[ This article has been written with inputs from Mr. Ashustosh Gupta & Surbhee Sirohi of Financial and Investment Research services firm Evalueserve ]

The USD-INR exchange rate is an important indicator of investor sentiment and can significantly impact not only the fortunes of individual firms and sectors, but also the government.

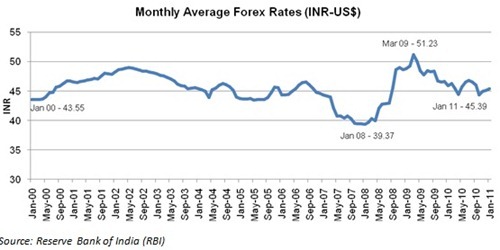

While this exchange rate has been very stable overall for the last five years, there have been periods of significant volatility. For example, USD-INR moved from 40 to 51.50 from March 2008 to March 2009. We believe there is a significant downside risk to USD-INR exchange rate and will explore some of the risk factors here:

Inflation is at an all-time high; the Consumer Price Index (CPI) increased by 10.88% in 2009 and by 13.19% in 2010. The monetary policy changes to control inflation have been ineffective. We believe this is because inflation is being driven primarily by structural supply side challenges such as lack of agricultural infrastructure, low crop yields, low organized retail penetration, and lack of import buffer for staples such as pulses where India is one of the main producers worldwide.

India as one of the fastest growing economies should be a favoured destination for investment. Nevertheless, it witnessed a decline in Foreign Direct Investments (FDI) in 2010, making it the only BRIC country where this happened. This is troubling as FDI is an important indicator of investors’ faith in a country’s long-term prospects. Foreign Institutional Investment (FII), which provides short-term portfolio investment money inflows, has been buoyant, but these funds are volatile by nature and are prone to “flight risk”, something that happened during the financial crisis.

Recent widespread corruption scandals have reinforced the negative perception of governance deficit in India. This, combined with regulatory and tax uncertainty, will deter foreign investors. For example, several global firms who invested in India’s telecom sector have had to write off billions of dollars of their investments.

A major source of foreign currency inflows to India is remittances; India received USD 55 billion in remittances during 2010. The Middle East accounts for a major share of this inflow and the current turmoil in the region may negatively influence it.

The combined central and state government deficit has stubbornly stayed around 10% of GDP. Another major concern is that India imports about 70% of its oil and efforts to increase the production capacity of petroleum and natural gas domestically have not been very successful.

India’s current deficit is about 3%, the level it reached during the crisis of the 1990s. A current account deficit is not bad by itself for a growing economy if it helps build important long-term productive assets. Unfortunately, some of this money already seems to be feeding speculative real estate activity instead. This is exacerbated by the fact that the more volatile FII money (and not the more stable FDI) is funding the current account deficit.

The US economy seems to be on the path to recovery. It is very likely that the improving US economy will draw more funds at the expense of emerging countries. This can already be seen in the FDI inflows, which increased by 43% in 2010.

After studying the various demand and supply factors for the Rupee, we have arrived at three likely scenarios:

First Scenario – Rupee Depreciation

This scenario is likely to occur if oil prices continue to rise or if FII money “exits” because of a crisis of confidence. Based on past evidence, even a relatively orderly outflow of USD 15 billion of FII money over a year could result in the INR depreciating by 22–30%. This would imply an exchange rate in the range of INR 55–60 to USD 1. It could get even worse if the flight of capital were to take place over a shorter period. This would imply a higher cost of petrol, diesel, and petroleum products in India, leading to even higher food prices and Consumer Price Index. The current account deficit would balloon and the rising inflation could create a vicious cycle.

Second Scenario – Rupee Appreciation

This scenario is likely to occur if the FII money continues to flow in and FDI levels improve. An appreciating Rupee will make imports cheaper and lead to better managed deficits and inflation. The flip side is that Rupee appreciation would erode India’s cost advantage in the export sector especially the booming ITES sector and likely invite government intervention. This is what happened just before the onset of the 2008 financial crisis when the USD-INR touched 39 and the Indian government repeatedly intervened in the currency markets to halt the Rupee appreciation.

Third Scenario – Status Quo

This is the most benign scenario. The exchange rate continues to move in its current range and slowly appreciates over the long term as the economy continues to develop and India strengthens its position in the global markets. The government’s efforts to improve agricultural infrastructure bear fruit in the longer term and inflation declines. Exchange rate fluctuations do not cause any major disruption in the trade environment.

