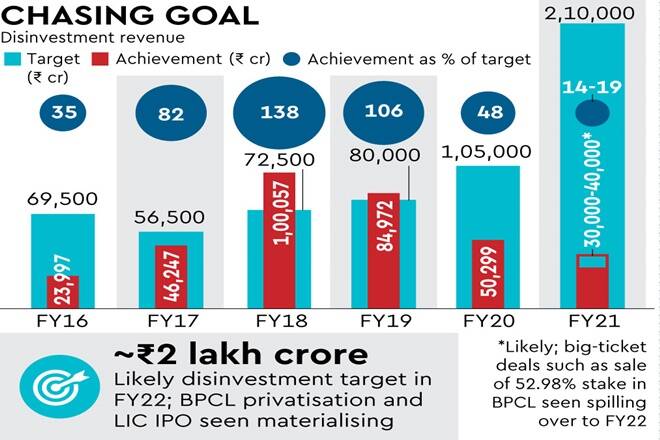

The government had set an annual disinvestment receipts target of Rs 2.1 lakh crore for fiscal year 2021, of which only Rs 30,000-40,000 crore have been achieved, which is 14-19% of the targeted amount.

Due to Covid-19 pandemic, all the set targets and plans for disinvestments to be conducted in the current FY got mismanaged and delayed, resulting in a five-year low since FY16, when the disinvestment revenue generated was Rs 23,997 crore.

Furthermore, with mega deals like disinvestment process of oil company BPCL, IPO of life insurer LIC, privatization of public transporter Air India, and many more shifting to be materialized in next fiscal year, the disinvestment receipts target for FY22 has been set to nearly Rs 2 lakh crore by the government.

Let’s learn in detail about this.

Contents

FY22 Disinvestment Target Set; Only 8.5% of FY21 Target Achieved Until Now

So far, the disinvestment receipts noted this year has been about Rs 17,958 crore, which is 8.5% of the set target for FY21.

The government’s residual 26.12% stake sale in Tata Communications is expected to fetch around Rs 8,000 crore by February-March.

The Centre has initiated an expression of interest (EOI) for the strategic disinvestment of its 63.75% stake in Shipping Corporation of India, worth about Rs 2,500 crore and 26% stake in BEML worth about Rs 1,000 crore, as reported by the Financial Express.

Also, as many deals set for this financial year will have to be pushed to the next, the government has set the disinvestment receipts target for FY22 to around Rs 2 lakh crore.

Let’s now discuss all the deals scheduled for this year, materialised in the next.

FY21 Deals Shifted to FY22

Disinvestment of BPCL

- The 52.98% government stake sale plan of BPCL was approved by the Union Cabinet in November 2019.

- Around the time of proposal, the government’s stake in BPCL was worth about Rs 60,000 crore, which at current market prices have pushed down the stake’s worth to Rs 44,500 crore.

- We have covered the whole issue here, which would answer all your questions related to the delay in the BPCL disinvestment process.

- Thus, the sale which was expected to be completed in this fiscal year will likely be shifted to the next financial year (FY22).

LIC IPO

- The IPO of national insurer LIC was anticipated to be among the biggest contributors to the budgeted disinvestment target of this fiscal.

- However, due to delay in the whole process, the coveted IPO will be taken into action in the following financial year.

- LIC is believed to be worth Rs 8-11.5 lakh crore, meaning a 10% IPO could fetch the government Rs 80,000-110,000 crore.

Privatisation of Air India

- Besides the aforementioned deals, privatisation of the national carrier was expected to be concluded by March 31, 2021.

- However, with the EoI stage completed yet, the process will enter the stage of financial bids in March-April, which will confidently shift the deal to FY22.

- The bids for AI are likely to be under Rs 20,000 crore.

Other Deals

- Launch of EOI for Government’s stake sale of 30.8% in Container Corporation and IDBI Bank has been delayed and pushed to FY22.

- EOI for ConCor stake to be floated after the Cabinet approves Indian Railways’ land leasing policy.

- Government stake sale of 47.1% in IDBI bank, worth about Rs 13,600 crore can be shifted to the next financial year.

Comments are closed, but trackbacks and pingbacks are open.