UPI Will Soon Cross $1 Trillion In Transactions! Breaches $100 Billion Mark In October

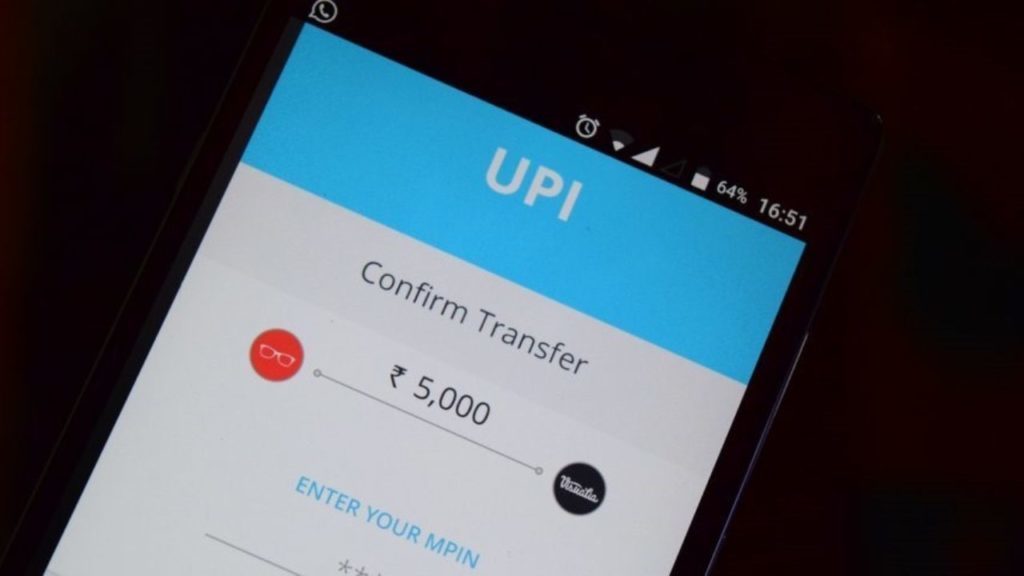

Another achievement has been recorded by the National Payments Corporation of India’s (NPCI) Unified Payments Interface (UPI) in the month of October.

The value of transactions for the month has now crossed $100 billion.

21 Crore UPI Transactions Clocked In October 2021

As per reports, the value of transactions is now at Rs 7.71 lakh crore, and as many as 21 crore transactions were clocked in the entire month.

The festive season was upon us in the month of October, which seems to have been the catalyst for the increase in e-commerce sales and UPI transactions, therefore.

The period between March to September 2021 saw an average monthly growth rate of UPI transactions of 5.8 percent. However, month-on-month growth in transaction values in October was around 18 percent.

Introduced only in 2016, the instant real-time payment system has climbed up the payments chain in India and now marks a make up of 10% of all retail payments.

In addition to the increase in transaction volume, the value of payments conducted through UPI has also shown unprecedented figures in FY21.

UPI Will Soon Cross $1 Trillion In Transactions

UPI transactions now show the potential to cross $1 trillion in FY 22.

According to the information provided by the National Payments Corporation of India (NPCI), the instant real-time payment system Unified Payments Interface (UPI) has registered a total of 2.8 billion transaction count in June 2021.

As the second wave of Covid-19 hit the Indian markets earlier this year, the number of UPI transactions took the hit too.

After posting impressive record-high figures in March, of about 2.73 billion transaction volume leading to transaction value amounting to Rs 5,04,886.44 crore, the numbers tumbled down immensely in April and May.

We had also reported that UPI’s market share was 17% in 2018-19 and the expected growth by the year 2024-25 is as much as 59%.

As of now, 40% of the transactions in India by volume are conducted through debit cards. However, this would reduce to just 11% in the future. Ever since its launch in 2016, UPI has had a compound annual growth rate (CAGR) of 414% till the financial year 2020. Also, it is expected to grow with the help of strong regulatory measures, innovative solution offerings by fintech companies, recurring payments, and new use cases.

Comments are closed, but trackbacks and pingbacks are open.