According to our analysis, during the next two years the probability of the first scenario (depreciation of Indian Rupee by 20%) is the highest (about 50%) while the other two scenarios have an equal probability of approximately 25% each. In other words, there will be pressure on the Rupee unless steps are taken to fix structural issues described in this article. The Indian government and RBI are well aware of this risk and are definitely hoping for the third scenario, in which India essentially grows its way out of trouble over a couple of decades and where they only have to intervene occasionally to smoothen out excess volatility. As Subir Gokarn, a deputy governor of RBI recently said, “Intervention is not costless; it simply transfers the cost from one constituency of the economy to another.”

A nice article which gives brief about factors which effect currency valuations at macro level.

The article tells us “where Rupee will be” (though inconclusive as so many factors can play role). However I would like to discuss “where we want Rupee to be”.

Lets take China for example. In international trade, they are net exporters for as long as one can remember. No surprise, they keep their currency overvalued. It benifits them.

Coming back to India, we are net importers in international trade since independence. We kept our currency to slide each year till late 90s. We still are net importer but due to Rupee reaching a stage where it is between 40-50 since last 10 or 12 years, we are losing overall.

There are two solutions :

1) Either we work hard and become net exporter and let Rupee stay in the range of 40-50.

or

2) Be happy with the fact that we will be net importers for next decade or so and let Rupee slide gradually.

What are the factors stopping us from becoming net exporters?

a) Oil and gas : Irrespective of the effort we put to explore, we have to accept the fact that we can not produce oil at a rate of 2 or 3 million barrels a day. We do not have such resources. This is th emajor import content which makes us net importer. Only every now and then, we make oil or gas finds (in and around already existing ones)

b) Minerals : Accept the fact that we need 1000 tons of gold net imports a year. We do not have industrial metals like nickel, cobalt, etc. We do not have phospate for our fertilisers. If we want our standards to be at a certain level, we need certain amount of minerals which we do not have. We have to import them come what may. We can do something to reduce the strain on this front by aquiring forign assets. We can not delete the effect of this overall.

c) 25 years back China was not considered behemoth in world toy market. By sheer effort, they got their image today that 95% of all toys are made in China. 25 years back China was not famed for its prowess for industrial goods. They struggled to get that distinction now. What we did in last 25 years to get some image in a particular sector? We have one trophy! IT Outsourcing. We need to develop few more sectors which will compensate for our imports.

d) Technology : Inspite of so many braggings, we do not have modern technology or the will to aquire one.

Our Power plants are some of the worst polluters in the world. By replacing with new equipment, we not only reduce pollution but reduce consumption of coal. The saved coal can be used for a new plant

Our steel mills survive on free mines doled out to them by govt. They do not produce special steels. The result? We export 100 million tons of iron ore and the forign currency is used to buy 2 or 3 million tons of special steel that is required for our industry. How pathetic? Though we and China were at the same level of industrialization 25-30 years back, China now produces every kind of steel that exists in West, while we still import 100% of it.

e) Efficiency in utilizing our resources : You may remember, last year Supreme Court ordering govt to distribute excess grains exposed to rain to the poor to atleast utilize them. Govt was helpless as though it may have intent, the mechanism was not there to do so. That was last year. Last year we had good rains and this year we witnessed bumper crops. Already our existing storage is full. Now where do we store this bumper crop? Solution? Exports. But the govt is scared. What if after exporting suddenly prices shoot up? So they are slow in exports while the grains rot. By the time they take decision, the grains will rot and have to be thrown in sea. Atleast govt should have wisdom to use such rotten grain to make ethanol.

f) Roads and petrol consumption : Every oen knows that if we reduce traffic jams, milage will go up. We know already the capacity of our roads is small compared to traffic. OK Agreed. Atleast we can use the same roads more efficiently. No!! We cant!! We are Indians!! If every one follows traffic rules and follow lane discipline, we can more more vehicles on the same roads faster, which increases collective milage and reduce consumption and reduction in imports. But when it comes to individuals, its a dog eat dog world out there. Do we have hope in this area? We criticise govt in all above factors but what about our contribution?

g) Tax collections : I am not a supporter or against taxes. Its govt job to decide how much it charges. We simply follow rules. If taxes are collected correctly and the collected money is used as planned, we will come out of deficits. Its a collective effort. As citizens we should pay up. As govt it should spend it on purpose like roads, schools, hospitals, etc. People should not create parellel economy and govt should not create atmosphere bribes, favors (situations like bofers, 2G, CWG etc).

Each of the above will reduce our negetives and increase positives in becoming a net exporter.

The we can think of keeping rupee high.

At the moment we need rupee to go down.

Just my two paisa :)