two countries very closely. Brazil & India.

The good part about an appreciating currency is Oil becomes cheaper. India, interestingly does not have an oil consumption rate as much as China. There is more and more reliance on CNG & public transportaion. Hence India's stands to benifit with appreciating rupee.

On the other hand, exports will be affected. I believe the govt. would offset the savings on oil in some way to help exporters in the long run. I do not believe the services sector will be affected much. India still have lots of competitive advantage. on the manufacturing sector, we will increasingly become converters, just the way China was 15 years back. We will import basic raw materials, convert, and export.

In my opinion, a continuous appreciation of the INR is inevitable. Once Rupee becomes completely convertible, it is bound to reach INR30=$1.

The Brazilian currency has appreciated 35% in last 2 years, the trend continues. Still the exports continue to rise from that country.

I am moving to India next year, and since dec of 2006, not a single dollar sits in the bank, every month I continue converting it to INR.

As per my belief, dollar will be depreciated for next 15 years, if the comditions remains same.

This is due to large inflow of dollar to India. And indian currency became stronger in the world market with respect to other currencies too. Because at the age of globalization ( when communication is going to fast every day), all European, US, Australia , NZ are looking for cheap services for their country. And India has advantage of English language and having cheap services.

While in case of China, English language a problem. That’s why india is best destination for software services. And another problem with U.S is struggling with the other countries and investing a huge amount for this. If India can play a better role in computer hardware sector, KPO ( i.e a huge unemployed sector is waiting for this), and provide corruption free service, no beuracracy, stable government. Then Indian economy boosting to its strength.

1 Dollar = x INR

x = (39 – 40), Oct 07

= (39.5 – 40.5) , Nov 07

= (40 – 40.75) , Dec 07

= (40 – 42), 2008

This is calculative projection, variance depends of EURO, Election.

i think dollar will not appericiate in near future because ryt now US economy is in recession period but once that period is over US economy will gain mometum

My personal opinion is what happened in the late 90s in the asean economies is very soon going to happen in India. Last time India was minimally effected. This time India would be effected the most. Yes, I am talking about the FIIs investment outflow in huge amount is going to bring up the dollar to 44+ rupees. But once again that is my personal opinion and I am betting on it.

At this moment FIIs are dumping money in India because they are over invested everywhere else. That amount is too much for RBI to control. I am sure all of you have read about all sorts of investments [ including terrorist money ] coming in. Traditionally it has been the IT guy / other professional sending in some investment / remittance and some FII investement. But now it’s FIIs diversifying their portfolio.

Once stock markets across the world crash [which I guess would happen sometimes in 2008], it would be interesting to see what happens with this FII inflow. I am betting on a lot of outflow soon enough.

Also, if the dollar keeps on going south, I would be interested in seeing what kind of outsourcing argument the ITES companies would have for their clients. To me, the current valuation of rupee / dollar is not sustainable in the long run.

There is also a political parameter for getting 43+ against $. General electection in India, after left pulling its support over Indo-Us N-deal.

A similar scenario existed in the late nineties. Lots of funds were poured into SE Asian economies and then were suddenly pulled out – initiating the great slump in ASEAN countries from which they have emerged only recently.

One wonders if India will fall prey to a similar fiasco.

anyone knows where to get a similar analysis between INR and Euro?

I am presently working in export department and facing huge problems due to unusal appriciation of Re against US Dollar. Price impact is tremendus and with this it has become dificult for me to sustain with same price level , there is huge pressure on my our profit margin.

In view of above, would anybody guide me, what would be senario in 2008, is it appropriate to switch over to Euro instead of US$ ? Will it be benficial to us?. I think fluctuation of Euro is stable as compare to US$.

Please guide me on this and also let me know any other possible options to tackle the situation.

Hi

Our export margins are dropping due to the drop in dollar .

Will this mean a death knell for all exporters in India and a field day for Importers ?

If Importing is cheaper , what would happen to the industries in India who supply to Local markets .

The company I work for has both markets .

What would be the best strategy ?

Can anybody suggest .

Given the huge talent pool and low-cost labour, India has to offer, India’s growth is unstoppable and in summary INR is going to get stronger and stronger. There may be bit of fluctuation and we may see weakening of rupee for a short period.

I am also in US and have seriously started thinking to back to India and grow with Indian economy.

Same here Nirav…Need to move back…:)

right now the dollar is enjoying some short term strength.

but i feel over the next few years the the Dollar will breach the

Rs40 level and probably hit the low 30s.

This sucks since I live in the US. I guess its time to move back.

Damn it.

i expect the rupee to touch 30 by october next year. The FIIS have no where else to invest other than india and China as these countries offer fantastic returns..With the foreign funds poring money into India the rupee is boung to appreciate and with the Indian goverment allowing the investors to come in freely the rupee is boung to appreciate in a substatial manner the trouble is when this money goes out. Its all about labour when the labour will start becoming costly the money will go out

i wish us $ willbe around 47, it will contnue to raise and be storng. waht i am thining is we will grow much more if we make Indian Rupee completey convertable. If indina rupee is compelty convertable you will see , a big hawana on $ much more comming into.

India’s growth is enormous in one side, but as a developed country US is struggling to comeback to ts charm.

So rupee will gain its natural cycle is taking over.

The dollar has been on a fall against all major currencies, not just the rupee. It has a lot to do with the recession in the US right now. Once the Democrats come to power and balance the budget, we should see a new strength to the dollar.

Also, the chinese stock market has begun to fall (a prophecy for the indian stock market?)

I may be wrong on all counts, but i truly believe the dollar will remain strong for at least the next fifteen years, definitely above Rs 30

Thanks for your valuable feedback….

Mufazzal,

This is million dollar question. No one in the world can prdict it accuratelly. Yes, we can take a guess based on technical analysis, current Economic and political situation, liquidity and Stock market scenario.

MY guess is it will stay between 40 to 41 for next couple of months and then appreciate to something like 38.5 to 39.

If we have a stock market crash, as the market has really shot up, you could see a reverse trend.

Hope this helps !

Today 05 june 07 Rupee exchange rate against dollar is 40.537

Anbody is having an idea or prediction thast what trend will there in next 15 days.

I am working for an export company, i am worried about this huge fluctuation

of indian rupee against dollar…..

thank you

The rupee may regain its value in short term, however, longer term (5years or more), it is subsequently going to get stronger on back of rising economy and general positive indicators. The rupee will be rangebound for atleast a year or so, after that it will keep getting stronger unless we face some kind of calamity :)

I hope that helps..

So what do you think? Will the rupee regain its past value? Or will it appreciate any more?