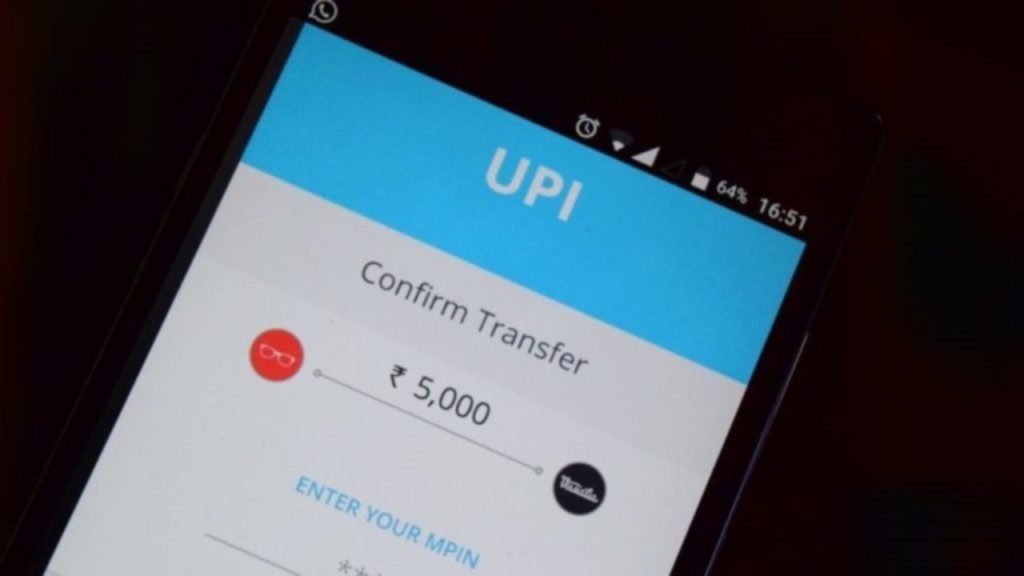

UPI Goes Global! Nepal Becomes 1st Country To Deploy UPI Payments After India

The National Payments Corporation of India (NPCI) said on Thursday that Nepal has become the first country outside India to adopt UPI.

Contents

The Companies Bringing UPI To Nepal

NPCI International Payments Ltd (NIPL), the international arm of NPCI, has partnered with Gateway Payments Service (GPS) and Manam Infotech to provide the services in Nepal.

GPS is the authorised payment system operator in Nepal and Manam Infotech will deploy UPI in the country.

Nepal will have their own UPI, their own apps, with their own banks like India.

Helping Digitise Cash Transactions

The partnership will contribute to Nepal’s larger digital public good and enhance interoperable real-time person-to-person (P2P) and person-to-merchant (P2M) transactions in the country.

Adopting UPI will help Nepal drive the digitalization of cash transactions and further the vision and objectives of the Nepal Government and Nepal Rastra Bank (its Central bank).

Last-mile consumers in Nepal will be able to reap the benefits of an open interoperable payments system which allows immediate payment transfers between bank accounts and merchant payments in real-time.

Enabling Cross-Border Remittances

It will also enable real-time cross-border P2P remittances between Nepal and India.

The regional economy will also be transformed by the partnership which will eliminate all the barriers of payment transformation within Nepal and across the border.

CEO of GPS Rajesh Prasad Manandhar said that UPI in Nepal would play a pivotal role in transforming the digital economy and in its ambitions of building a less-cash society.

Proof Of UPI’s Global Capabilities

Ritesh Shukla, CEO of NIPL said of the development that Nepal adopting UPI will serve as testimony to NIPL’s technological capabilities in a global context.

UPI’s real-time payment infrastructure will help catalyse the process of financial inclusion in Nepal and create more opportunities for businesses.

It will also help modernise Nepal’s digital payment infrastructure and bring the convenience of digital payments to its citizens.

Population Using Smartphones And Bank Accounts

Nepal has a population of about 30 million (3 crore) with around 45% banked.

Mobile penetration of over 135% with 65% of the population using smartphones provides a foundation for replication of the digital revolution in India in Nepal.

Over the next few months, all three companies will work closely to deploy UPI in Nepal with all the functionalities and features presently available in India.

UPI In India

In 2021, UPI enabled 39 billion financial transactions amounting to commerce worth $940 billion.

This is roughly equivalent to 31% of India’s GDP.

A Jefferies report estimates UPI to cross $1 trillion in overall volumes for FY22, making up 50% of India’s retail digital payments in the current financial year.

Other International Ventures

NIPL has also forged partnerships in Singapore and Bhutan for accepting UPI QR-based payments.

The partnership with Singapore’s PayNow also allows cross-border payments.

NIPL had also tied up with UAE’s Mashreq Bank to enable Indian travelers to pay for their purchases using UPI.

[…] Post Your Air Tickets Will Become Expensive As Prices Of Jet Fuel Reach Record HighNext Post UPI Goes Global! Nepal Becomes 1st Country To Deploy UPI Payments After India Indian IT Companies Have 23% Less Jobs Compared To Last Year: The Bubble Has Burst? Why […]