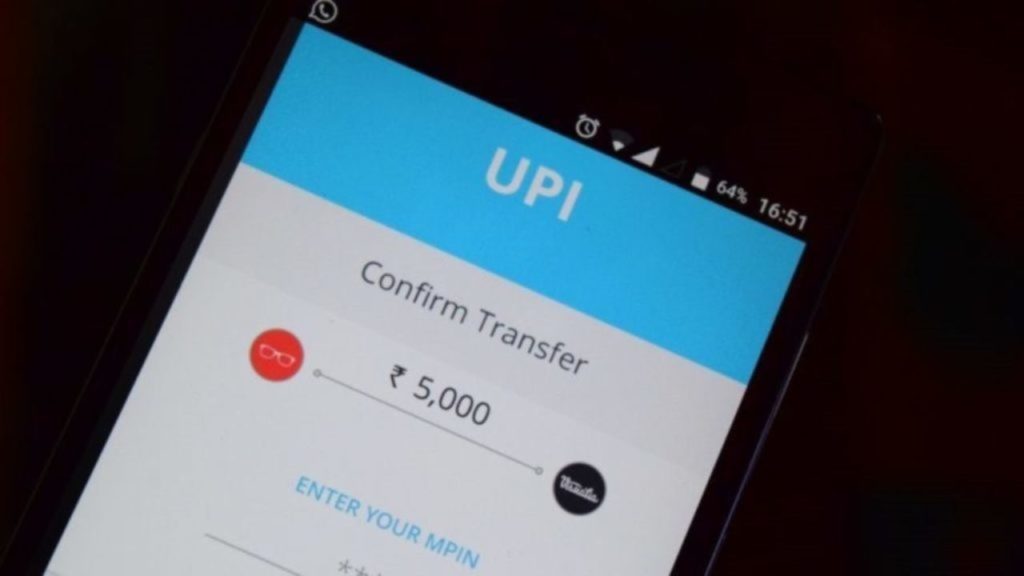

UPI Is About To Conquer Europe! Soon, Make UPI Payments Across Europe (Find Out How?)

Soon travelers from India will be able to make payments through UPI (United Payments Interface) in Europe, thanks to the NPCI International Payments Ltd (NIPL) partnership with European payment services facilitator Worldline.

UPI Payments In Europe

The above-mentioned NIPL is the global arm of the National Payments Corporation of India (NPCI).

The main aim behind this partnership between NIPL and Worldline is to expand acceptance of Indian payment means across Europe, as per the joint release issued on Tuesday.

The Worldline will bring more convenience for Indian customers in the European markets by allowing merchants’ point-of-sale (POS) systems to accept payments from UPI, under this partnership.

With this move, Indian customers will also be able to use their RuPay debit or credit cards to make payments in Europe.

Expected Increased Footfall and Spending

Presently, Indian customers pay through international card networks.

It is noteworthy here that UPI allows multiple bank accounts to be accessed through one single mobile application.

This facility enhances customer experience whilst opening up new business prospects for merchants.

Ultimately resulting in a multitude of customer-related merchant benefits owing to increased footfall and spending from Indian tourists, according to NPCI and Worldline, mentioned in the release.

During the previous fiscal year 2021, UPI transactions stood at 38.74 billion and the value was USD 954.58 billion.

So far, NPCI has issued 714 million indigenously-developed RuPay cards till date on the physical cards front.

Expanding Business In Abroad

In future, NIPL is planning to target the markets like BENELUX — Belgium, the Netherlands and Luxembourg– and Switzerland.

Further, planning to expand with the rollout of Worldline QR in more European countries.

The Deputy CEO of Worldline, Marc-Henri Desportes said, “Our analysis of international customers’ payment behavior have indicated a push away from international card schemes in recent times, and a preference for any mobile payment method they are acquainted with. Our partnership with NPCI International seeks to mitigate the risk of excluding or limiting Indian customers from safely using electronic payments in the EU,”.

This partnership will provide the company an opportunity with a good coverage of the European markets as well as an advanced and universally applicable solution, said Ritesh Shukla, the CEO of NIPL.

Further adding, “The rollout of acceptance of UPI-powered apps and RuPay cards across Europe is important to us, as we expect increased mobility of Indians in the continent in the coming years. We believe this partnership will empower Indian consumers to continue using their preferred payment modes as they travel across Europe,”.

Comments are closed, but trackbacks and pingbacks are open.