Govt Wants To Treat Fantasy Games Same As Gambling; 28% Tax Can Be Imposed On Such Online Games

From today, all eyes are set on the two-day meeting of the Goods and Services Tax (GST) Council, especially the taxpayers and policymakers.

Headed by the finance minister Nirmala Sitharman, GST Council is likely to discuss several key issues during this meeting.

Further, the main agenda for the 47th GST Council meeting includes GST compensation to states, GST rate revisions of certain items and services, and easier compliance norms for taxpayers.

Contents

Extension of GST Compensation to States

Earlier, the Center had assured the states to compensate them for five years (base year 2015-16) for the revenue losses rising from the implementation of the new regime while introducing GST in 2017.

No Extension On Compensation Of Cess

Notably, the compensation given to states will cease on June 30, 2022.

Although, the cess will continue on a host of sin and luxury items, till March 2026.

According to the finance ministry, this move will help the central government to repay the borrowings to meet the states’ revenue shortfall over the last two financial years, as she said in a notification last week.

Kerala’s finance minister, KN Balagopal said, “We will be requesting for the extension of the compensation window for five years. Not just Kerala, even other states will be seeking an extension as the revenue growth is not as promised,” ahead of the GST Council meeting.

But it appears that the Center is not in favor of extending the compensation cess for another five years, as per the reports.

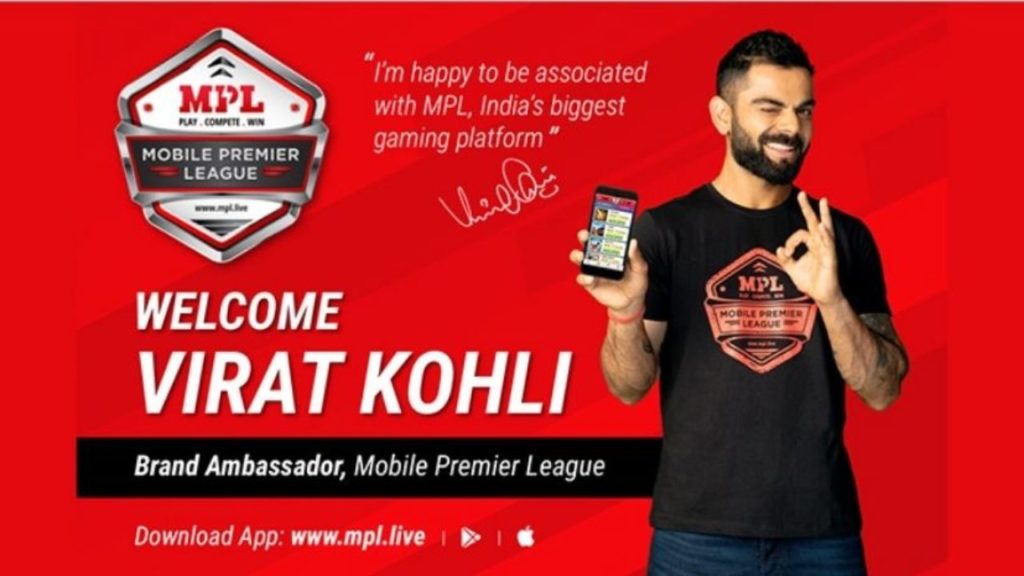

GST On Online Gaming, Casinos, Race Courses

According to the suggestion of the group of ministers (GoM), a flat rate of 28 percent GST can be applied on popular online gaming, casinos and horse racing.

Earlier, the Union government had set up a panel of state ministers to examine the valuations of several services related to casinos, online gaming portal and race courses for levying GST in May 2021.

It seems that GoM is in favor of imposing a flat 28 percent GST on various services of fantasy gaming, casinos and horse racing.

The decision is expected on this during the June 28-29 meeting.

Revision Of GST Rate

As per the recommendations of the Fitment Committee, it has recommended to revise the GST rates on a handful of items.

They have proposed a uniform rate of 5 percent GST on prostheses (artificial limbs) and orthopedic implants (trauma, spine, and arthroplasty implants).

Further recommending a 5 percent GST rate for several kinds of orthoses such as splints, braces, belts and calipers.

Among other measures, the Fitment Committee advised that the GST rates on ostomy appliances (including pouch or flange, stoma adhesive paste, barrier cream, irrigator kit, sleeves, belt, micro-pore tapes) should be reduced to 5 per cent, from 12 per cent at present.

So, during the meeting, the GST Council is likely to discuss the suggestions of tweaking rates and also issuing clarification on the categorisation of the other items too.

Comments are closed, but trackbacks and pingbacks are open.