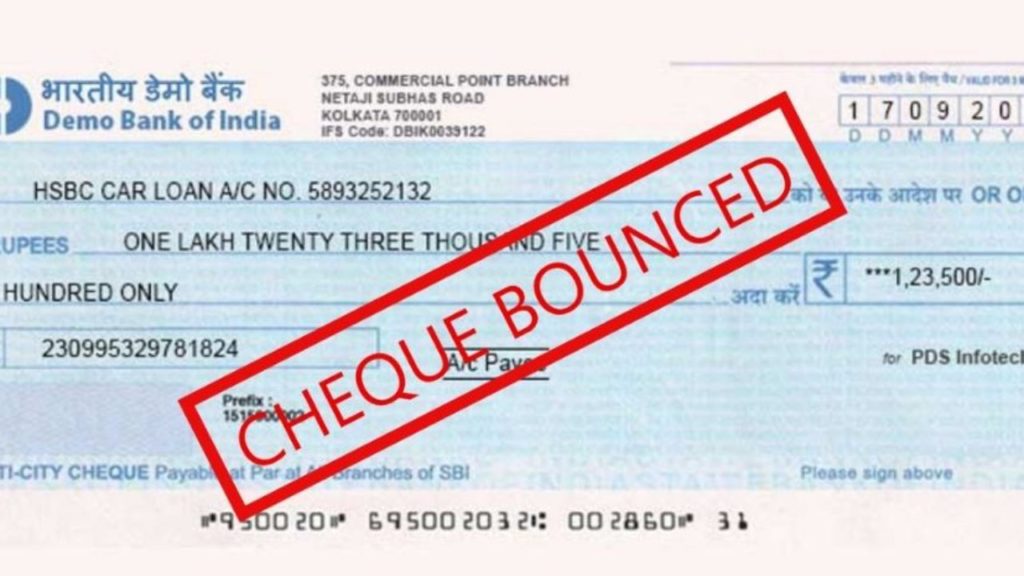

Your Cheque Will Bounce If You Don’t Follow This New Rule; Also Pay Penalty!

As per a new notice by the Reserve Bank of India, the customers who rely on cheques for frequent transactions must make sure that they have sufficient funds in their bank account.

The RBI has come up with a new set of guidelines about the changes to the banking rules. These will come into effect from this month.

Your Cheque Will Bounce If You Don’t Follow This Rule

The new rules state that cheques can be cleared on a Sunday or any bank holidays as well. Customers who issue cheques should make sure that there are sufficient funds in their bank accounts. They will be required to maintain a minimum balance in their bank account at all times. If this minimum balance is not maintained, the cheque may bounce and the customer will also have to pay a penalty.

Starting August 1, 2021, this facility has been made available on all days of the week.

This facility of 24/7 bulk clearing of cheques will mostly be beneficial for cheque users. It hass been implemented in all national and private banks. The new change will also benefit the cheque user because from now, cheques will be cleared on holidays and Sundays too.

NACH To Be Available All Days Of The Week

In June, we reported that the National Automated Clearing House (NACH) payment system will be available on all days of the week from August 1.

The NACH system provides a secure and scalable platform with both transaction and file-based transaction processing capabilities accessible to all participants across the country.

“In order to further enhance customer convenience, and to leverage the 24×7 availability of RTGS, NACH which is currently available on bank working days, is proposed to be made available on all days of the week effective from August 1, 2021,” RBI Governor Shaktikanta Das had said.

NACH, the NPCI’s bulk payment system, enables one-to-many credit transfers such as dividend, interest, salary, pension, and other payments, as well as the collection of payments for electricity, gas, telephone, water, periodic instalments on loans, mutual fund investments, insurance premiums, and other items.

NACH has become a prominent mode of direct benefit transfer (DBT) to a large number of beneficiaries.

“This has helped the transfer of government subsidies during the present COVID-19 in a timely and transparent manner,” said RBI Governor.

As the economy faces the heat of the second COVID wave, the Reserve Bank of India (RBI) has kept the benchmark interest rate at 4% and maintained an accommodative approach.

This is the sixth time in a row that the Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das has maintained the status quo. RBI had last revised its policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting the interest rate to a historic low.

Comments are closed, but trackbacks and pingbacks are open.