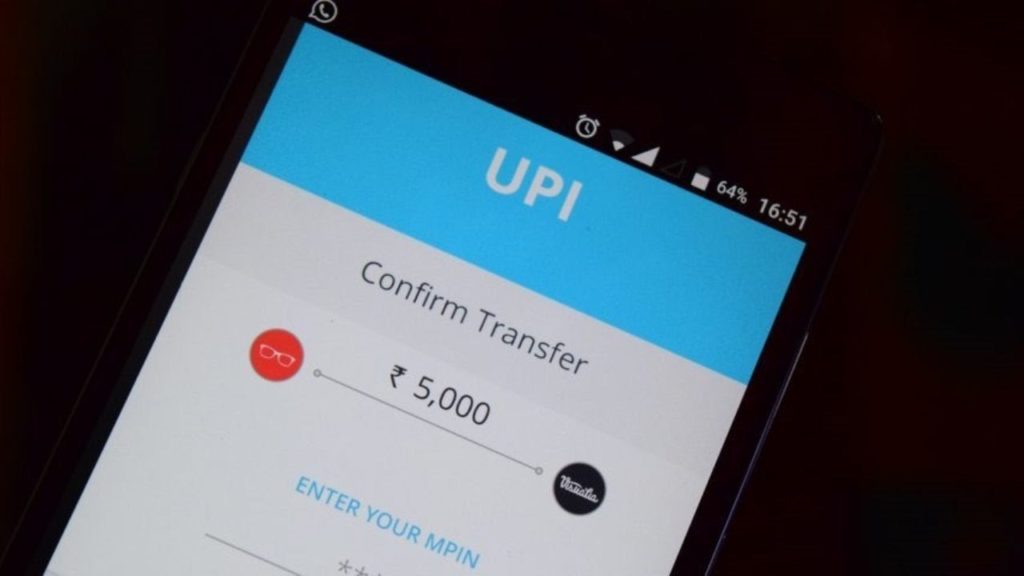

UPI Losing Its Shine? Transaction Volume Reduce By 4% In May: What’s The Reason?

UPI transactions increased by double digits during the lockdown months as the virus spread and customers began to prefer digital payments. And thus march saw a significant increase in UPI volumes, with total transactions exceeding $5 trillion, up 18% from February.

But in May, the digital payments market recorded 2.53 billion transactions worth Rs 4,90,638 crore, according to NPCI data in a tweet shows.

Drop-In Volume And The Value Of UPI Transactions

The recent slowdown in growth may be attributed to rising transaction failures because of frequent technical glitches at banks, which also dethroned Google Pay and the UPI market leader.

In May, the digital payments market recorded 2.53 billion transactions worth Rs 4,90,638 crore

When compared to April, the UPI recorded 2.64 billion transactions worth Rs 4,93,663 crore, there is a 4.16 per cent decline in volume and a 0.61 per cent decline in value.

Whereas it had set a new record in March, with 2.73 billion transactions worth Rs 5,04,886 crore

While the market share of UPI apps for May has not been revealed by NPCI, PhonePe dominated the market in April with a 45 per cent share.

UPI Transactions During The lockdown Months

UPI market leader PhonePe also crossed a milestone during March. “We crossed a billion UPI transactions in March. Last month, the total transactions on our platforms across the payment instruments of wallet, card, and UPI that we offer stood at 1.3 billion,” a PhonePe spokesperson said.

Google recorded a decline in its market share to 34.3%.

Paytm had a market share of 12.14% in April.

NPCI Expanding Its Service To International Markets

The NPCI has already issued a new guideline that limits the market share of all third-party UPI apps to 30%.

The regulating body will, however, give exemptions to the top applications to comply with the new regulations.

NPCI is also expanding its service to international markets.

It partnered with Financial Software and Systems in April and incorporated a new entity called NPCI International Payments Limited (NIPL) to study potential use cases outside of India.

Comments are closed, but trackbacks and pingbacks are open.